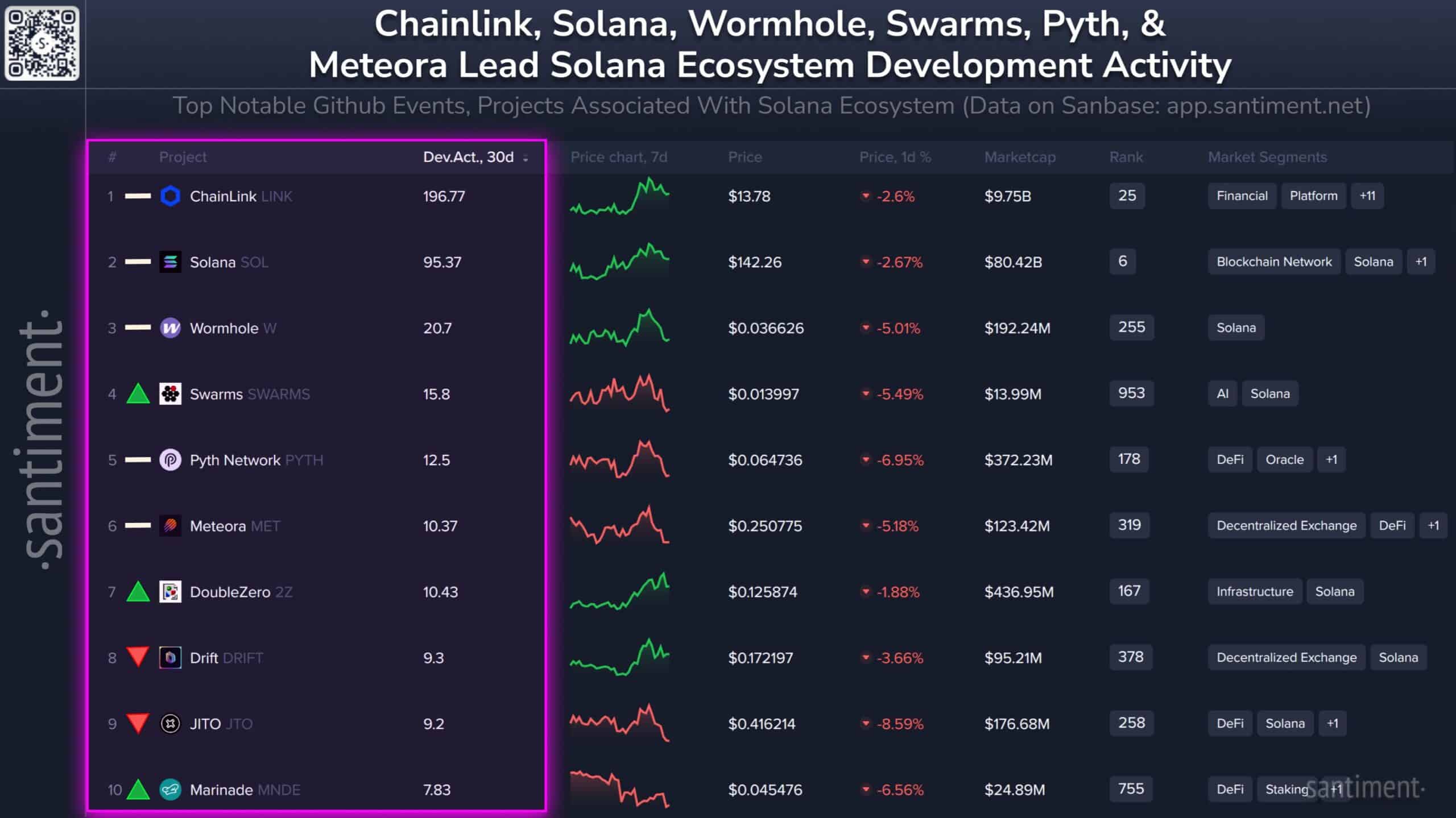

Chainlink [LINK] was the leading ecosystem development project on Solana [SOL].

This could be confusing at first glance, but since Chainlink is an oracle infrastructure, it will require more ongoing developmental activity.

Source: Santiment on X

The Santiment ecosystem filter includes the Chainlink platform due to the focus on the Cross Chain Interoperability Protocol (CCIP). It also provides price and other data feeds to DeFi projects on Solana, helping explain the healthy developmental activity lead it has over even SOL-native protocols.

Apart from developmental activity, other on-chain metrics showed Chainlink could be turning bullish once more.

Reasons investors should be interested in Chainlink

Source: Glassnode

There is a huge market for Chainlink now that the global financial system is increasingly moving on-chain.

It can help draw long-term investors’ attention. Metrics, such as the HODLer net position change, showed that accumulation from holders could begin soon.

The metric had been deeply negative in November but has reset to neutral levels recently. It indicated that holders had stopped cashing out and were preparing to accumulate new positions.

The shift away from aggressive distribution came alongside another potentially bullish signal.

Source: Glassnode

The Chainlink supply in profit metric tracks the percentage of circulating supply in profit. In November and December, the metric reached lows not seen since September 2023.

It was at 27.58% at the time of writing, which was still relatively low. From August to October 2024 and March to July 2025, the metric had oscillated between 30%-40%.

Both times, LINK prices saw a multi-month consolidation near the market lows before rallying higher. It was likely that a similar scenario would play out once again.

In other news, CME Group, the world’s largest derivatives market, has announced LINK and Micro LINK Futures contracts.

The Bitwise spot ETF attracted $2.59 million in inflows on the day of the launch. Whale accumulation helped make the case that LINK buyers were gaining strength.

These factors together gave investors a “buy” signal. Bitcoin [BTC] was another factor buyers should keep an eye on, as it could heavily sway market sentiment.

Final Thoughts

- The on-chain metrics showed long-term holders were done aggressively distributing LINK since the end of November.

- The low supply in profit showed a pattern since August 2024, which could be a bullish signal for Chainlink in the coming months.

Source: https://ambcrypto.com/chainlink-is-link-drawing-investors-as-key-metric-hits-cycle-lows/