- Solana maintains bullish momentum while trading within a defined rising channel.

- ETF approval prospects boost institutional optimism, strengthening Solana’s price outlook.

- Support at $200–$190 remains critical for sustaining Solana’s medium-term uptrend.

Solana (SOL) has continued to draw investor attention as its price navigates a rising channel against the US Dollar (SOL/USD) on the daily chart. This pattern highlights a persistent bullish trend, where price oscillates between defined support and resistance levels.

Recently, SOL approached the upper boundary of the channel, signaling potential profit-taking and a minor pullback. Despite this correction, the trend remains intact, suggesting optimism among traders.

Rising Channel and Key Levels

The current trend channel indicates clear directional momentum. The lower boundary acts as strong support, while the upper boundary presents resistance. The most recent high reached $215.70, marking a critical resistance zone.

Conversely, support has been consistently observed near $190.00 and $182.68, providing potential rebound points if the price declines further. Notably, the $200 level continues to act as a psychological barrier, causing periods of sideways consolidation as traders evaluate their positions.

Exponential Moving Averages (EMAs) reinforce Solana’s bullish bias. The short-term 20 and 50-period EMAs remain above the 100 and 200-period EMAs, confirming upward momentum.

Related: Solana Price Prediction: SOL Price Consolidates Within Rising Channel

Currently, the price trades above these moving averages, which could serve as dynamic support during future pullbacks. Investors often view these levels as reliable entry points in an ongoing uptrend.

Market Sentiment and Open Interest

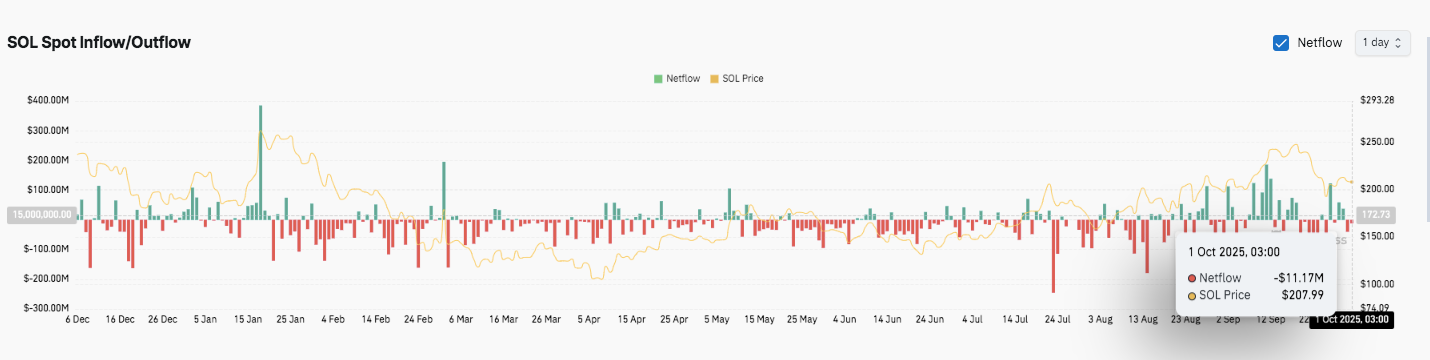

Recent data shows a negative net inflow of $11.17M, alongside a SOL price of $207.99. This suggests mild selling pressure and cautious investor sentiment.

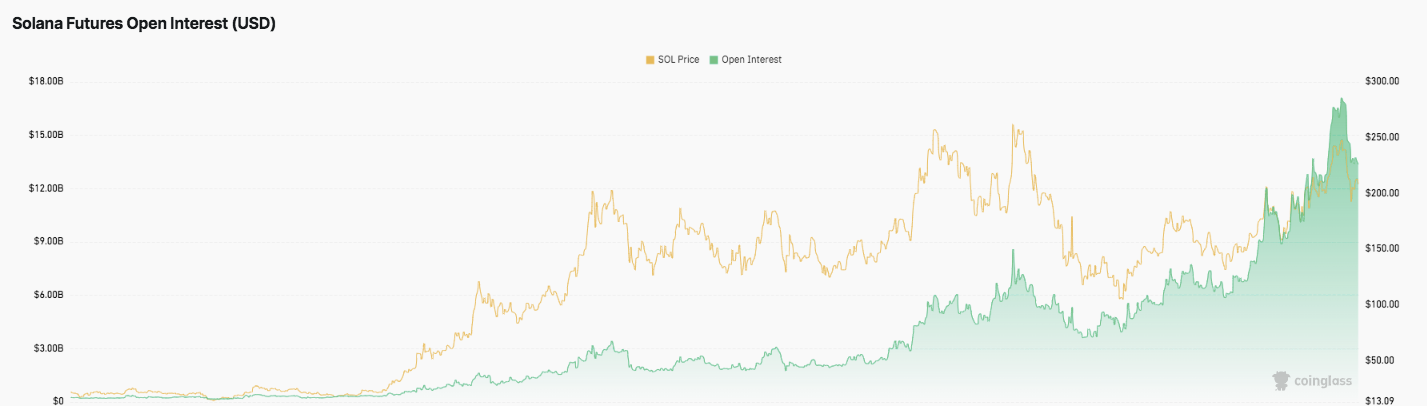

Futures open interest also indicates reduced market participation, with significant declines correlating to price dips or consolidation. Hence, future price movements may depend on whether open interest recovers or continues to shrink, reflecting the broader market’s confidence in Solana.

ETF Developments Provide Optimism

Beyond technical factors, regulatory progress is adding a bullish narrative. As reported by Coin Edition, the pathway for a Solana exchange-traded fund (ETF) appears increasingly clear. Bloomberg analyst Eric Balchunas noted near-certain approval odds for spot crypto ETFs.

The SEC has simplified its approval process, requiring only S-1 filings instead of lengthy 19b-4 submissions. Consequently, institutional interest may rise, potentially boosting Solana’s price and trading volume.

Technical Outlook For Solana (SOL) Price

Key levels are shaping the trend as Solana heads into October:

- Upside levels: $210.50, $215.70, and $220.00 represent immediate hurdles. A decisive breakout could push SOL toward $225.00 and even $235.00.

- Downside levels: $200.00 psychological support, followed by $190.00 and $182.68 as stronger trendline support.

- Resistance ceiling: $215.70 (recent high) is the key level to flip for medium-term bullish momentum.

The technical picture shows SOL trading inside a rising channel, where natural pullbacks to support zones may set the stage for renewed upside. EMAs remain bullishly aligned, with short-term EMAs above the long-term EMAs, reinforcing the trend. However, reduced futures open interest and recent net outflows hint at temporary caution in the market.

Will Solana Continue Its Uptrend?

Solana price action in October will largely depend on whether buyers can defend the $200.00–$190.00 support range. If these zones hold, SOL could retest $215.70 and potentially extend to $220.00–$235.00.

Related: Solana Price Prediction: SOL Struggles at $196 as Futures Interest Drops

On the other hand, failure to sustain support at $190.00 could expose SOL to $182.68 and lower, signaling a temporary trend pause or deeper consolidation. Additionally, potential ETF approval could act as a bullish catalyst, attracting institutional inflows and strengthening upward momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/solana-price-prediction-can-sol-sustain-momentum-above-200/