- Bullish sentiment and technical indicators hint at ADA’s potential breakout.

- Neutral whale activity but liquidity trends lean bullish.

Cardano [ADA] shows strong bullish sentiment from both retail and institutional investors. The crowd sentiment score of 2.73 and a smart money score of 0.74 signal growing confidence in ADA’s upward potential.

This could catalyze a significant rally in the upcoming market cycle.

Are ADA’s technical indicators pointing toward a surge?

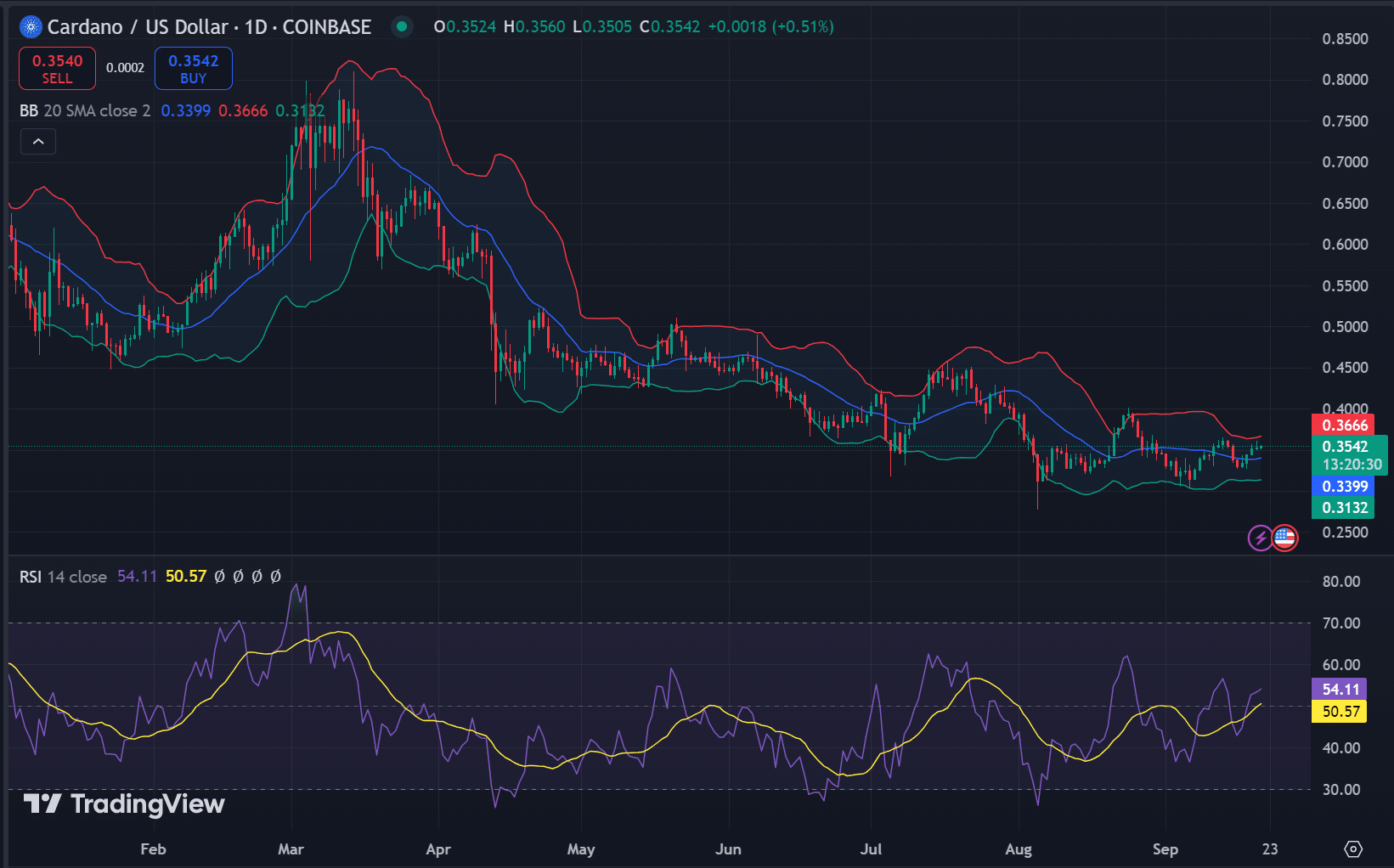

The technical setup for Cardano shows promising signals. The Relative Strength Index (RSI) sits at 50.57, indicating neutral momentum with a slight bullish bias.

This suggests that buying pressure is building but has yet to reach the overbought zone, giving room for further gains.

Additionally, the Bollinger Bands (BB) are squeezing, which often hints at an impending price breakout. With Cardano trading near $0.354, a push above the upper band at $0.3666 could unlock further momentum.

Source: TradingView

Are on-chain signals a concern for ADA?

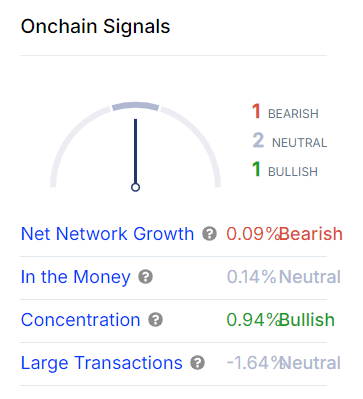

Despite strong sentiment, ADA’s network growth appears to be slowing. On-chain data reveals a slight contraction of 0.09%. While this decline may seem concerning, network growth is not the sole driver of price action.

Cardano’s robust ecosystem and development pipeline could easily reignite growth as new projects come online. Therefore, this dip in network activity may be temporary.

Whale activity, which often provides early clues about price direction, remains largely neutral. On-chain data shows a minor 1.64% decrease in large transactions.

Although this decline suggests that whales are not aggressively buying, they are not selling either. This neutrality could reflect a “wait and see” approach, as large holders may be positioning themselves for ADA’s next significant move.

Source: IntoTheBlock

How will liquidity influence ADA’s price action?

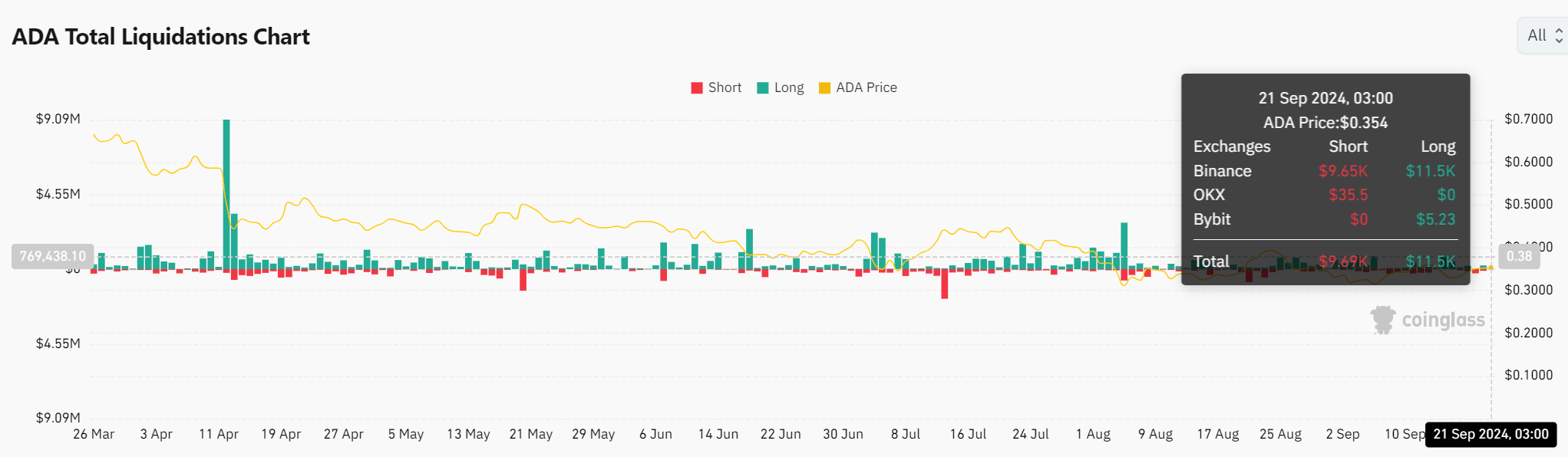

ADA’s liquidation data shows a slight bias toward long positions, with $11.5K in longs compared to $9.69K in shorts. This relatively balanced liquidation trend indicates that the market is indecisive but leans toward optimism.

A sustained move upward could trigger more short liquidations, amplifying buying pressure and propelling ADA higher.

Source: Coinglass

Read Cardano’s [ADA] Price Prediction 2023-24

ADA’s bullish sentiment, technical indicators, and solid liquidity trends suggest the potential for a major rally.

While network growth and whale activity are neutral, the broader market signals point to a possible breakout soon.

Source: https://ambcrypto.com/cardano-breakout-ahead-bullish-sentiment-and-liquidity-trends-suggest/