Cardano faces a strong resistance point at the $0.38 price territory, representing a zone where over 319,000 addresses purchased 7.19 billion ADA.

On-chain data provider IntoTheBlock called the public’s attention to Cardano’s current situation in a recent post on X. The analytics resource provided an overview of the ADA market, showcasing the rate of investor profitability at the asset’s current price level.

IntoTheBlock data reveals a massive supply wall between $0.3726 and $0.3943 at an average price of $0.3834. This supply wall formed due to 319,430 addresses purchasing 7.19 billion ADA within the highlighted price range.

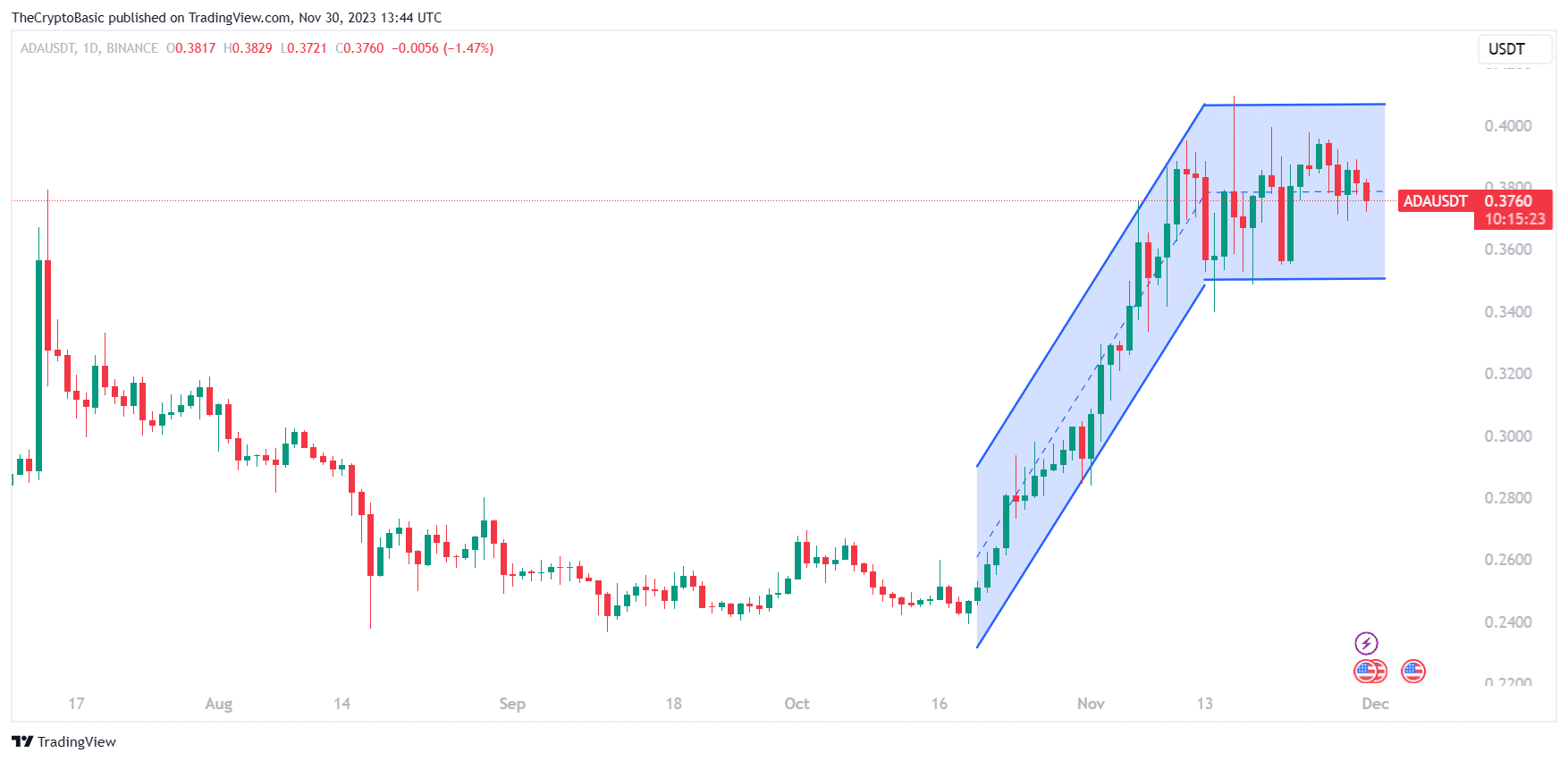

Despite a massive uptrend that began on Oct. 20, Cardano has struggled to conquer the price range. However, each attempt has met opposition from the bears due to the supply wall. ADA had skyrocketed 65% from $0.2394 in late October to $0.3951 on Nov. 11.

– Advertisement –

ADA witnessed resistance at the $0.3951 high, leading to a slump to $0.3400 three days later. Another resurgence saw Cardano tower above the $0.38 resistance and breach the $0.40 psychological territory. The asset soared to a 7-month high of $0.4095 on Nov. 16, riding on the market-wide rally.

Nonetheless, this rally also met another resistance, like the previous ones. ADA soon dropped to $0.3551. Subsequent attempts to sit comfortably above $0.38 have also been futile, but Cardano has continued to register higher lows, indicating bullish momentum.

Only 35% of ADA Holders in Profit

Despite this bullish momentum and the previous uptrend recorded by Cardano, IntoTheBlock confirms that most ADA investors are seeing a loss on their holdings. Data confirms that only 35% of ADA holders are in profit, with about 57% witnessing unrealized loss, and the rest at breakeven.

This pattern suggests that most Cardano investors procured their ADA tokens above the current price. The trend contributes to ADA’s resistance, as upward price movements lead to investors scrambling to sell off their assets at breakeven, triggering selling pressure.

As a result, Cardano has faced a general roadblock to the previous upward momentum, resulting in a 2-week long consolidation. This consolidation has triggered the formation of a bullish pennant, a structure recorded by most assets this period.

A bullish pennant is a continuation pattern comprising a previous upward momentum (the pole), triggered by a strong price movement, and a consolidation structure (the pennant). It suggests a brief pause in the uptrend before a resumption.

Market watchers are looking for a breakout from the pennant, which would signal a potential resumption of the uptrend. The upper trendline of the pennant currently rests on $0.4083, representing one of Cardano’s fiercest resistance points. ADA trades for $0.3760 as of press time.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Source: https://thecryptobasic.com/2023/11/30/cardano-faces-strong-resistance-at-0-38-where-319k-investors-bought-7-19b-ada/?utm_source=rss&utm_medium=rss&utm_campaign=cardano-faces-strong-resistance-at-0-38-where-319k-investors-bought-7-19b-ada