- Chinese experts highlight stablecoin risks tied to traditional reserves.

- Stablecoins are digital fiat proxies, limited monetary innovation.

- UST collapse underscores need for robust reserve backing.

On June 28, the 21st Century Business Herald explored stablecoins, emphasizing their alignment with traditional monetary systems. Zou Chuanwei and Zhao Binghao, Chinese economists, pointed to stablecoins’ reliance on reserve assets, posing potential risks highlighted by past incidents.

The detailed examination by Chinese financial experts underscores stablecoins’ limitations in monetary innovation and risk under extreme market conditions, evidenced by UST’s collapse.

Chinese Analysts Warn of Stablecoin Reserve Challenges

Chinese financial experts demystified stablecoins, emphasizing their ties to traditional systems. Zou Chuanwei of Wanxiang Blockchain highlighted that stablecoins replicate existing bank deposits and invest in low-risk assets like U.S. bonds, rather than creating new currency. As he stated, “The mainstream model of stablecoins did not create new currencies, but simply tokenized bank deposits and invested reserve assets in low-risk assets such as US bonds. The essence is the ‘blockchain translation’ of the existing monetary system.” – Source

Zhao Binghao pointed out potential instability, stating that in extreme market conditions, stablecoin value could drop significantly as seen in the UST collapse. They argue that compliance with reserves is crucial, challenging stablecoins’ perceived sovereignty resistance. Zhao added, “The stability of stablecoins depends on the reserve assets of the issuer. In extreme market environments, the value of stablecoins may even return to zero, and the collapse of UST is a typical example.” – Source

Market responses were varied, with consistent discussions stressing the need for robust reserve models. Statements from these experts follow a broader regulatory discourse on ensuring transparency and adequate backing for stablecoins, reflecting recent emphasis on reserve scrutiny.

UST Collapse Sparks Regulatory Reevaluation and Transparency Focus

Did you know? During the 2022 UST collapse, the loss of peg led to widespread regulatory actions, underscoring the importance of solid reserve backing for stablecoins and reshaping regulatory approaches.

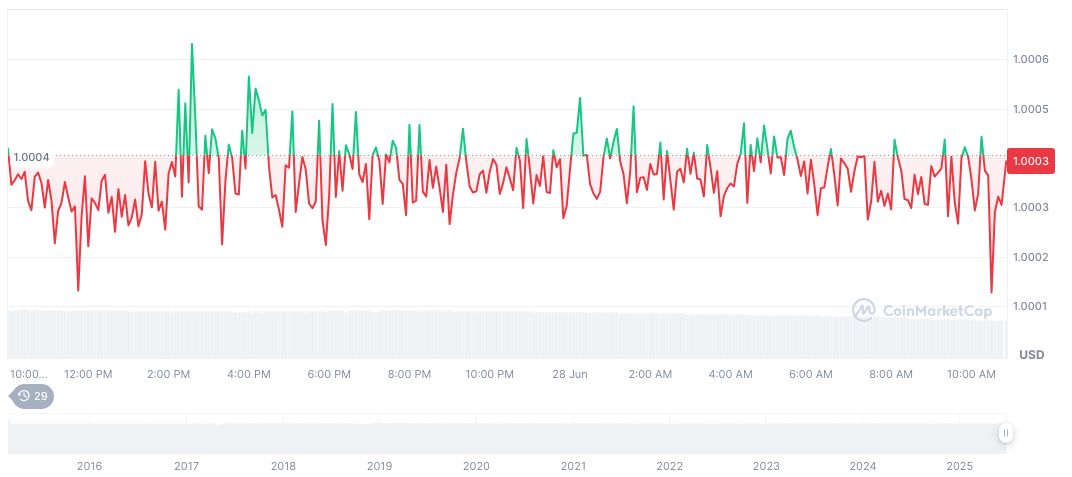

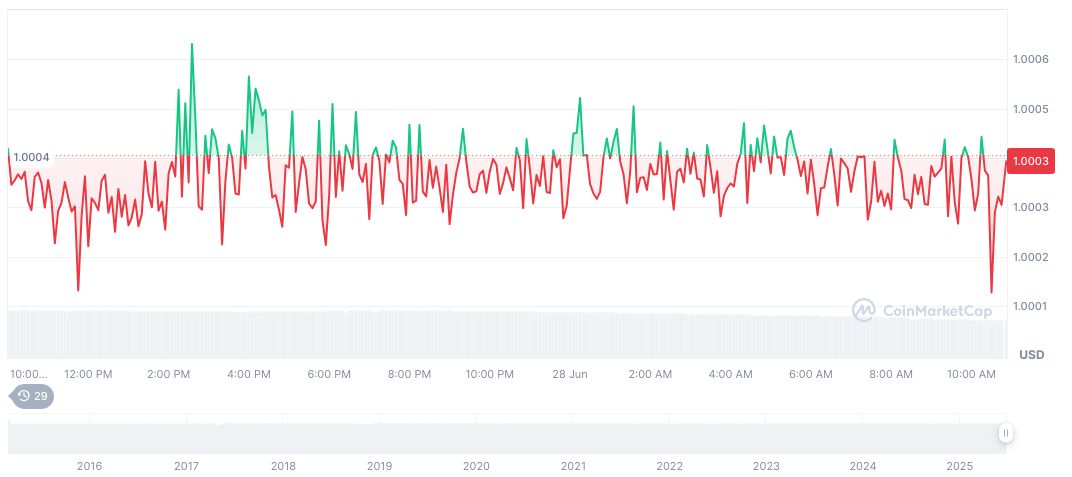

Data from CoinMarketCap reveals Tether (USDT) maintains stability at $1.00 with a market cap of formatNumber(157531510257, 2), reflecting 4.79% dominance. Volume dropped by 20.96% to approximately formatNumber(49967416920, 2). The circulating supply stands at 157,480,181,405, with stability across recent price changes.

Coincu research team anticipates that increased regulatory scrutiny will enforce stablecoin transparency, making reserve audits more critical. Historical trends suggest a stronger emphasis on technological improvements in reserve management and transaction efficiency to fortify market confidence in stablecoins. More insights can be found on Insights on stablecoins in banking from 2025 survey.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345690-stablecoin-vulnerabilities-ust-collapse/