- CBOE proposes automatic listing for qualifying crypto ETFs.

- Removes the SEC’s case-by-case approval.

- Impacts crypto assets with regulated futures.

The Chicago Board Options Exchange proposed automatic listing for crypto ETFs on July 31, seeking streamlined approvals from the U.S. Securities and Exchange Commission.

This move could accelerate market access for Bitcoin, Ethereum, and other crypto ETFs, significantly impacting market liquidity and institutional investment strategies.

CBOE’s Proposal and Industry Reactions

CBOE submitted a proposal to the U.S. Securities and Exchange Commission (SEC) to enable automatic listings for cryptocurrency ETFs. The proposal outlines that if a crypto asset has been trading in futures on a regulated market for at least six months, the relevant ETF would qualify for listing. In addition, collateralized ETFs must create a liquidity risk management plan when more than 15% of the ETF’s assets are not instantly redeemable.

With this proposal, CBOE seeks to bypass the SEC’s traditional case-by-case approval process for ETFs. This regulatory shift aims to streamline and expedite the launch of new spot and staking-enabled ETFs, including those tied to Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and XRP. Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, remarked, “It’s about a dozen of the usual suspects… final approvals are likely September to October for all.”

Industry reactions are largely supportive. Notably, Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, indicated that final approvals might occur between September and October. Moreover, other exchanges such as NYSE Arca and Nasdaq are anticipated to submit similar proposals, displaying broad industry endorsement.

Market Impact and Future Prospects for Crypto ETFs

Did you know? The creation and redemption mechanics approved for crypto ETFs in July 2025 prepared the way for CBOE’s current initiative towards automatic listings.

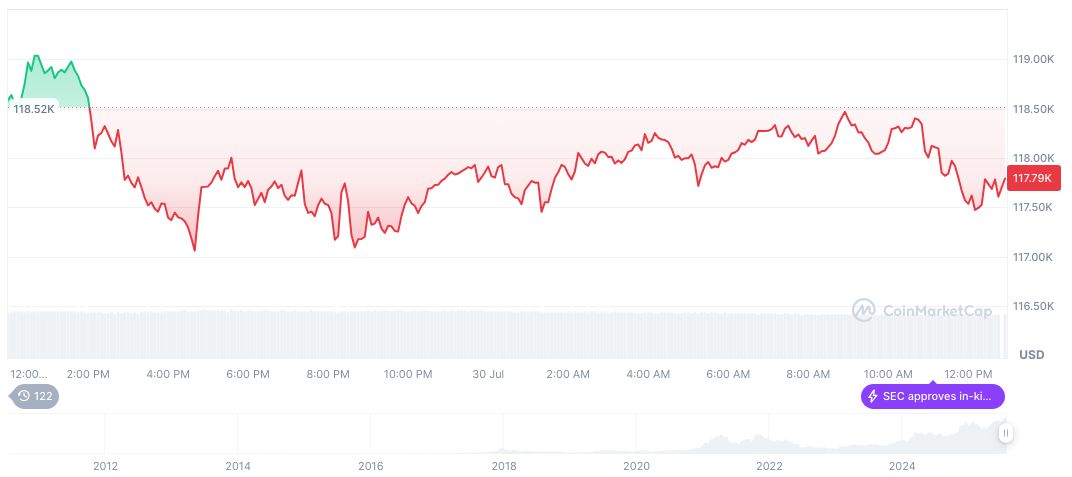

As per CoinMarketCap, Bitcoin (BTC) currently maintains a price of $118,602.78 with a market cap at $2.36 trillion. The trading volume over the last 24 hours stands at $69.74 billion, presenting a minor change of 0.38%. Over the past month, BTC has experienced a price increase of 11.25%.

Insights from Coincu research team predict that increased accessibility to ETFs could result in notable institutional investment inflows and enhance mainstream adoption of digital assets. Nate Geraci, President of ETF Store, stated, “CBOE just filed 19b-4 requesting a rule change which would allow crypto ETFs to list & trade under a standard framework… [instead of] specific approval for each crypto ETF as long as it meets certain criteria.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/cboe-crypto-etfs-automatic-listing/