- China and US reached preliminary trade consensus in Kuala Lumpur talks.

- Traditional trade focus; no direct crypto impact seen.

- Global markets attentively monitor geopolitical developments.

China and the US held economic and trade consultations in Kuala Lumpur on October 25-26, 2025, aiming to address key bilateral issues and stabilize relations.

The talks impact global markets, potentially affecting macro-economic assets like Bitcoin, but no direct cryptocurrency market reactions are evident at this time.

Preliminary Economic Accord Reached in Kuala Lumpur

The economic and trade consultations between China and the US held in Kuala Lumpur involved senior officials including He Lifeng and Li Chenggang for China, and Scott Bessent and Jamieson Greer for the US. Efforts were centered on de-escalating trade tensions. China reports significant global economic developments and impacts for 2025 which provides additional context to these discussions. A preliminary consensus on important economic topics was reached, driven by mutual respect.

While the discussions addressed tariffs and trade, the talks did not have a direct impact on cryptocurrency markets. China discusses international collaborations and future global partnerships in 2025 which may influence the geopolitical landscape, thereby affecting global markets indirectly. The encounter is likely to impact traditional trade sectors, with both nations pledging to continue dialogue for more stable economic partnerships.

“In the past month or so, there have been some fluctuations and disturbances in China–US economic and trade relations, which have attracted global attention… Both sides reached a preliminary consensus on properly addressing several important economic and trade issues of mutual concern…” — Li Chenggang, International Trade Negotiation Representative, Ministry of Commerce, China.

Bitcoin Stability Amid Historical Trade Tensions Analysis

Did you know? Historical trade tensions between China and the US from 2018–2020 increased the global demand for Bitcoin and Ethereum as macro hedges during periods of geopolitical uncertainty.

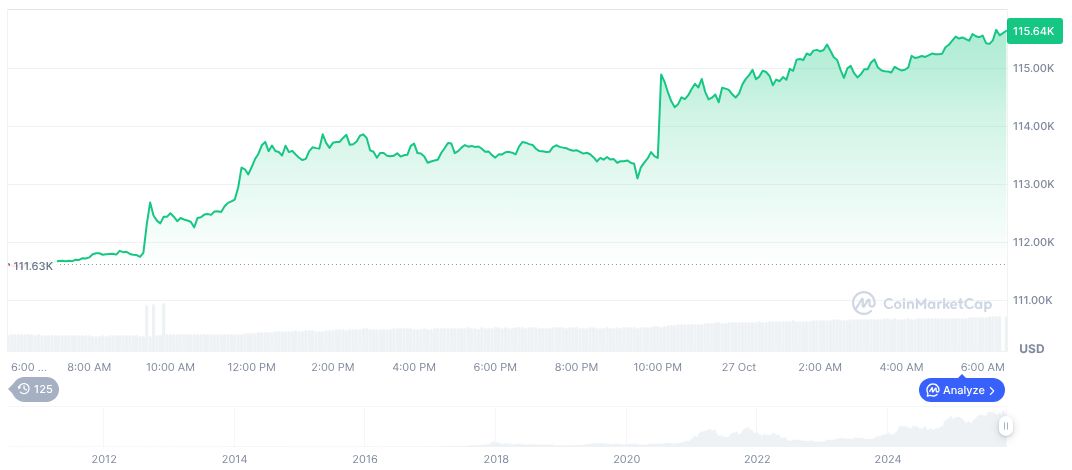

According to CoinMarketCap, Bitcoin trades at $114,826.04, with a market cap of $2.29 trillion and market dominance at 59.23%. Over the last 24 hours, trading volume reached $58.23 billion, indicating an 80.74% change, while the price saw a 1.16% increase.

The Coincu research team anticipates potential shifts in traditional markets if geopolitical tensions are relieved further. While cryptocurrencies like BTC remain stable, historical trends point to increased market interest during geopolitical turmoil, suggesting continued close tracking of these events.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |