Federal Reserve Governor is doubling down on his push for a September Fed rate cut ahead of the FOMC meeting later this month. The Fed Governor also indicated that a potential September cut might be the first of many over the next three to six months.

Chris Waller Advocates For A September Fed Rate Cut

In a CNBC interview, the Fed Governor opined that they need to start cutting rates at the next FOMC meeting, while noting that he is not worried about inflation. He further remarked that they don’t have to go in on a locked sequence of steps, as they can see where the economy is heading.

He added that multiple Fed rate cuts could happen over the next three to six months. Notably, the Fed Governor last week explicitly said that he would vote in favor of a 25 basis points (bps) rate cut at the September 17 meeting. He also opened the door to a 50 bps cut if the August nonfarm payrolls data comes in weaker than expectations.

Inflation has so far been the FOMC’s major concern this year, as Powell and the Committee have, up till now, chosen a wait-and-see approach before lowering rates. However, Waller expects inflation to remain steady and doesn’t see it rising anytime soon. He admitted that there might be a blip of inflation, but that it won’t be permanent.

He also assured that the Trump tariffs won’t cause long-term inflation, as some Fed officials fear. The Fed Governor again made it clear that he supports a Fed rate cut at the next FOMC meeting.

It is worth noting that Waller was one of two FOMC members who dissented at the July meeting, voting in favor of a 25-bps Fed rate cut while the majority voted in favor of holding rates steady. Meanwhile, he is currently the frontrunner to replace Jerome Powell as the next Fed Chair.

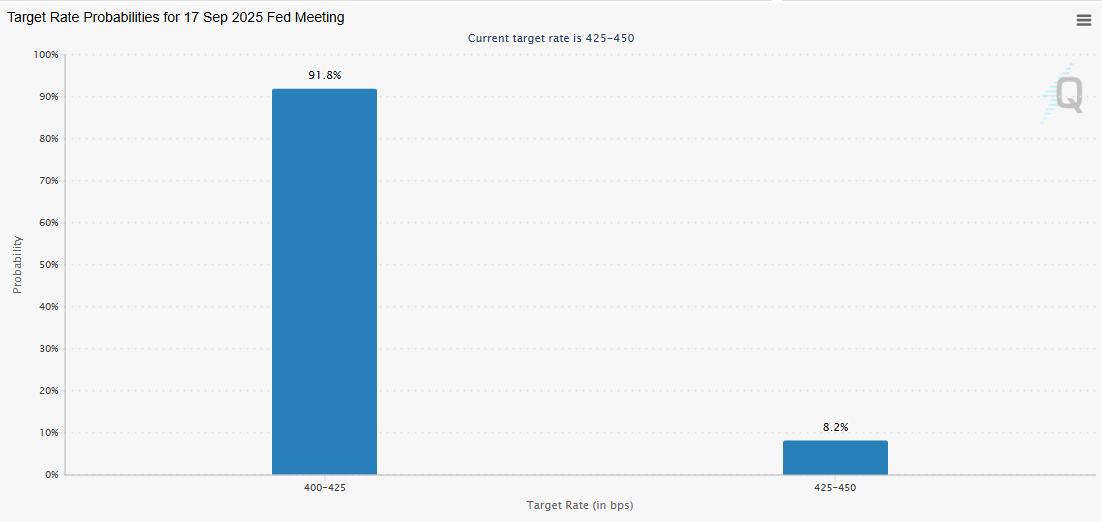

92% Chance Of A Cut At The Meeting

CME Fed Watch data shows that there is a 91.8% chance of a 25 bps rate cut at the September FOMC meeting. These odds had begun to increase following Jerome Powell’s statement at the Jackson Hole conference, where he signaled that they might lower interest rates.

He noted that the downside risk to the labor market is rising, and it is something they cannot ignore. Powell had argued before that the labor market was strong and they didn’t need to make a Fed rate cut yet.

However, the July nonfarm payrolls data showed otherwise, suggesting the labor market is weakening. Chris Waller has also warned that the committee needs to get ahead of a sharp slowdown in the job market. He remarked that “when the labor market turns bad, it turns bad fast.”

The Fed Governor also opined that the current benchmark is above the neutral rate, indicating that monetary policy is restrictive. However, he said incoming Fed rate cuts to get to neutral will depend on the data that comes in.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/fed-rate-cut-at-the-september-fomc-chris-waller-says/