Virtuals Protocol [VIRTUAL], an artificial intelligence token, has defied expectations of a potential weak performance following projections of a bubble phase, instead extending its move to the upside.

The asset, which had been on a downward trajectory after recording a 12% loss, emerged as the top gainer over the past day, posting a 21% rally at press time.

This move followed a community vote in which more than 86,000 out of 104,000 investors turned bullish, representing roughly 83% of participants. The shift has since been reflected across both on-chain and off-chain user activity.

User growth and revenue support price action

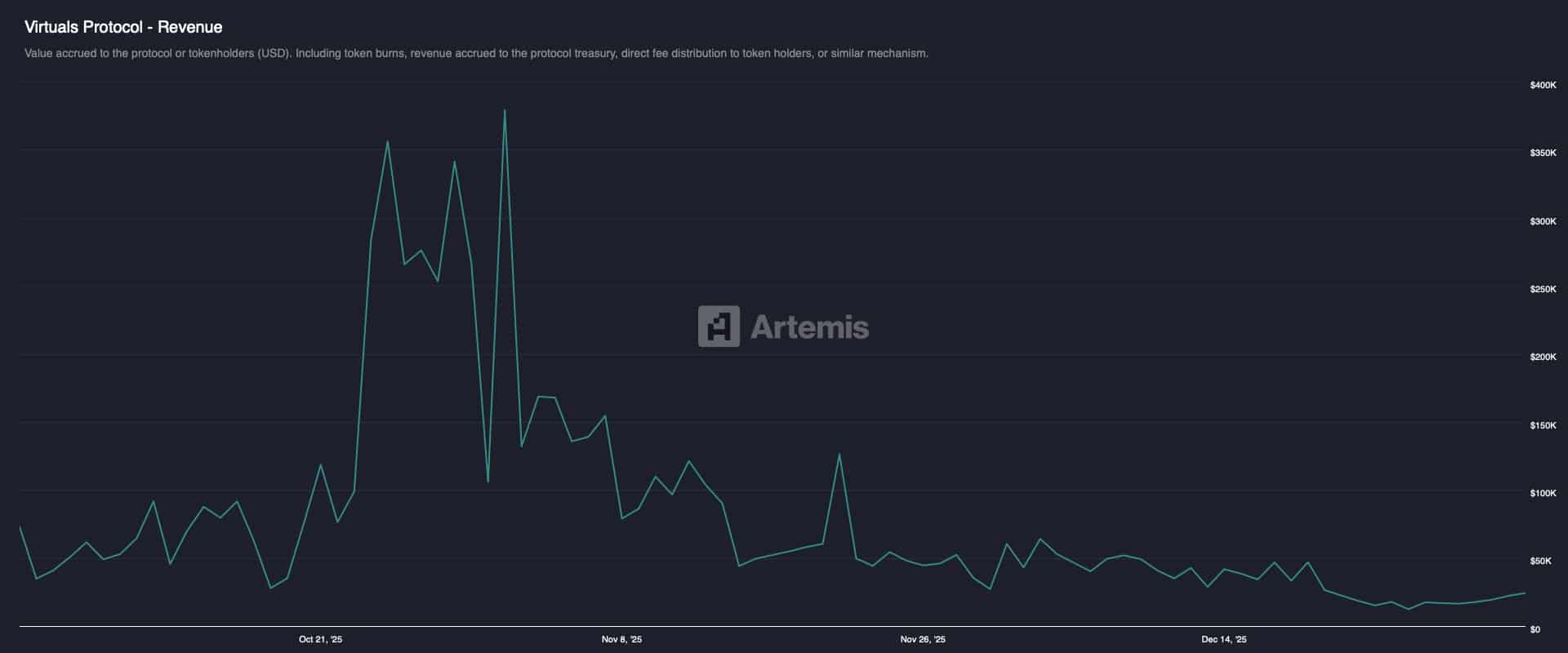

Investor activity around VIRTUAL has remained elevated. According to Artemis, there has been a noticeable increase in both user engagement and protocol revenue over the past day.

Data shows that the number of active spot users trading VIRTUAL across decentralized exchanges climbed to 3,700, a level last seen on the 19th of December.

The rising trading volume suggests increased adoption and usage of VIRTUAL, which has translated into price appreciation and stronger revenue performance.

Source: Artemis

DeFiLlama data shows that protocol revenue generated over the past day alone exceeded $26,000, a level last recorded in mid-December when broader market sentiment remained deeply fearful.

The combined rise in user participation and revenue points to a strengthening positive outlook that could support further price growth.

Other drivers remain in place

The derivatives market has also played a key role in VIRTUAL’s recent performance, driven by rising liquidity from investors opening long positions.

Market data indicates that liquidity surged by more than $24.4 million over the past day, with the majority of flows linked to buy-side contracts.

Source: CoinGlass

CoinGlass data on the Open-Interest-Weighted Funding Rate, which reflects perpetual market liquidity based on long and short positioning, supports this trend.

A positive Funding Rate typically signals buyer dominance in the perpetual market. At press time, the rate stood at 0.0055%, indicating a moderately bullish environment.

Similarly, long-to-short data, which tracks relative buy and sell volume, shows stronger buy pressure, with more long contracts changing hands than short positions.

Unfilled levels remain a key risk

An analysis of liquidation clusters on the price chart shows that downside risk remains.

Liquidation clusters often act as price magnets and can function as either support or resistance zones. These areas are typically highlighted in different shades, including green and yellow.

At present, a larger concentration of liquidity clusters remains below the current price, indicating that downside pressure still outweighs upward pull.

Source: CoinGlass

However, the risk of a sharp decline appears limited, as short liquidations have exceeded long liquidations, giving long traders a relative advantage.

At the time of writing, short liquidations stood at $491,000, compared with $134,000 in long liquidations.

Final Thoughts

- VIRTUAL saw a majority of community members vote in favor of a rally as capital inflows reached $24.4 million.

- On-chain activity remains positive, while revenue and active user numbers continue to grow.

Source: https://ambcrypto.com/can-virtual-hold-its-21-gain-as-active-users-return-to-3-7k/