- Schwab proposes stablecoin amid ETF trading plans for BTC and ETH.

- Impact on traditional finance and digital integration remains substantial.

- Market reactions cautious pending official Schwab confirmations.

Schwab CEO Rick Wurster revealed intentions to introduce a stablecoin and expand into spot trading for Bitcoin and Ethereum ETFs during a recent conference call. This potential shift could provide new blockchain transaction solutions for Schwab’s extensive client base.

Charles Schwab is examining the role stablecoins could play in blockchain transactions, as expressed by CEO Rick Wurster in a conference. Schwab’s strategy to move towards issuing its own stablecoin highlights an effort to integrate digital transactions in traditional finance. Meanwhile, Schwab is simultaneously gearing up to offer spot trading for Bitcoin and Ethereum ETFs, further entrenching cryptocurrency access within its service portfolio. As one of the world’s largest financial services firms, managing over $10 trillion in assets, this technological shift could position Schwab as a pivotal player in digital finance. Market observers are alert to how such developments will influence digital asset accessibility and mainstream adoption. Institutional responses remain cautious, awaiting more official confirmations from Schwab concerning timeline and product details, reflecting a broader industry trend of careful adoption under regulatory scrutiny.

Schwab’s Stablecoin and ETF Strategy Unveiled

Schwab CEO Rick Wurster revealed intentions to introduce a stablecoin and expand into spot trading for Bitcoin and Ethereum ETFs during a recent conference call. This potential shift could provide new blockchain transaction solutions for Schwab’s extensive client base.

Market observers are alert to how such developments will influence digital asset accessibility and mainstream adoption. Institutional responses remain cautious, awaiting more official confirmations from Schwab concerning timeline and product details, reflecting a broader industry trend of careful adoption under regulatory scrutiny.

“If Schwab were to issue its own stablecoin, it would mark a significant institutional step toward integrating digital assets with traditional finance.” — Rick Wurster, President and CEO, The Charles Schwab Corporation

Financial Precedents and Market Impact

Did you know? The introduction of JPM Coin by JPMorgan marked a significant precedent in stablecoin utilization by major U.S. financial institutions, signaling potential industry-wide validation and adoption of blockchain technology.

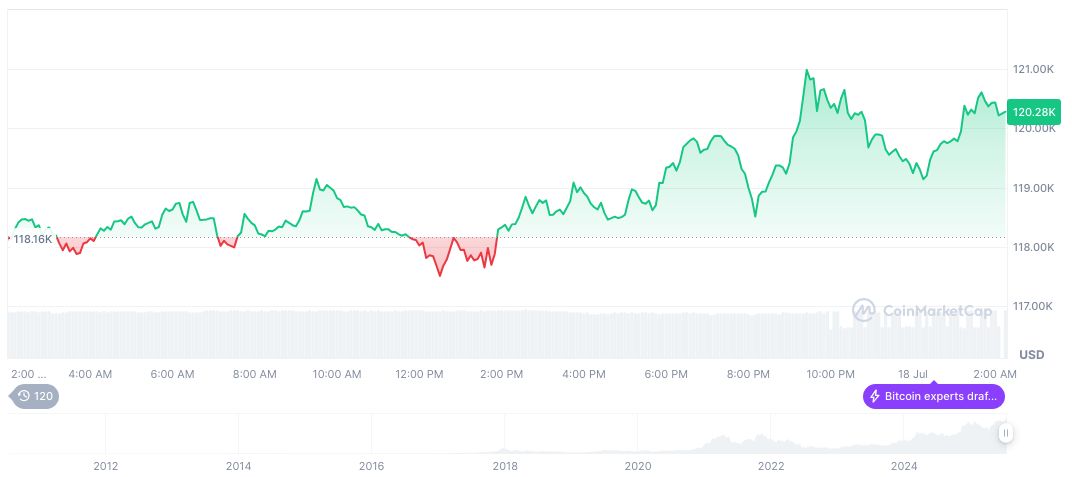

On July 19, 2025, Bitcoin’s price stood at $118,122.70 with a market cap reaching $2.35 trillion, commanding 61.07% market dominance. Despite a 2.16% decline over 24 hours, the asset showed a robust 38.56% gain over the past 90 days, as reported by CoinMarketCap.

Insights from the Coincu research team suggest such financial moves by Schwab could alter the landscape for traditional finance engagement in crypto markets. The absence of official Schwab-backed protocols signals a cautious regulatory approach, likely aligning with high compliance standards before any stablecoin or ETF launch.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349499-schwab-stablecoin-crypto-etfs/