- The US imposes tariffs up to 245% on Chinese imports.

- China responds with retaliatory tariffs on US goods.

- Bitcoin seen as a potential hedge against trade tension-induced market volatility.

The ongoing trade tensions between the United States and China intensified on April 15, 2025, as the US reportedly imposed tariffs up to 245% on Chinese imports. This escalation follows China’s response with increased tariffs on US goods. Trade relations between the two nations have reached a pivotal point, with both sides emphasizing their respective national interests.

Key Developments, Impact, and Reactions According to statements from both governments, the US has set tariffs on Chinese imports as a response to China’s previous trade measures. China asserts these actions continue the pattern of economic coercion, which it opposes strongly. The Ministry of Foreign Affairs in China, represented by spokesperson Lin Jian, commented that “there are no winners in tariff wars.” Lin further remarked, “You can ask the US side for the specific tax rate figures… Tariff and trade wars have no winner. China does not want to fight these wars but is not scared of them.” On the other hand, the US administration, with President Trump at the helm, remains firm on its stance.

Cryptocurrency as a Hedge Amid Market Volatility

The significant fluctuations in Asian and European markets denote increased investor caution, with asset-risk premiums reflecting concerns over inflation and potential supply chain disruptions. Despite this, China’s official position remains that of a “willingness to counter if the US infringes on Chinese interests,” signaling potential further retorts. Karoline Leavitt of the White House reiterated China’s need to adhere to proposed negotiations.

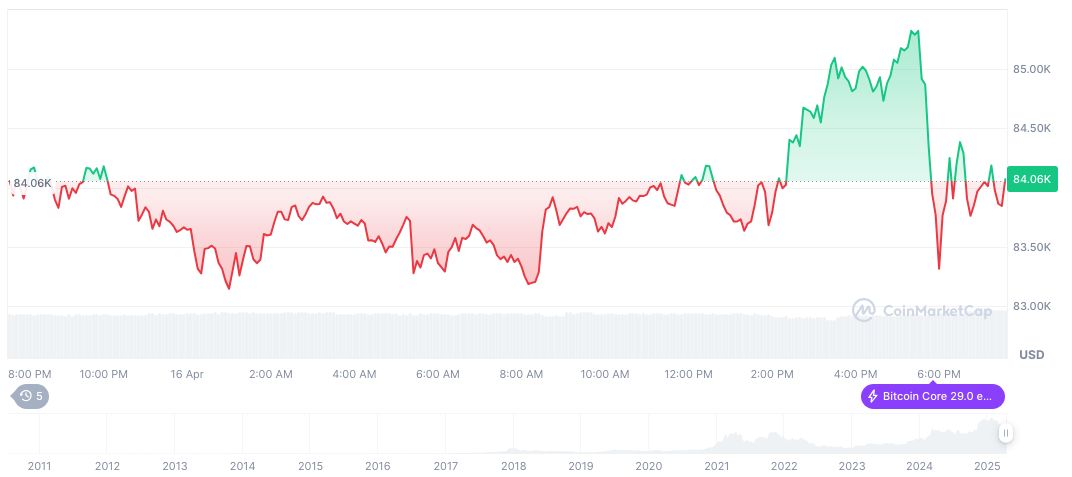

Bitcoin (BTC) is trading at $84,394.43, with a market cap of $1.68 trillion, comprising 63.04% of global market dominance, according to CoinMarketCap. Bitcoin’s recent 24-hour price change stands at 1.29%, accompanied by a trading volume of $28.85 billion, signifying a shift of 3.82%. The cryptocurrency’s value has fluctuated throughout the past 90 days, marked by a decrease of 16.46%.

Coincu’s research team forecasts that ongoing trade tensions could reinforce the speculative appeal of digital assets. Investors may perceive Bitcoin and other cryptocurrencies as potential hedges against uncertainty, responding to historical trends during economic conflicts. As both the US and China deliberate further steps, regulatory and financial outcomes remain pivotal topics for stakeholders.

Market Impact and Future Outlook

Did you know? Economic conflicts often lead to increased interest in alternative assets like cryptocurrencies, as investors seek to mitigate risks associated with traditional markets.

The cryptocurrency market has shown resilience despite the ongoing trade tensions, with Bitcoin maintaining a significant market share and attracting new investors looking for alternatives amidst traditional market volatility.

Analysts suggest that the current geopolitical climate will likely keep digital assets in the spotlight, as investors continue to seek refuge in cryptocurrencies during uncertain economic times.

Source: https://coincu.com/332631-china-us-tariff-tensions-2025/