- Cardano’s price surged 4.75% after Charles Hoskinson addressed rumors.

- 76.59% of Cardano holders are “out of the money,” indicating potential downside risks.

Since the start of September, Cardano [ADA] has faced consistent bearish pressure, as indicated by key technical indicators.

The MACD remained below the Signal line, showing red histograms until a bullish crossover occurred on the 9th of September.

This positive shift was further validated by the RSI, which climbed from below the neutral level to enter the bullish zone by 10th September.

Source: Trading View

Despite technical indicators suggesting bullish sentiment, the price hikes remained modest and largely unnoticed until Cardano founder Charles Hoskinson addressed rumors circulating the project on X.

This triggered a 4.75% surge in ADA, bringing its trading price to $0.3549.

As of the latest CoinMarketCap update, Cardano recorded a 10% weekly gain, outperforming both Bitcoin [BTC] and Solana [SOL] over the same period.

Rumors surrounding Cardano

So for those unfamiliar, on the 11th of September, a group of well-known crypto analysts, including MartyParty, CTO Larson, InvestAnswers, and Mando, discussed Cardano’s market standing during a podcast posted on X.

The conversation focused on why projects like Cardano and Ripple [XRP] maintain large market capitalizations despite recent lackluster price performance.

To which an X user – Stake with Pride replied,

“Cardano is the only top 20 coin with native liquid staking. No staked ADA is ever locked and no LSDs/LSTs required.”

It further noted that some critics argue that the high market cap may be inflated, with accusations that investors are mistakenly led to believe their staked ADA is locked and inaccessible—although it isn’t.

Additionally, questions about Cardano’s real-world adoption persist, with some alleging that its market valuation may not fully align with its actual utility and adoption within the broader crypto ecosystem.

Source: Stake with Pride/X

Mando reiterated the same and even suggested that restrictions on unstaking ADA might be keeping the market cap artificially high.

He even went ahead and tagged Hoskinsons’ old post where he claimed,

“The biggest threat to #Bitcoin’s dominance has and always will be #Cardano.”

To which Mando added,

Source: Mando/X

Hoskinson’s response to rumors

In response to the rumors, Charles Hoskinson took to X to clarify the situation, stating that the claims were far from accurate. He said,

“The lies and misinformation about Cardano have reached epic levels. Stake isn’t locked, but they still lie. Why does anyone trust these people anymore?”

Despite Hoskinson’s efforts to dispel the rumors, ADA’s price didn’t see an immediate positive impact.

Shortly after his post, the token dropped from $0.35 to $0.33, showing that his statement wasn’t enough to drive an upward trend.

However, it wasn’t long before ADA experienced significant gains, marking its strongest price increase in weeks.

ADA’s price looks iffy

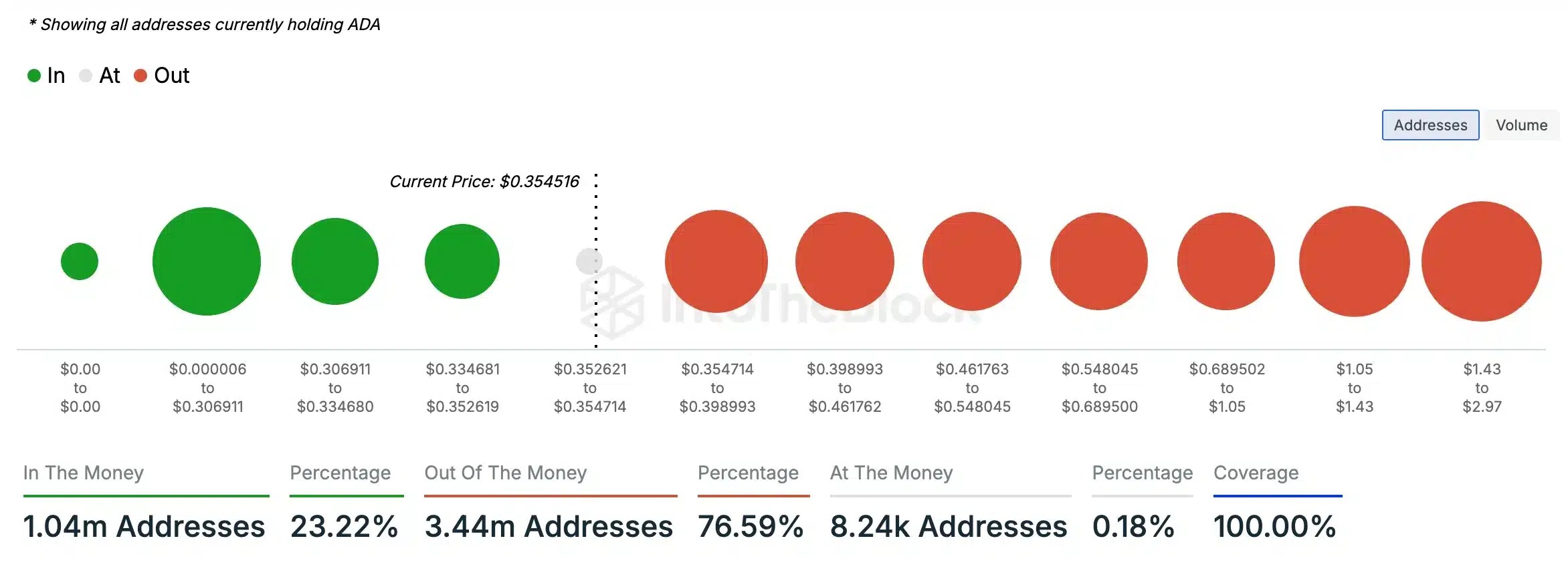

However, according to AMBCrypto’s analysis of IntoTheBlock data, a mere 23.22% of Cardano holders are currently “in the money,” with their tokens valued higher than their initial purchase.

In contrast, a striking 76.59% of holders are “out of the money,” holding ADA worth less than their investment.

This disparity highlights potential downside risks for ADA, suggesting that a bearish sentiment could emerge if this trend continues, further impacting the token’s value shortly.

Source: IntoTheBlock

Source: https://ambcrypto.com/cardanos-hoskinson-debunks-ada-rumors-but-price-fluctuates/