- Canary Capital removed clause; SEC controls XRP ETF timeline.

- Nasdaq approval may trigger November 13 launch.

- Government reopening could influence ETF launch date.

Canary Capital has revised its Form S-1 for an XRP spot ETF, with a launch potentially set for November 13 pending Nasdaq approval, subject to regulatory constraints.

This development may influence XRP’s market dynamics, reflecting broader acceptance of digital assets. Regulatory responses will determine the ETF’s final launch date.

Canary Capital’s Strategic Clause Removal and Potential Impact

Canary Capital submitted an updated S-1 form for its XRP spot ETF, removing the “delayed amendment clause” that restricted automatic registration. If approved by Nasdaq, the ETF could debut on November 13, 2025. Timing hinges on SEC acceptance and the resolution of the current government shutdown, which may adjust the launch schedule.

This launch marks a shift in ETF filings. By listing immediately should the SEC have no objections, it increases investor interest in spot cryptocurrencies over futures. The removal of these clauses from the S-1 demonstrates a confidence in compliance with regulatory frameworks.

“The removal of the ‘delayed amendment clause’ is a strategic move that allows us to pursue a more flexible timeline for our ETF launch.” — Canary Capital Group LLC

Market Speculations: XRP’s Position Amid ETF Developments

Did you know? Historical data from the Bitcoin Spot ETF launch in 2024 showed a substantial liquidity boost, which might repeat with the XRP ETF, facilitating significant market changes.

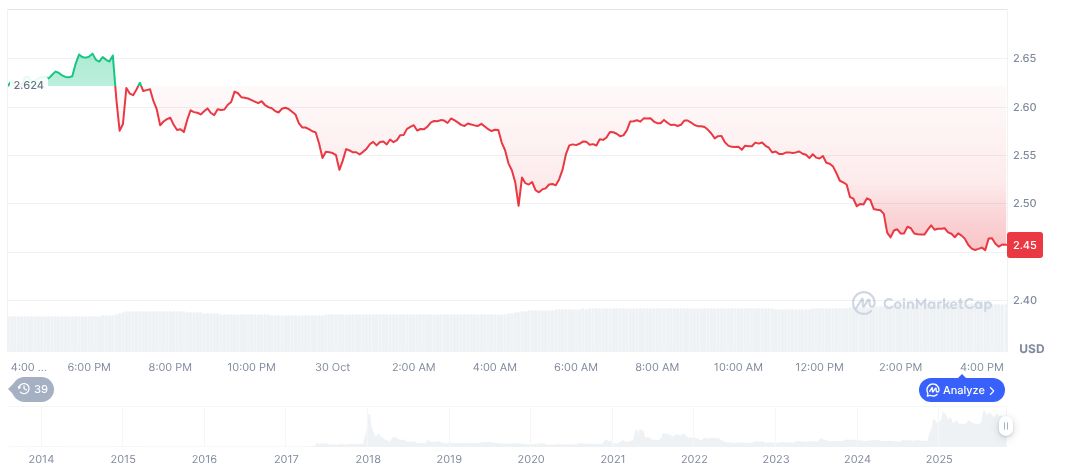

XRP’s market value is $2.44, with a cap of $146.20 billion, according to CoinMarketCap. Market volatility revealed a 24-hour drop of 6.11%, despite a 7-day increase of 1.64%. Trading volume rose to $6.23 billion. The current circulation is over 60 billion XRP.

Coincu’s research team notes that XRP’s ETF listing could affect spot asset demand, potentially reducing reliance on derivatives. The removal of the amendment clause may establish a streamlined path for future ETF developments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/canary-xrp-etf-sec-approval/