- Whale accumulation highlighted a potential breakout as LINK battled a key resistance level.

- Declining exchange reserves and rising transactions created bullish conditions.

Chainlink [LINK] has been thrust into the spotlight after 30 newly created wallets withdrew 1.37M LINK worth $34.1M from Binance within just five days.

This accumulation coincided with a 4.01% price increase, pushing LINK to $24.93 at press time.

According to Lookonchain on X (formerly Twitter),

“Suspicious $LINK accumulation spotted! Over the past 5 days, 30 newly created wallets have withdrawn 1.37M $LINK($34.1M) from #Binance.”

Such whale activity often stirs speculation about a potential breakout, leaving traders wondering whether LINK could be preparing for its next big move in the market.

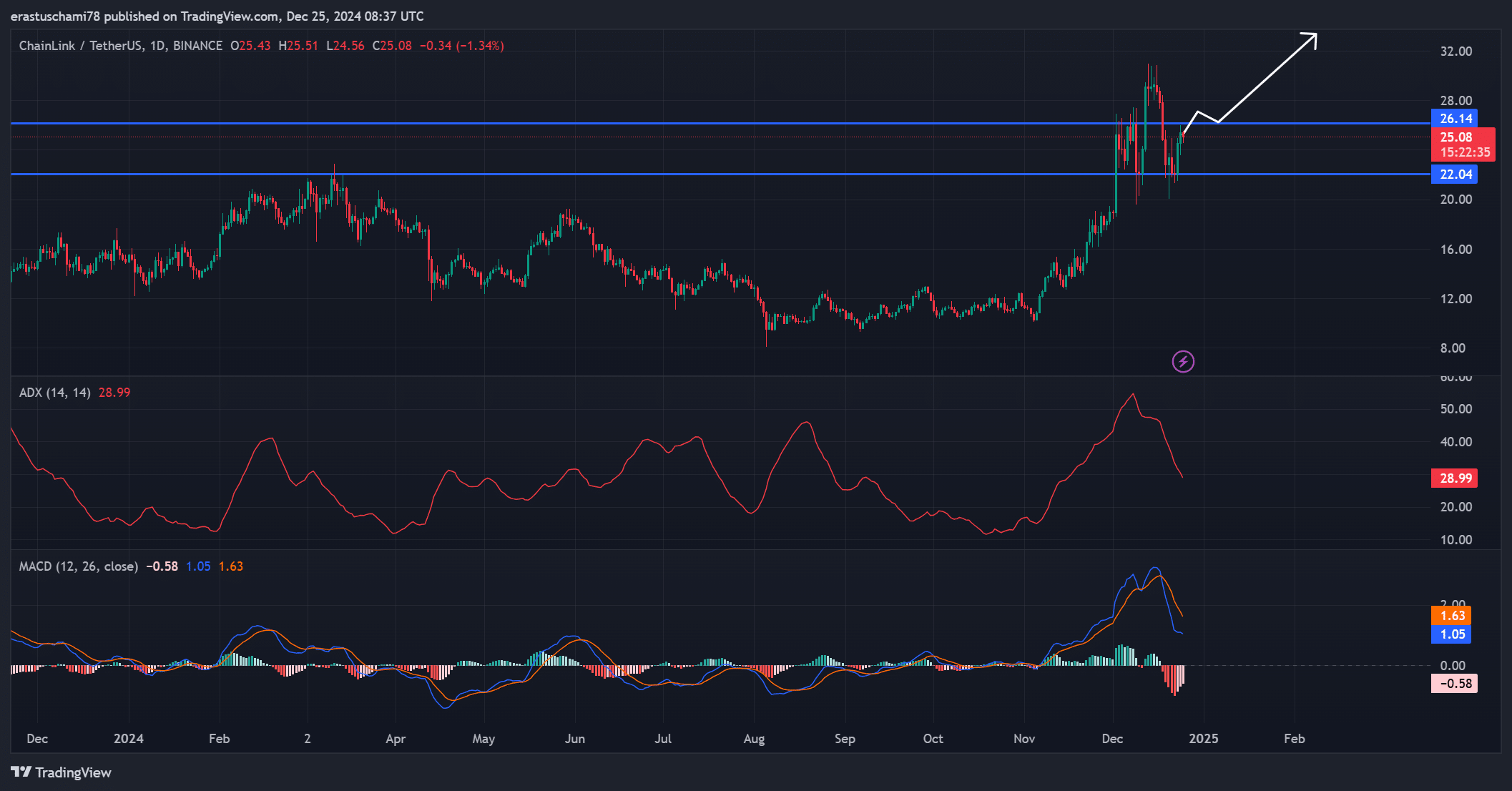

LINK price momentum faces resistance

On the technical front, LINK was battling a critical resistance at $26.14, while $22.04 served as a reliable support zone.

The MACD indicator displayed bearish momentum, yet the ADX reading of 28.99 highlighted a strengthening trend.

Additionally, the price action suggested that buyers were accumulating near support, which could spark a breakout if momentum builds.

A move above $26.14 would likely set the stage for a rally toward $30 and higher, adding excitement for bullish investors. However, failing to hold these levels may invite further consolidation.

Source: TradingView

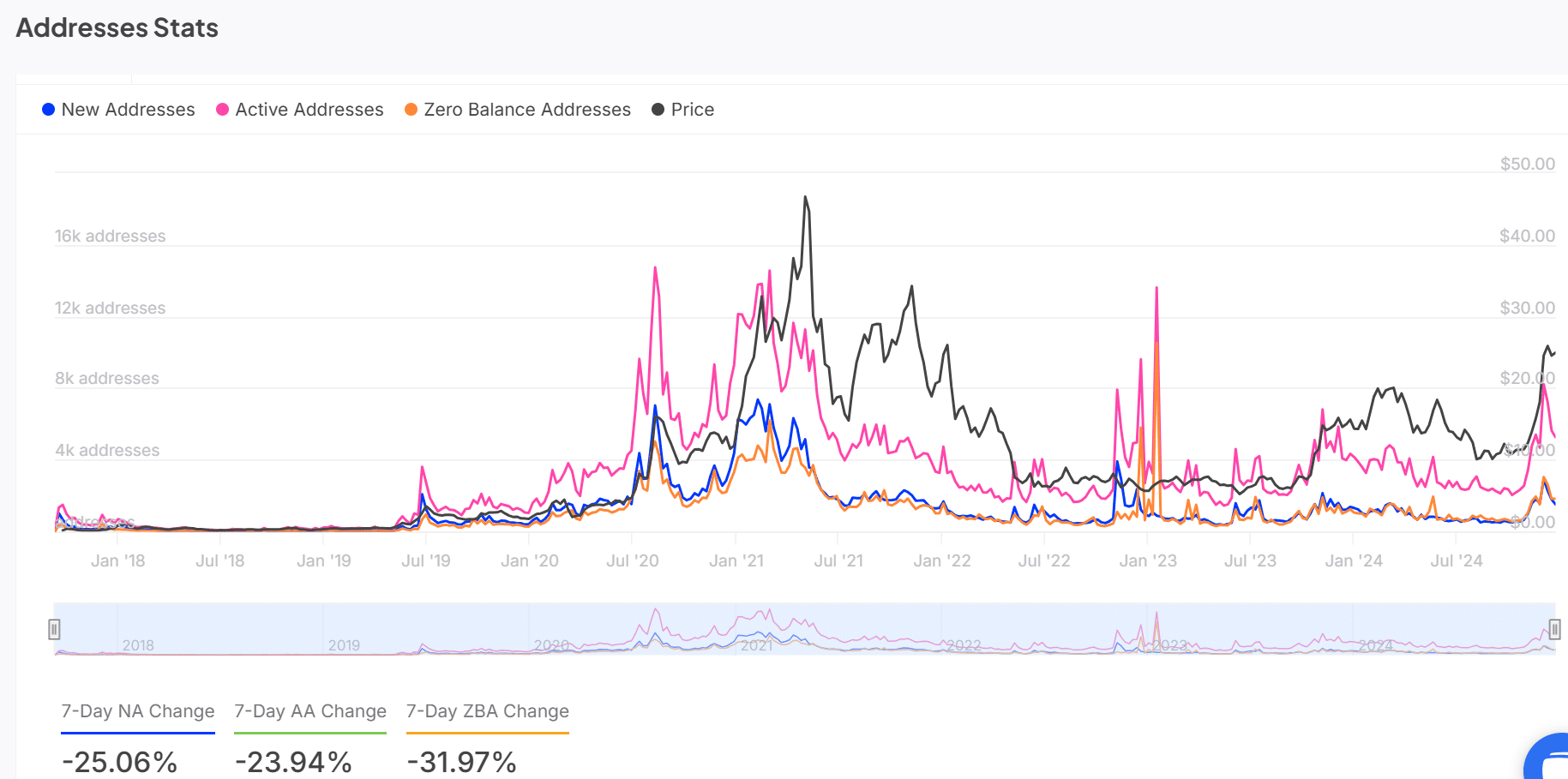

Address statistics reflected mixed on-chain activity

On-chain data revealed a mixed picture for ChainLink addresses. New addresses and active wallets have declined by 25.06% and 23.94% over the past week, respectively.

Zero-balance addresses also dropped significantly by 31.97%, indicating reduced retail engagement.

However, this contrasts with the notable whale activity, signaling that large holders may be positioning themselves for a potential price surge.

This divergence between retail and whale behavior could mark the early stages of a strategic accumulation phase.

Source: IntoTheBlock

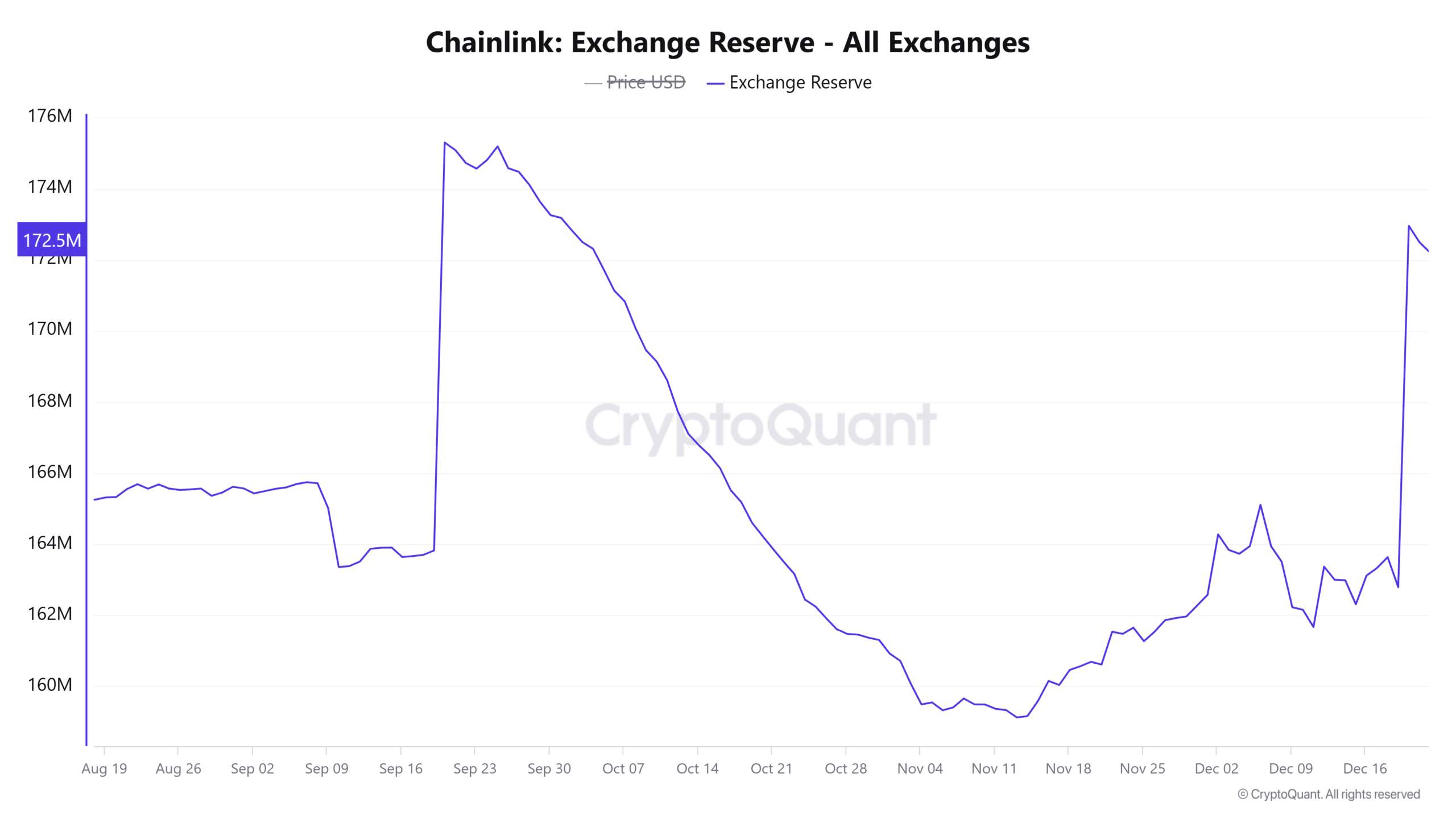

LINK: THIS bolsters optimism

Daily transaction counts for LINK grew by 1.05%, surpassing 11,466 transfers, as per CryptoQuant analytics. This uptick in activity suggests growing interest in ChainLink, potentially fueled by recent whale movements.

Additionally, exchange reserves dropped slightly by 0.06% to 172.5M, reflecting reduced sell-side liquidity.

Lower reserves often indicate a supply squeeze, which can create upward price pressure if demand remains steady. Therefore, these factors together point to an environment conducive to bullish outcomes.

Source: CryptoQuant

Is your portfolio green? Check out the LINK Profit Calculator

Conclusion: Is a rally inevitable?

All signs suggest that LINK is on the cusp of a significant breakout, with whale accumulation, declining exchange reserves, and rising transactions creating bullish conditions.

If LINK can break above $26.14, a rally to $30 seems highly likely, offering promising opportunities for investors.

Source: https://ambcrypto.com/chainlink-records-suspicious-whale-activity-whats-going-on-with-link/