Key Takeaways

Why is social sentiment about Chainlink high?

The increased tokenization of RWAs on LINK drove the social volume.

Can Securitize integration ignite reversal?

The integration of Securitize showed the institutional importance of Chainlink and could spark a reversal if the market structure aligned.

The crypto market was weak, and so was the price action of Chainlink [LINK] at the time of writing.

However, LINK was doing well on other fronts, like the social sentiment, growth of its reserve, and tokenization on the oracle platform.

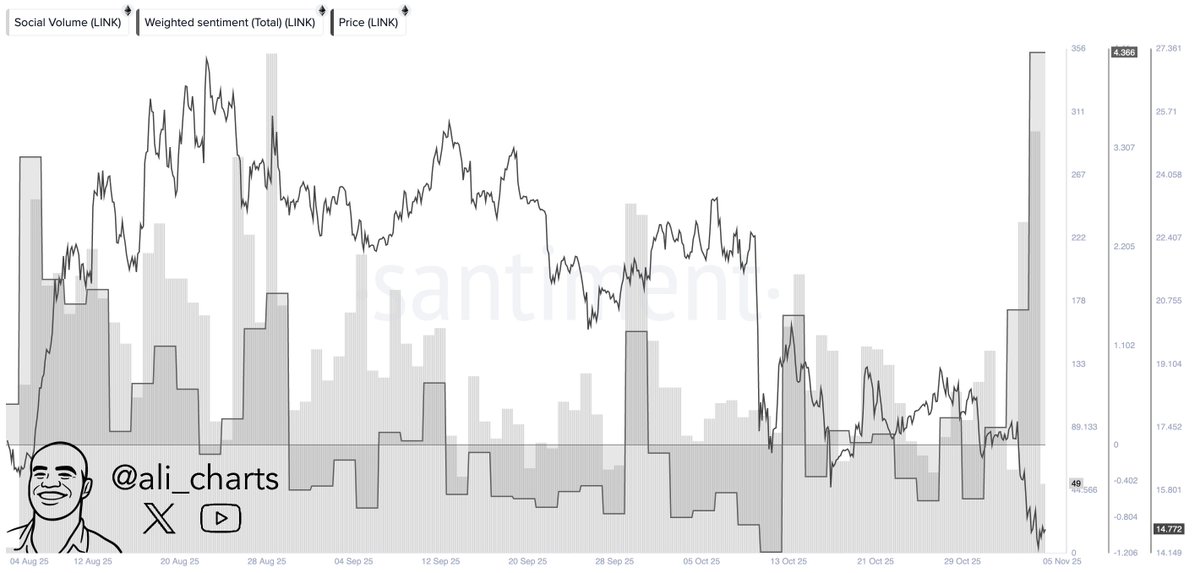

Social Volume hits a three-year high

The social sentiment for Chainlink hit a three-year high as the price dipped to the lowest since the 4th of August of this year. This kind of positive Social Volume at 356 coincided with a Weighted Sentiment total of 3.307, at press time.

Despite this reading, some users believed it could be a trap for potential holders. For others, it might be the beginning of its next leg up.

Usually, positive Social Volume corresponds with price appreciation, but this was not the case. As a result, this produced a bullish divergence, which often marks reversal points.

Source: Ali Charts/X

During such periods, it indicates that informed money is accumulating while retailers watch on the sidelines. The scenario was promising since LINK price was trading below $15, a level that pushed it to $27.

Chainlink Reserve peaks amid rising tokenization

Institutions that were tokenizing on the oracle were increasingly attracted to Chainlink tokens. Securitize integrated Chainlink data standard for the pricing of funds used as collateral on Aave Horizon.

Aave Horizon, which is powered by Chainlink NAVLink, surpassed $450 million in deposits. This explained how Chainlink was powering TradFi and DeFi convergence.

As tokenization gained traction, the Chainlink Reserve account was growing too. The reserve added 78,250 LINK tokens valued at $1.1 million. This sum became the largest amount ever purchased by the reserves since their inception.

The additions were coming in a span of about a week. When writing, the reserve had grown to 729,338 LINK tokens worth $10.8 million, acquired at an average cost of $20.49.

Source: Chainlink Reserve

While the altcoin was displaying positive market sentiments, the price was headed south. Can these developments ignite a reversal in price structure?

Potential LINK price reaction

On the charts, LINK had broken below a triangle pattern, reiterating its bearish outlook. In fact, the altcoin continued to drop, with the price trading at $14 after an attempted recovery back above $15.

However, the positives could be seen in the MACD and On Balance Volume (OBV). The MACD was in the green zone, and the volume stood at $48.24 million, as of writing, suggesting a slight buyer involvement.

Source: TradingView

For a bullish price reversal, LINK needed to rise above the broken zone at $16. Otherwise, price could drop to $11.60, June’s low that ignited the altcoin season trend in Chainlink.

Source: https://ambcrypto.com/chainlink-adds-78k-link-to-reserves-is-a-bullish-reversal-near/