- TIA is close to breaking a key price resistance.

- Despite the price, more traders have taken short positions.

Celestia has recently experienced one of the most positive price trends in the last seven days, driving significant growth in its market capitalization.

However, despite the upward price momentum, the funding rate for Celestia remains in negative territory, signaling a divergence between the spot market and derivatives market sentiment.

Celestia shows positive trends despite recent decline

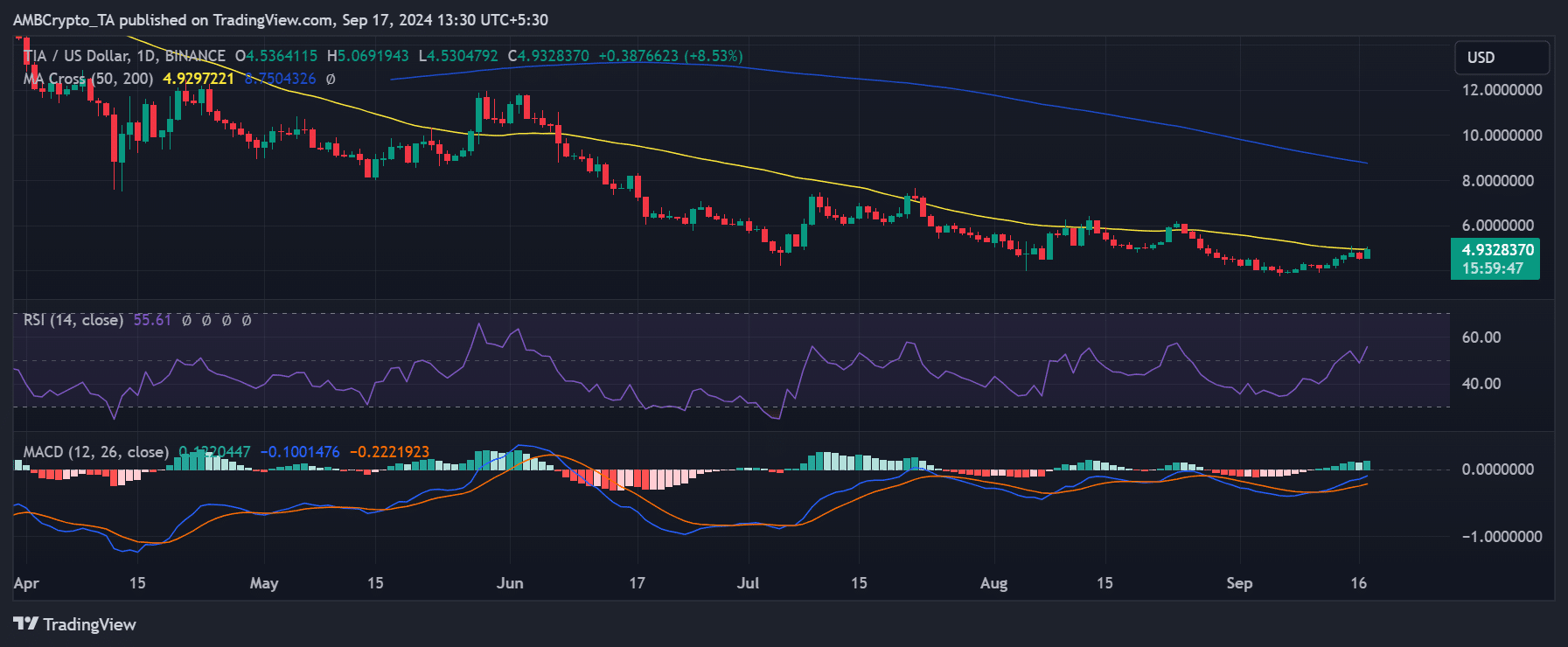

A recent analysis of Celestia on a daily time frame reveals positive trends over the past few days. Although the token saw a decline of over 5% in the previous trading session, dropping to around $4.50, it has since rebounded.

As of this writing, Celestia has risen by over 8% and is trading at approximately $4.90.

Source: TradingView

The data also indicates that Celestia is nearing a key resistance level, which coincides with its short-term moving average.

Additionally, Celestia has already surpassed one significant resistance—the neutral line on its Relative Strength Index (RSI). The RSI is now approaching 60, signaling a potential bullish run ahead.

Celestia among the top gainers with over 18% gains

According to CoinMarketCap, Celestia (TIA) has emerged as one of the highest gainers in the last 24 hours. The data shows that TIA has increased by over 5%, making it the second-highest gainer as of this writing.

Over the past seven days, Celestia ranks as the third-highest gainer with an impressive 18% rise.

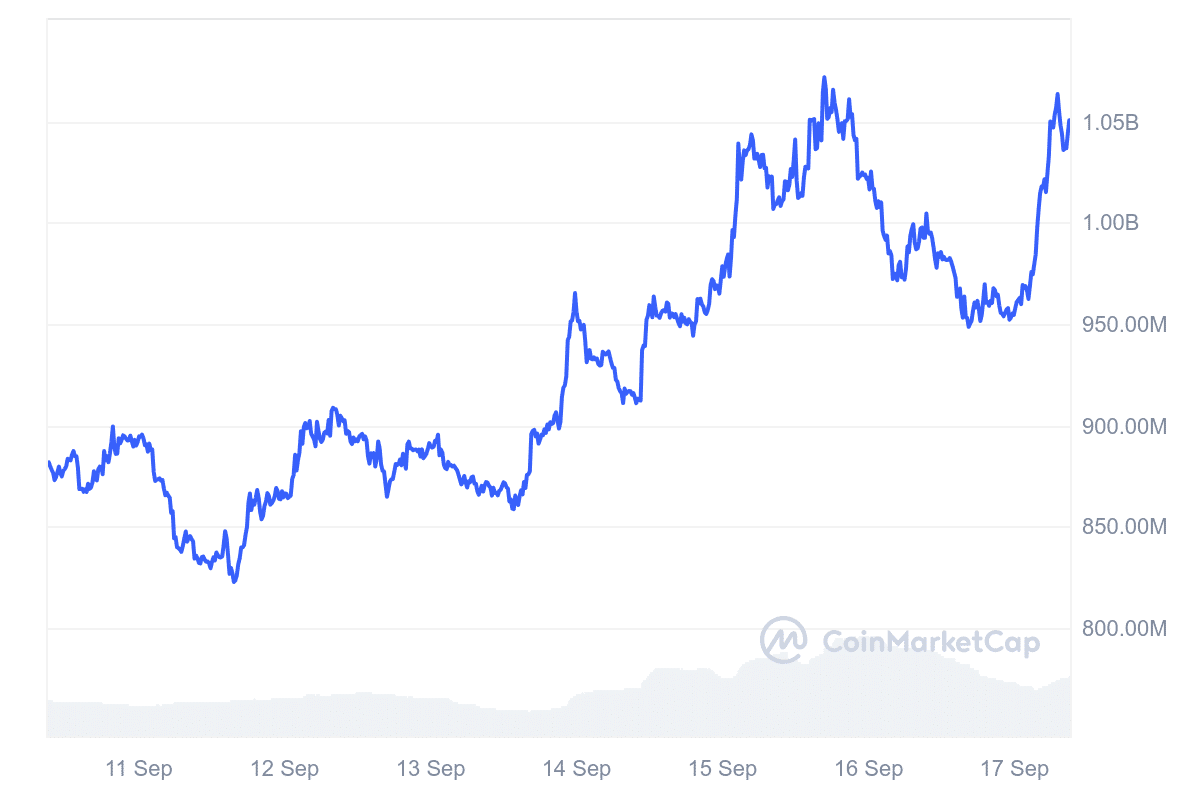

Source: CoinMarketCap

Furthermore, an analysis of Celestia’s market capitalization reveals significant growth in the past week, rising from approximately $879 million to over $1 billion.

However, on a 30-day time frame, the data indicates that its market capitalization remains below its value from a month ago, when it stood at around $1.2 billion.

TIA’s positive price movements not reflected in derivatives

Despite recent positive price trends, Celestia’s derivative market has not mirrored this optimism, according to data from Coinglass.

An analysis of the funding rate shows that it has remained below zero for the past few weeks, indicating that there have been more sellers than buyers during this period.

Is your portfolio green? Check out the Celestia Profit Calculator

This suggests that many traders are taking short positions on Celestia, expecting its price to decline.

However, if the spot trading volume continues to rise and outweighs the derivative market’s sentiment, Celestia (TIA) could still experience further price growth despite the bearish outlook from derivative traders.

Source: https://ambcrypto.com/celestia-climbs-to-top-gainers-list-but-funding-rate-signals-caution/