Chainlink price trades near a sensitive zone after weeks of steady weakness. LINK price shows early signs of stabilization as buyers step back into the demand region. Meanwhile, the Chainlink Reserve continues to expand, increasing supply absorption across the network.

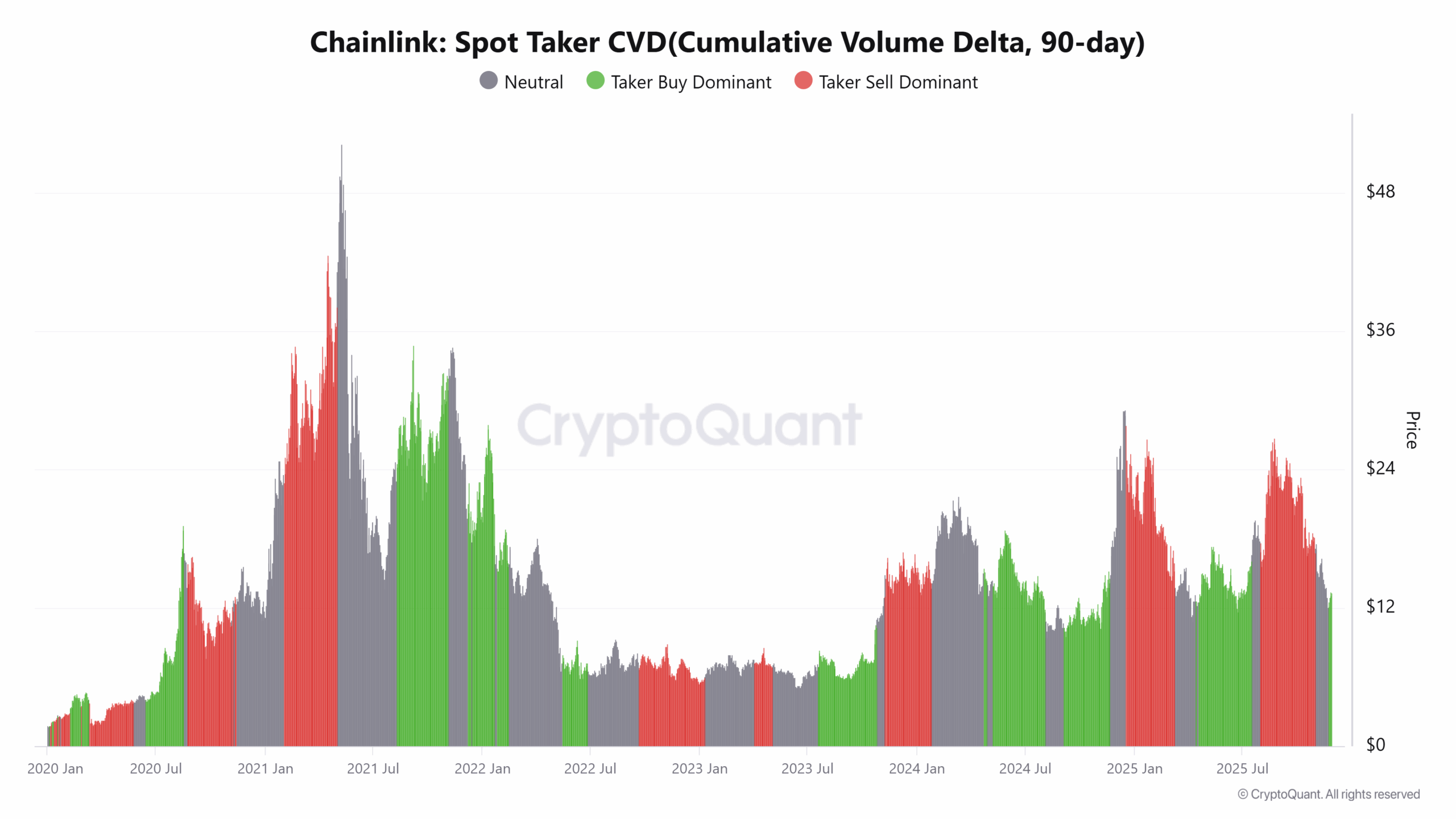

Besides, the Spot Taker CVD also trends higher, reflecting stronger buy-side activity at these levels. Together, these metrics create a decisive setup for the next major move as Chainlink price approaches a pivotal point.

Chart Signals Strength For Chainlink Price

At press time, Chainlink value sits inside the $12.00 to $13.20 demand zone. This area produced several strong rallies earlier in the year. Buyers now defend it again, and the candles show firmer reactions.

Notably, LINK price touched the lower band last week. Sellers failed to push deeper, and buyers stepped in quickly. This behavior shows fading sell strength each time price returns to this region.

The regression trend still caps recovery attempts. Price now presses against the lower boundary, and the candles show shorter upper wicks. The first resistance stands at $14.65. LINK price tested it twice, and both rejections weakened.

Meanwhile, a break above this level opens the path toward $19.05. This zone aligns with a weekly resistance that shaped earlier selloffs. A stronger rally could stretch toward $24.00. That level marked the earlier cycle peak before sellers took control.

The MACD rises with tighter bars forming. The signal line curves upward, which fits early recovery phases. These signals support a long-term Chainlink price forecast that favors a steady climb if buyers protect the demand zone.

Chainlink Reserves Expand And Tighten Supply

The Chainlink Reserve holds 973,752.70 LINK after adding 89,079.05 LINK. This increase continues a steady pattern of weekly accumulation. These inflows remove tokens from liquid circulation and support Chainlink price during weaker periods. The reserve often grows when enterprise activity strengthens.

Historically, LINK price reacts well when supply is near strong demand regions. That dynamic returns here because the reserve absorbs more tokens. This reduces sell-side pressure and improves stability as bulls push for structure.

The update lands at a crucial moment, with price testing a historical accumulation zone. Sellers lose strength while the reserve expands, which creates a supportive environment for a broader shift in trend.

RESERVE UPDATE

Today, the Chainlink Reserve has accumulated 89,079.05 LINK.

The Chainlink Reserve now holds a total of 973,752.70 LINK.https://t.co/oxMv5N3rFC

The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink Network by… pic.twitter.com/r5u9UpIhtu

— Chainlink (@chainlink) November 27, 2025

Spot CVD Highlights Strong Buyer Flow

Spot Taker CVD shows clear buyer dominance across the 90-day window. Market buys outpace sells, and the line trends upward. This behavior matches the reaction inside the demand zone. Buyers show more urgency, and each dip attracts stronger flow.

Chainlink price responded in a similar way during earlier rallies. The pattern repeats now, and the CVD structure supports that view. LINK price sits right below the regression boundary.

A breakout attempt becomes likely because the flow strengthens at a critical point. Buyers hold the advantage, and sellers struggle to create new lows.

To sum up Chainlink price now trades at a zone that shaped major rallies earlier in the year. The expanding reserve reduces liquid supply and supports conditions for a stronger recovery. Spot Taker CVD also leans toward clear buyer control, which matches the improving chart structure.

If bulls clear $14.65, LINK price could push toward $19.05 and eventually $24.00. The setup leans bullish as long as buyers protect the demand region and sustain pressure near the trend boundary.

Source: https://coingape.com/markets/chainlink-price-outlook-as-reserve-nears-1m-link-bullish-shift-ahead/