- SHIB’s liquidity sweep zone around $0.00001150 marked a crucial support.

- SHIB saw a slump in transaction count while the daily burn rate rose.

Shiba Inu [SHIB] continues to decline, but the chart has now indicated a potential upward move, with the press time price at $0.00001534.

The resistance zone near $0.00003333 suggested a bullish scenario if this level is breached.

After price swept liquidity around $0.00001250 zone, it marked a crucial support. This zone previously absorbed substantial volume of orders, indicating that it was a significant level for future price actions.

The MACD indicator also showed a convergence towards the signal line, which could indicate a change in momentum towards bullishness, especially if it crosses above the signal line.

This could catalyze a price surge towards the resistance.

Source: Trading View

Conversely, if SHIB fails to maintain the momentum and breaks below the liquidity sweep level at $0.00001250, it might lead to further declines, testing lower support levels, potentially exacerbating sell-offs.

The reaction of SHIB at the order block level will be pivotal.

A strong bounce from this level could confirm the support’s strength, whereas a breakdown might indicate weakening buyer interest, setting a more bearish market outlook for SHIB.

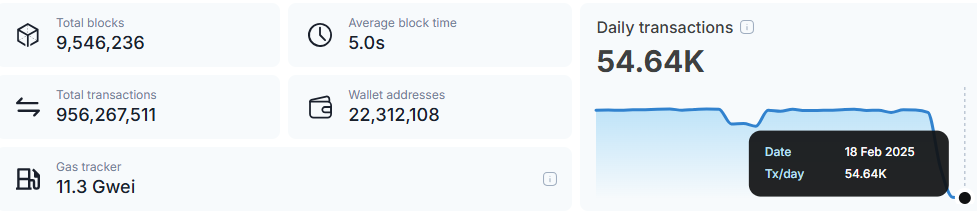

SHIB transaction count

The decrease in Shibarium’s daily transactions to 54.64K coincided with a falling SHIB price, suggesting reduced network activity and possibly waning investor interest.

In the short term, this could lead to lower demand for SHIB, potentially exacerbating the price decline as fewer transactions reduce the token’s utility and visibility.

Source: Shibariumscan

Long-term outlook could depend on the broader adoption and technological developments within Shibarium.

If the platform doesn’t regain activity, it could lead to a prolonged bearish outlook for SHIB as diminished use cases and network effects might deter new investment and use.

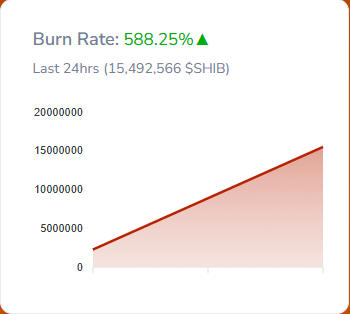

Shibarium burn rate

The substantial increase in SHIB’s burn rate to 588.25%, with 15,492,566 SHIB burned in the last 24 hours, signaled an intensified effort to reduce the circulating supply amidst a price decline.

This strategy could stabilize SHIB’s price in the short term by creating scarcity. However, long-term effects depend on sustained interest and broader market conditions.

Source: Shibariumscan

If Shiba Inu’s burn rate continues at this high level without corresponding demand, it may not suffice to counteract the bearish sentiment alone.

Continuous burns could bolster investor confidence by showing commitment to managing supply, yet without growth in utility and adoption, these efforts might only offer temporary relief to price pressures.

Source: https://ambcrypto.com/can-shiba-inu-overcome-this-challenge-for-a-rally-assessing/