Cardano price today is trading near $0.871, stabilizing after bouncing from $0.85 support. With derivatives positioning improving and Grayscale’s ETF staking plan making headlines, traders are now eyeing the $0.90–$0.95 zone as the next critical barrier.

Cardano Price Holds Channel Structure

The daily chart shows ADA trading within a rising channel that has guided price action since July. The lower boundary around $0.84–$0.85 acted as firm support last week, while the mid-channel trendline near $0.88 is now being retested.

Exponential moving averages remain supportive. The 20-day EMA at $0.84 and 50-day EMA at $0.82 are rising, while the 100-day EMA at $0.78 offers deeper structural backing. RSI currently sits at 55, reflecting balanced momentum with scope for further upside.

Related: Solana (SOL) Price Prediction For September 11

Clearing $0.90 would confirm renewed strength, setting up a move toward $0.95 and potentially $1.00 if momentum accelerates.

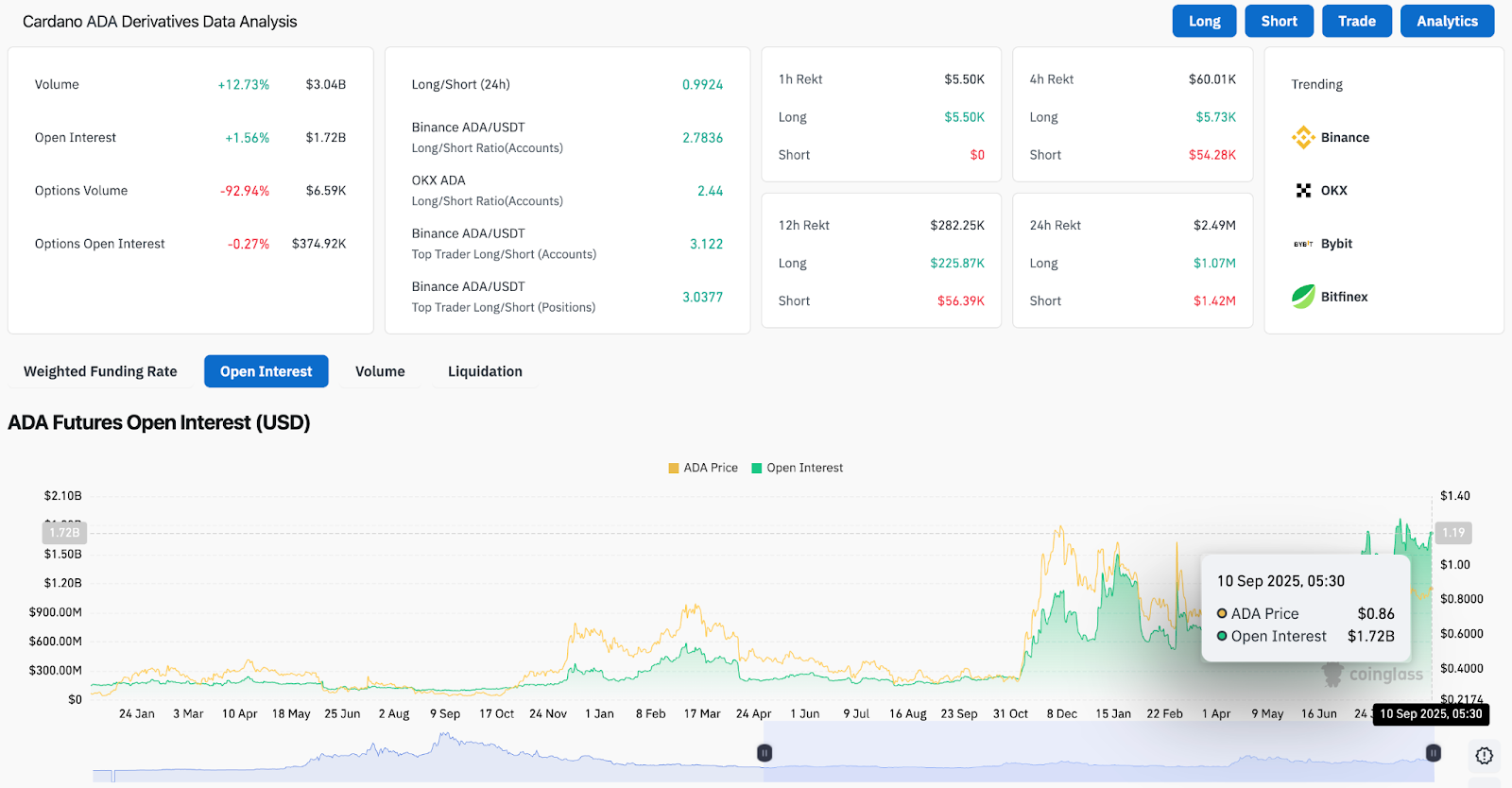

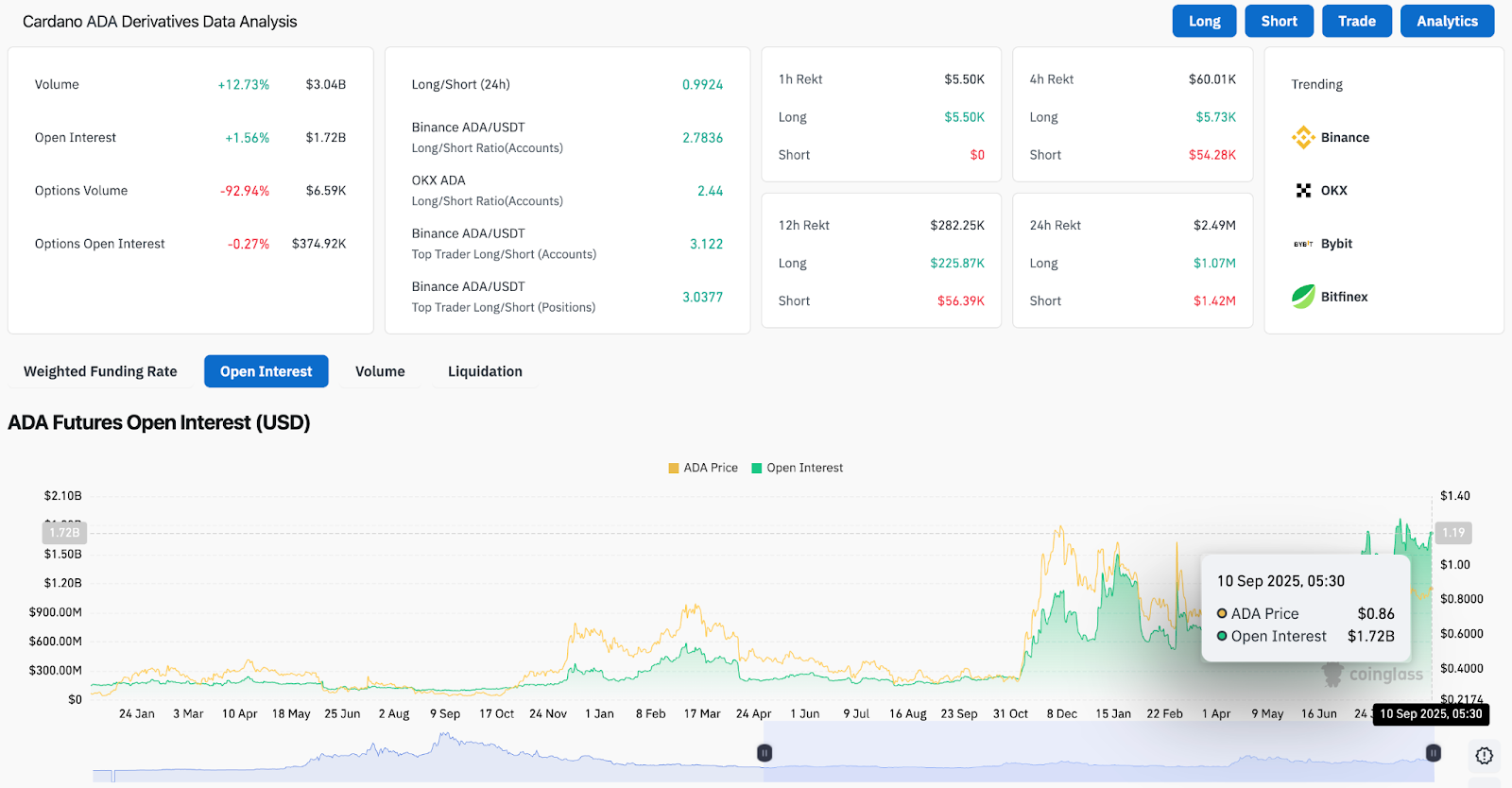

Derivatives Show Rising Open Interest

Market data highlights a steady pickup in derivatives activity. Open interest has climbed to $1.72 billion, up 1.56% in the last 24 hours, while trading volumes surged 12.7% to $3.04 billion.

Long-to-short ratios remain strongly tilted toward buyers. Top traders on Binance have a 3:1 skew in favor of longs, while the skew on OKX is similar. This suggests professional traders are preparing for further upside, though liquidations remain a risk if $0.85 fails.

Related: XRP (XRP) Price Prediction For September 11

The sharp decline in options activity indicates that futures markets are primarily expressing directional conviction, not hedging flows.

Grayscale ETF Staking Plan Lifts Market Narrative

Fundamentals are providing a supportive backdrop. Grayscale has confirmed plans to stake all ADA held in its proposed Cardano ETF (GADA), pending regulatory approval.

Staking rewards would be reinvested into the fund, effectively boosting share value and reinforcing Cardano’s narrative as a yield-bearing asset for institutional investors. The move mirrors strategies seen in Ethereum ETFs and could mark a milestone for ADA’s mainstream adoption if approved.

Technical Outlook For Cardano Price

The near-term roadmap places $0.85 as critical support, with $0.82 and $0.78 as secondary levels if selling resumes. On the upside, $0.90 is the immediate resistance to break, followed by $0.95 and the psychological $1.00 threshold.

Related: OpenLedger (OPEN) Price Prediction

Momentum within the channel structure suggests that as long as ADA remains above $0.85, the bullish thesis remains intact. A decisive rejection at $0.90, however, could trigger another consolidation phase.

Outlook: Will Cardano Go Up?

Cardano’s setup for September 11 leans constructive, supported by rising open interest, positive derivatives skew, and the Grayscale ETF staking narrative. As long as price holds above $0.85, traders are likely to test the $0.90–$0.95 band.

A breakout above $0.95 could open the path toward $1.00, while failure to defend $0.85 risks exposing ADA to deeper retracements. The balance of flows and ETF-driven optimism, however, keeps bias tilted to the upside.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/cardano-ada-price-prediction-for-september-11-2025/