Key Takeaways

What fueled Plasma [XPL]’s recovery?

Buy Volume hit 506.9 million tokens and exchange Netflow dropped to -$19.35 million, showing accumulation.

Will the uptrend sustain?

High on-chain activity and a DMI reading of 26 indicate strength, but Stochastic RSI signals short-term volatility.

Plasma [XPL] bounced back after dipping to a low of $0.86 and reclaimed $1 resistance as earlier projected by AMBCrypto.

At press time, XPL traded at $0.99, slightly below the $1.07 intraday high, marking a 12.22% rise in 24 hours.

Trading volume surged 70% to $4.2 billion, signaling strong capital rotation. With Spot and on-chain demand increasing, XPL appeared poised for another leg up after a brief cooldown.

What inspired XPL recovery?

Spot demand revives XPL’s momentum

As pointed out by AMBCrypto, Plasma saw massive demand from the Spot market, boosting the altcoin’s recovery.

Data from Coinalyze showed 506.9 million tokens in Buy Volume against 497.13 million in Sell Volume, yielding a positive Buy/Sell Delta of 9.77 million — a clear sign of bullish spot activity.

Source: Coinalyze

In parallel, CoinGlass data confirmed three consecutive days of negative Spot Netflow.

Source: CoinGlass

At press time, Netflow was -$19.35 million, signaling higher outflow, a clear sign of aggressive accumulation.

Historically, shrinking exchange supply has preceded low selling pressure, a precursor to higher prices for an asset.

Network activity shows renewed strength

Besides the Spot demand, Plasma’s on-chain network usage has skyrocketed significantly.

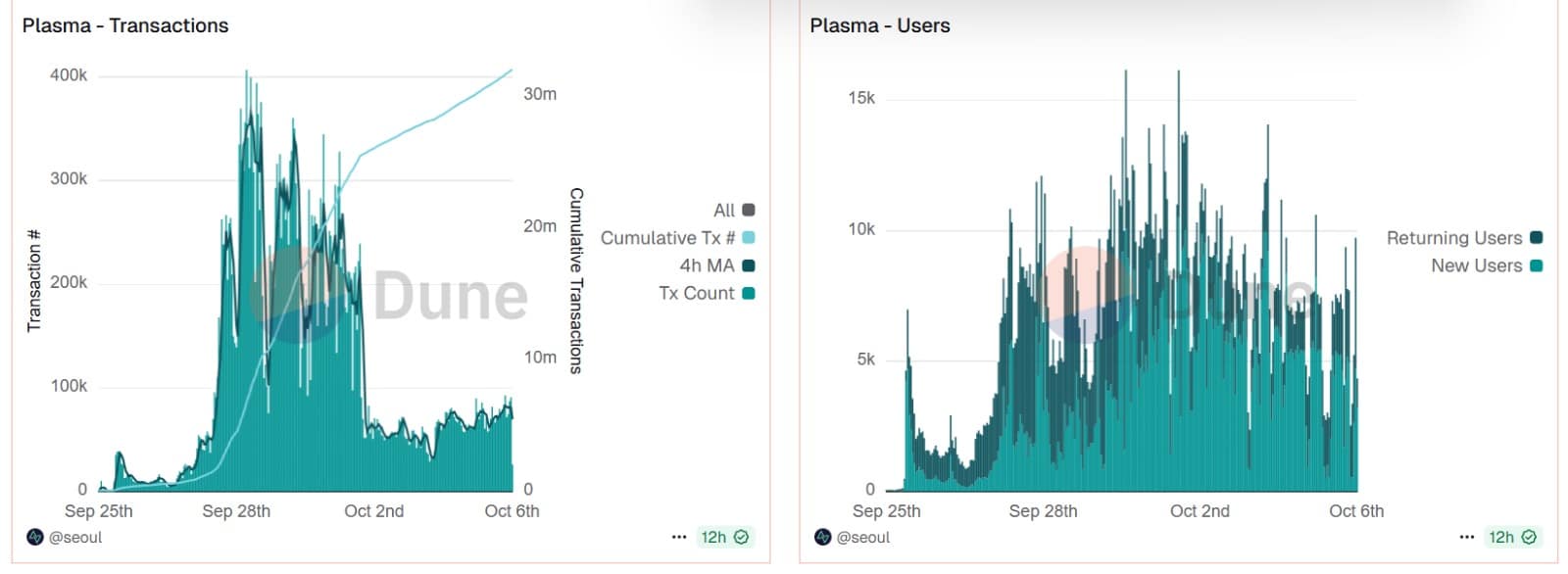

According to Dune Analytics, Daily Active Users bounced back from 5.4k to 9.6k at press time, indicating strong network usage.

At the same time, Cumulative Transactions surged to reach 31 million, further validating the network’s demand.

Source: Dune

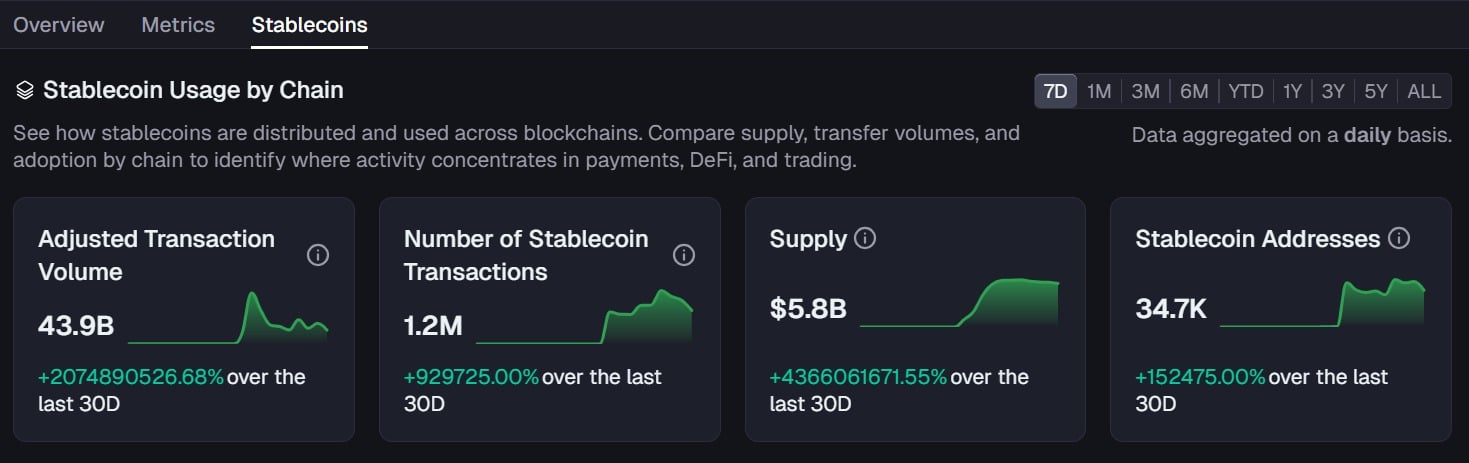

Interestingly, this on-chain demand is even more prevalent when we examine Stablecoin’s transfers.

According to Artemis, the Number of Stablecoin Transactions surged to 1.2 million, while Addresses have reached 34.7k at press time.

Source: Artemis

Moreover, Adjusted Transaction Volume reached a total of $43.9 billion, with USDT leading with $3.4 billion daily volume.

This level of activity typically enhances liquidity and developer participation, forming a reinforcing loop that sustains price momentum when maintained over time.

Can XPL sustain this uptrend?

AMBCrypto’s analysis showed Plasma’s recovery coincided with both demand and network strength.

For that reason, the altcoin’s upward momentum strengthened, with the Directional Movement Index (DMI) rising to 26 on 4-hour charts.

However, Stochastic RSI dropped to 78 after a downside crossover, hinting at potential near-term volatility.

Source: TradingView

At press time, XPL was trading within an ascending channel, reflecting a controlled and steady uptrend with buyers dominating while sellers take profit.

If aforementioned conditions persist, XPL could revisit the upper boundary near $1.07 and possibly target $1.37. But if profit-taking intensifies, the token might retrace toward the $0.86 support zone again.

Source: https://ambcrypto.com/charting-plasmas-xpl-12-rally-bulls-target-1-37-despite-profit-taking/