- Mark Carney re-elected as Canadian Prime Minister, hints at stricter crypto regulations.

- Emphasis on economic stability could limit crypto market innovation.

- Focus on central bank digital currency might reduce Bitcoin’s influence.

Mark Carney secured re-election as Canada’s Prime Minister on April 28, 2025, overcoming Bitcoin supporter Pierre Poilievre. His victory likely suggests imminent changes in Canada’s cryptocurrency regulatory stance and possible increased focus on central bank digital currencies.

Carney’s prior financial roles provide him with the expertise needed to navigate Canada’s economic policy. His past critique of Bitcoin, labeling it unstable, may lead to reinforced regulatory measures, affecting Canada’s cryptocurrency and blockchain sectors.

Carney’s Reelection Marks Shift in Canadian Crypto Policies

Mark Carney’s election signals a pivotal change in Canada’s cryptocurrency-related policies. His preference for a skeptical stance on Bitcoin was evident during his campaigns, marking a clear divergence from the deregulated approach Poilievre proposed. This result might see a pivot towards citing CBDC and tighter scrutiny over decentralized finance, influencing both domestic and international cryptocurrency exchanges.

Carney’s focus on maintaining economic stability could bring stringent regulatory frameworks to the Canadian crypto landscape. This potential policy shift may restrain startups in the blockchain space while prioritizing a regulated and secure financial ecosystem. Stricter oversight might deter speculative activities prevalent in crypto markets under his leadership. Mark Carney stated previously, “Bitcoin is not a store of value because it is all over the map. Nobody uses it as a medium of exchange.”

The market response to Carney’s win has been varied, with stakeholders expressing both optimism and concern. Some industry voices suggest tighter regulations may stifle innovation, while others foresee increased stability attracting institutional participation.

Impact of Canadian CBDC Initiative on Bitcoin’s Market Role

Did you know? Canada’s focus on CBDC might mirror initiatives in countries like China, aiming for regulatory oversight while integrating digital assets into their economies.

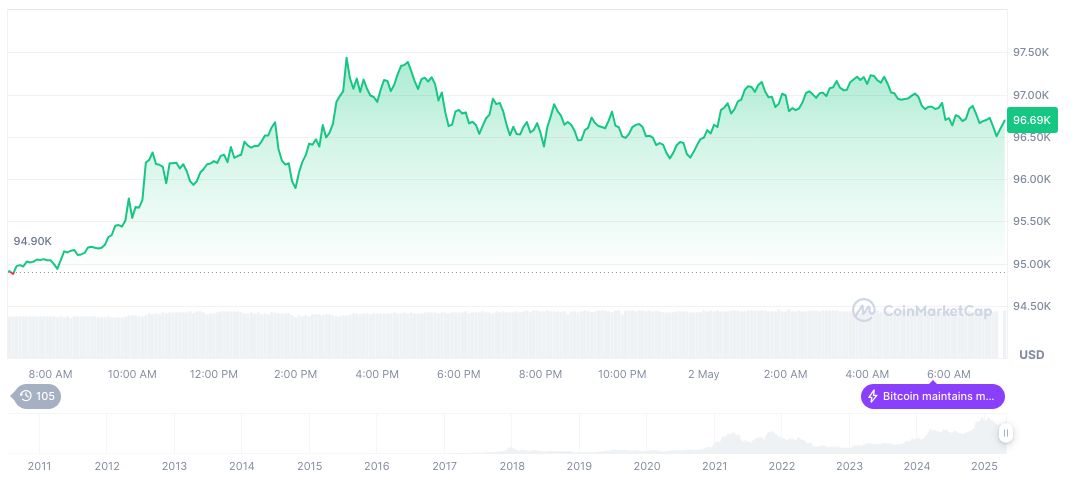

CoinMarketCap’s latest Bitcoin data indicates a market cap of $1.92 trillion, with a dominance of 63.86%. The fully diluted market cap stands at $2.03 trillion, reflecting Bitcoin’s substantial place in digital finance. Recent price changes include a 0.83% 24-hour increase and a 3.09% rise over the past week, highlighting Bitcoin’s volatile nature as noted by Carney.

Experts from Coincu speculate that regulatory measures under Carney can encourage safer adoption of blockchain technologies. While restrictions may slow some digital finance innovations, they could also promote a secure environment for sustainable growth. Emphasizing regulated adoption, Carney’s tenure may steer the crypto scene towards compliant, risk-averse frameworks.

Source: https://coincu.com/335323-canadian-prime-minister-cryptocurrency-policy/