- Cardano broke from a falling wedge, indicating a potential bullish reversal toward $0.380.

- Indicators showed growing bullish momentum for ADA, with key resistance and support levels in focus.

Cardano [ADA] has broken out of a falling wedge pattern, a chart formation typically associated with a bullish reversal. The pattern, characterized by lower highs and lower lows, has been a key indicator for a potential upward trend.

This breakout could suggest the end of a prolonged downward movement, with ADA showing signs of entering a more positive phase.

Historically, falling wedge breakouts often lead to stronger upward momentum. If this breakout follows similar patterns from the past, ADA may see notable price increases soon.

The breakout comes after a sustained price decline, which may indicate that selling pressure has eased and buyers are gradually returning to the market.

Retest phase and critical support levels

Following the breakout, ADA is undergoing a retest phase, where the price is slightly pulling back to confirm the breakout. This phase is crucial as it often determines whether the breakout is legitimate and if the price can maintain its upward momentum.

A successful retest would validate the bullish trend and increase the likelihood of further price movement to the upside.

If ADA holds this retest, it could trigger a strong bounce upward, potentially driving the price toward higher resistance levels.

However, failure to hold this support could result in a return to previous levels, leading to more price consolidation. The next key resistance for ADA is around $0.380, which was previously tested in mid-September.

A breach of this level would signal the continuation of bullish momentum.

Large transactions and address activity decline

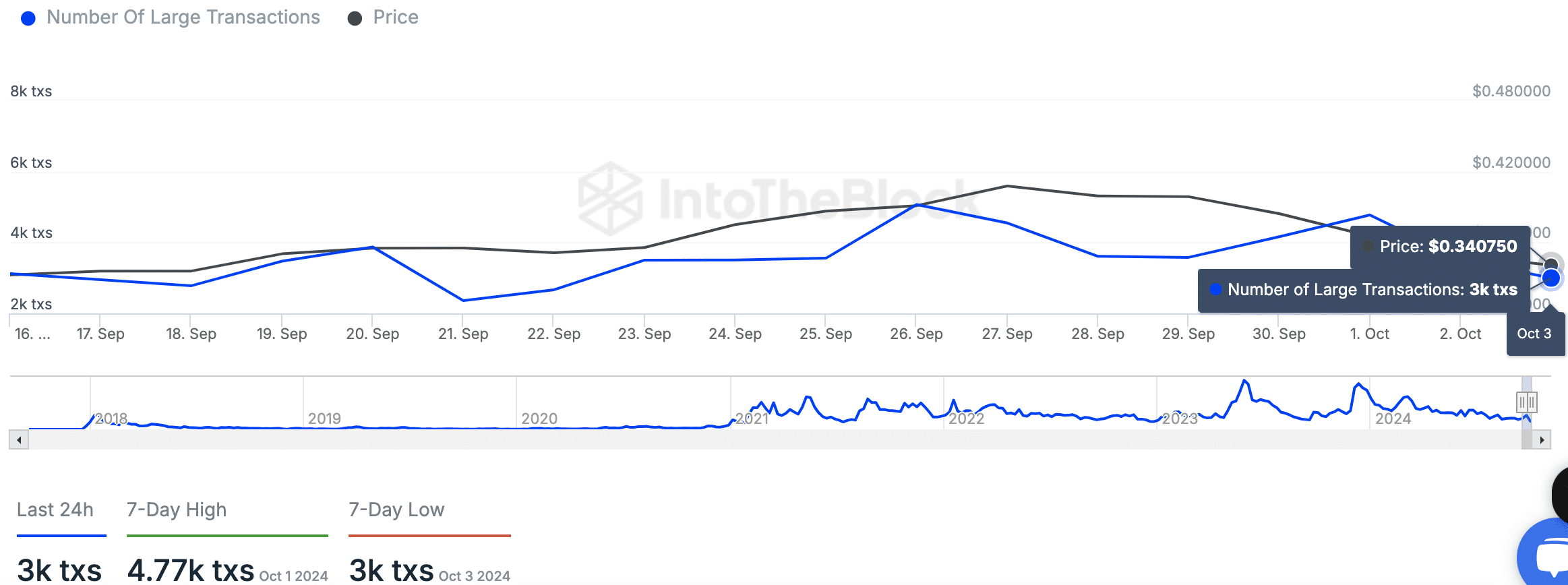

According to IntoTheBlock data, Cardano has registered 3,000 large transactions, marking a 7-day low in comparison to the 4,770 large transactions recorded on the 1st of October.

This reduction in large transactions may indicate a temporary decline in whale activity or institutional interest.

Price consolidation often follows a drop in large transactions, and it is a factor to watch closely as the market evolves.

Source: IntoTheBlock

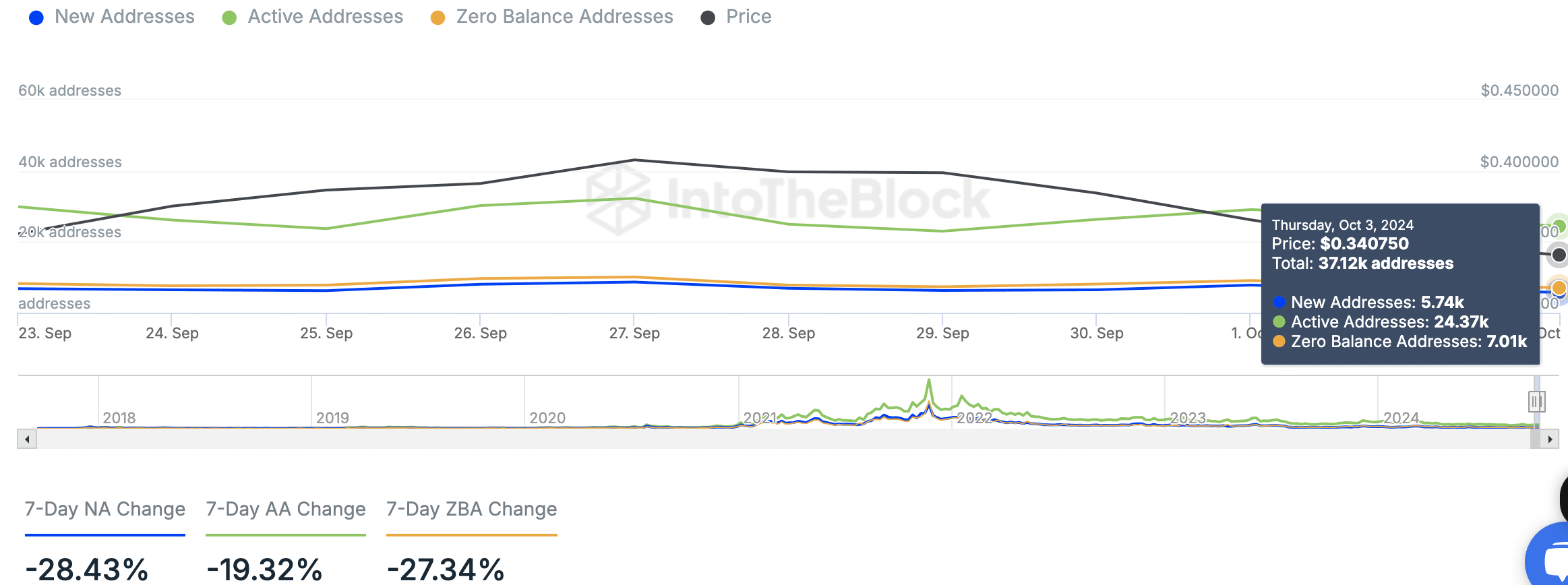

In terms of network activity, ADA’s total addresses reached 37.12k as of the 3rd of October, including 5.74k new addresses, 24.37k active addresses, and 7.01k zero-balance addresses.

Read Cardano’s [ADA] Price Prediction 2024-25

The 7-day data shows a decline across all categories, with new addresses down 28.43%, active addresses falling by 19.32%, and zero-balance addresses decreasing by 27.34%.

These metrics suggest a temporary reduction in overall user engagement and activity within the network, which could influence short-term price movement.

Source: https://ambcrypto.com/analyzing-cardanos-recent-breakout-could-0-380-be-next/