- ADA’s active addresses showed that one key on-chain data reacted to the upgrade.

- ADA has remained in a bear trend.

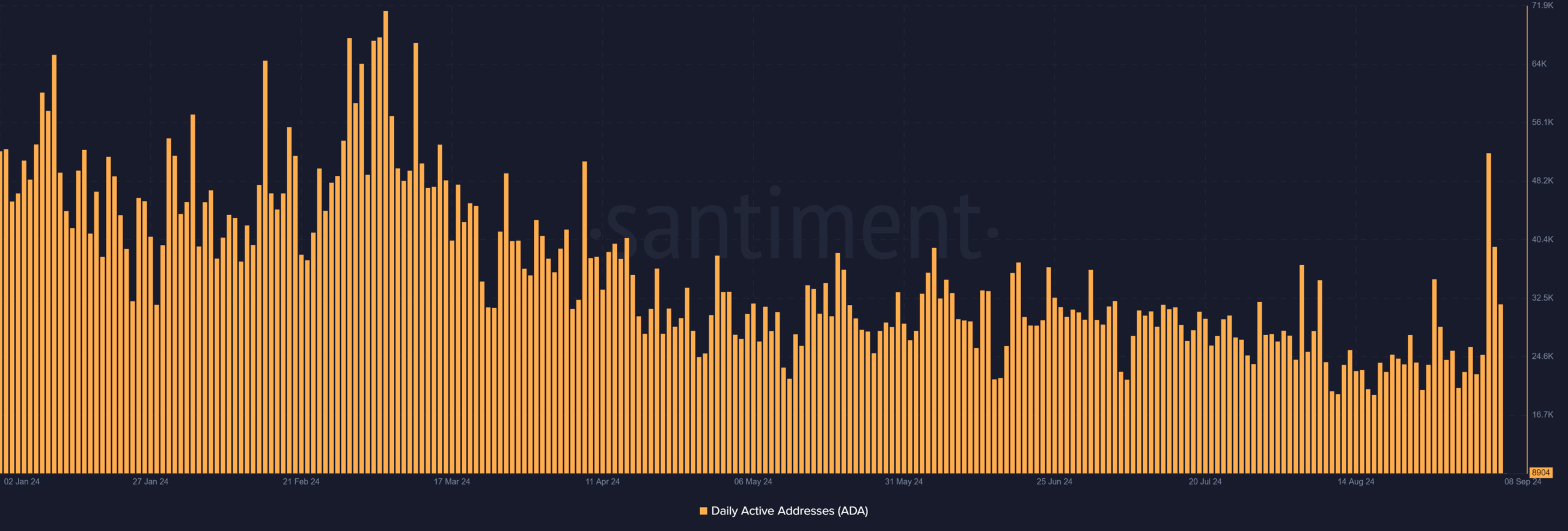

Cardano [ADA] recently garnered attention with its latest upgrade earlier this month. Despite the upgrade, the network did not see an immediate impact on price or activity. However, ADA’s active addresses have surged over the last three days, reaching their highest levels in months.

Cardano gets more active addresses

An analysis of Cardano’s daily active addresses shows a recent surge to its highest level in over five months. According to data from Santiment, ADA’s daily active addresses spiked to over 52,000 on 5th September.

Although this number dropped to around 39,400 the following day, it was still the highest since May. By the end of trade on 7th September, the active addresses had declined further to approximately 31,600.

Source: Santiment

Despite these declines, this marks the first time in months that Cardano has seen a strong surge in daily active address activity. The sudden spike in active addresses suggests growing interest and engagement within the Cardano ecosystem, which may be a delayed reaction to the recent network upgrade.

While the initial impact of the upgrade was muted, this rising network activity could indicate that the improvements are beginning to resonate with users.

The increase in active addresses might pave the way for greater utility and participation on the Cardano network in the coming weeks, signaling a renewed interest in the platform.

ADA getting close to a reversal?

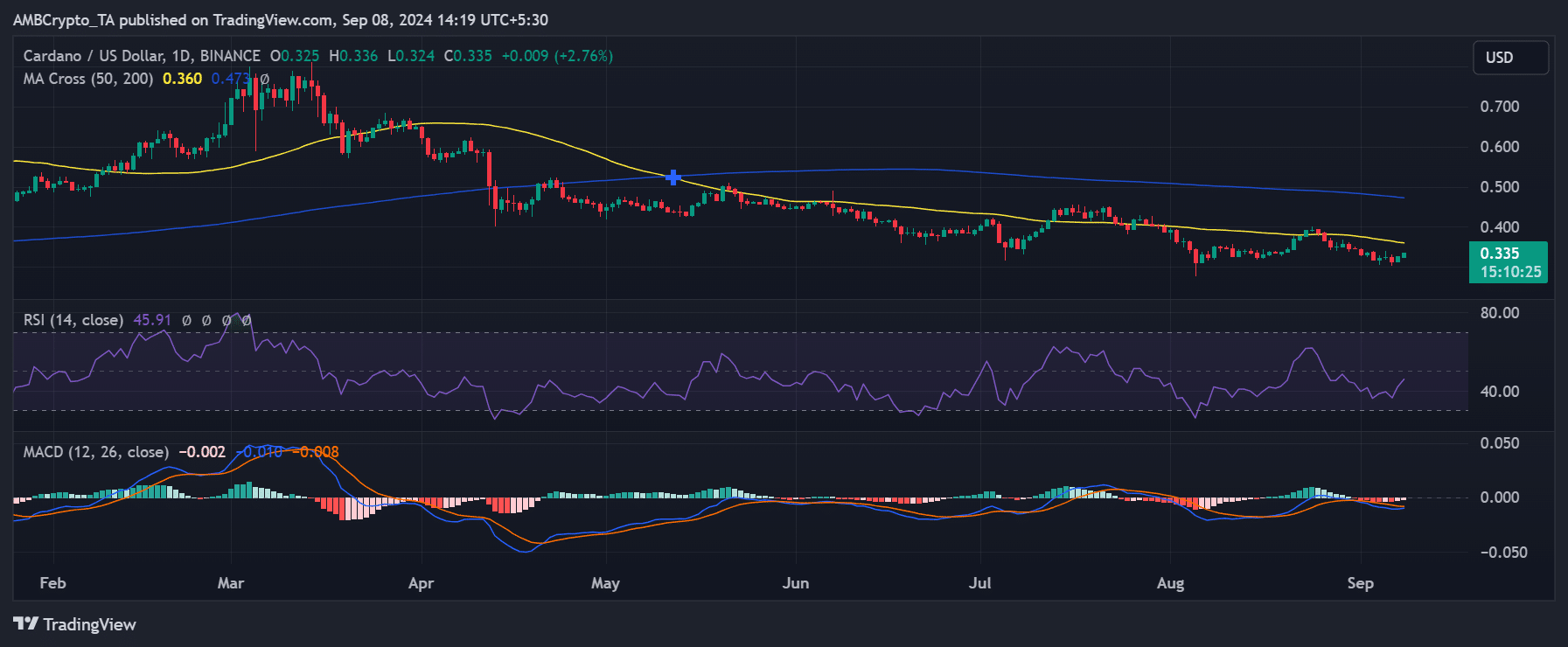

An analysis of Cardano’s daily chart shows that the asset is still in an overall downtrend, but it has seen some positive momentum in the last 24 hours.

According to AMBCrypto’s analysis, ADA closed the last trading session at around $0.32, reflecting a 3.4% increase. As of this writing, it is trading at approximately $0.33, with an additional 2.7% increase.

If Cardano can maintain this current upward trend, it will mark the first time in two weeks that the asset has posted consecutive gains of over 2%. Should this momentum continue, it could signal a potential return to a bull trend for ADA.

Source: TradignView

An analysis of Cardano’s Relative Strength Index (RSI) shows that it remains below the neutral line, indicating that it is not yet in bullish territory.

However, the RSI has moved closer to neutral over the past 24 hours, currently at around 46. A continued rise in RSI could further strengthen the case for a shift toward bullish momentum, indicating that Cardano may soon break out of its downtrend if positive price action persists.

Cardano held in the $300 million volume level

Recent analysis shows that Cardano’s (ADA) trading volume has consistently stayed in the $300 million range, with the highest volume reaching around $340 million.

While this is a decent level of activity for ADA, higher volumes will be necessary for the price to break out of its current downtrend and maintain a sustained bullish trend.

Realistic or not, here’s ADA’s market cap in BTC’s terms

A convergence of both rising price and volume would be crucial to solidifying a positive trend. With a corresponding increase in volume, any short-term price gains may be sustainable.

Cardano’s trading volume was around $160 million as of this writing.

Source: https://ambcrypto.com/cardanos-network-activity-soars-post-upgrade-will-prices-follow/