- The Central National Debt Registration and Settlement Co., Ltd. (CCDC) drops commitment-letter rule for foreign institutions.

- Simplifies how foreign banks access China’s bond market.

- May marginally boost foreign holdings of Chinese bonds.

The Central National Debt Registration and Settlement Co., Ltd. has removed the commitment letter requirement for foreign central bank-like institutions under China’s People’s Bank directives, effective immediately.

Simplifying investment access could enhance foreign participation in China’s bond market, with potential impacts on demand for government bonds and market liquidity.

CCDC Streamlines Foreign Entry into China Bonds

The CCDC’s announcement aims to simplify the entry process for foreign central banks and similar institutions into China’s interbank bond market. Implementation of People’s Bank of China directives encouraged this change, highlighting ongoing efforts to make China’s bond market more accessible.

The change signifies the removal of prior bureaucratic hurdles, potentially accelerating investment flows from qualified foreign entities into Chinese bonds. This simplification can also expedite the account-opening process.

The decision to remove commitment letters marks an important step towards integrating foreign investment into the fabric of China’s growing financial market, informs a financial analyst specializing in China’s economic policies.

Historical Easing and Bitcoin Surge Insights

Did you know? China previously eased foreign access to its interbank bond market in efforts to stabilize its growing financial sector amidst challenges. This has historically led to a steady rise in foreign ownership rather than dramatic shifts.

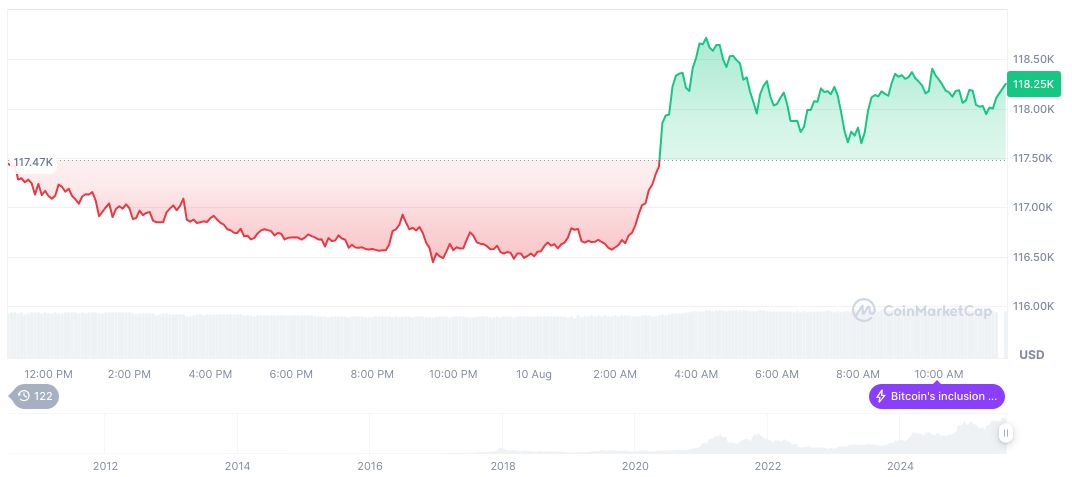

Bitcoin (BTC) currently trades at $121,220.19, reflecting a 2.54% increase in the last 24 hours according to CoinMarketCap. With a market capitalization of $2.41 trillion, Bitcoin commands a 59.83% market dominance. Recent data indicates a 5.78% rise over the past week, highlighting continued bullish sentiment.

Experts from the Coincu research team suggest that this policy shift could signal China’s openness, fostering greater foreign participation and potentially influencing broader liquidity narratives. While immediate crypto impacts are minimal, macro shifts could arise if foreign capital flows increase under these relaxed regulations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/ccdc-simplifies-foreign-bond-access/