- ICP consolidated on its daily chart, with immediate resistance and support levels dictating the next major move.

- The derivate data for ICP revealed a slight edge for bulls.

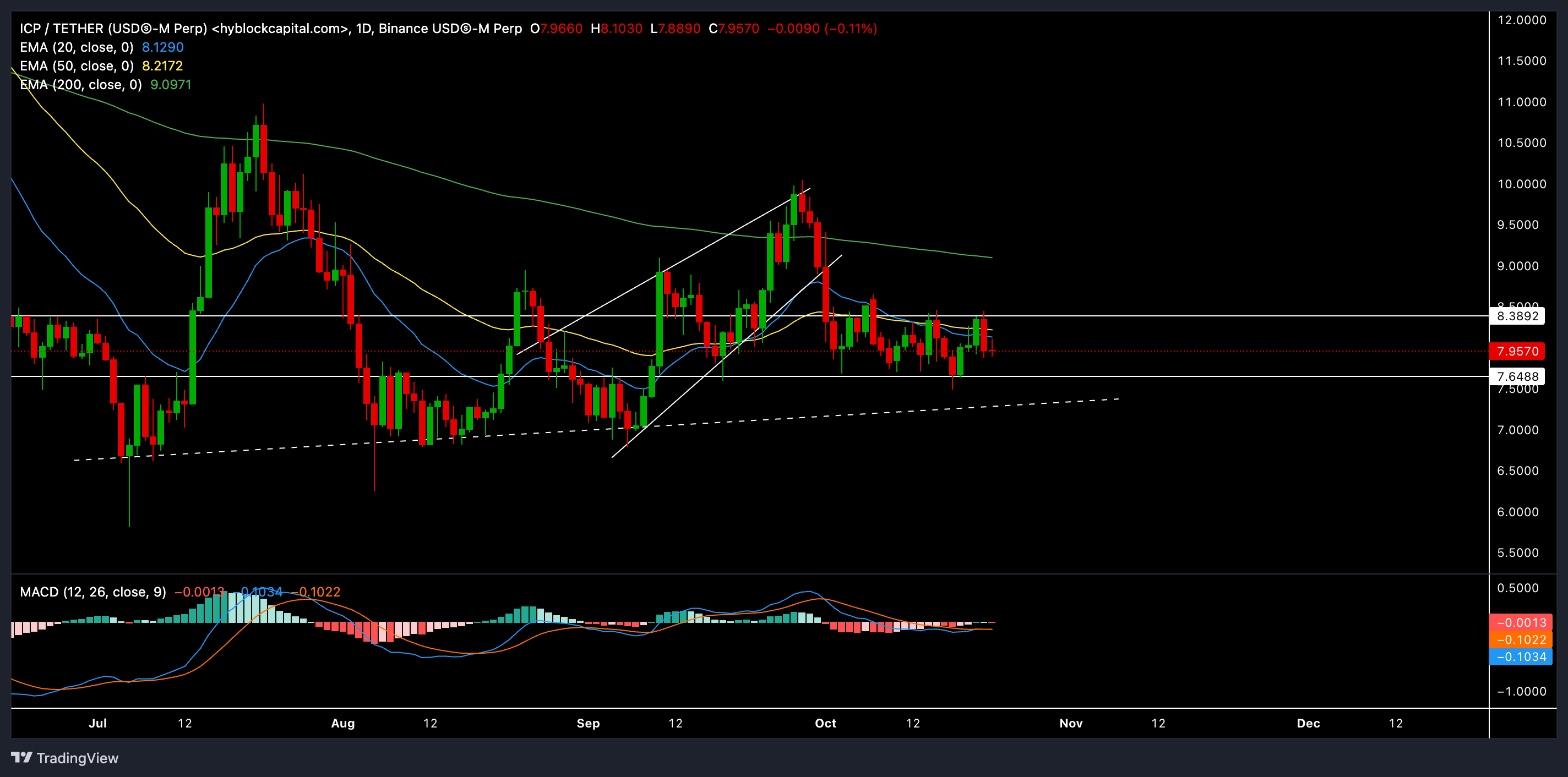

Internet Computer [ICP] has been in a sideways consolidation phase for nearly three weeks, struggling to establish a decisive trend after breaking down from its rising wedge pattern on the daily chart.

The altcoin’s press time price faced strong resistance amid uncertain conditions.

Can ICP break out of the consolidation phase?

Source: TradingView, ICP/USDT

ICP’s price recently reversed from the $8.3 resistance, which led to a decline below its 20-day EMA ($8.1) and 50-day EMA ($8.2), reflecting a prevailing bearish sentiment. At press time, ICP was trading at $7.957, staying within the $7.6 – $8.3 range.

Should the current sluggish sentiment prevail, ICP may continue traversing between the $7.6 and $8.3 levels in the near term. The 200-day EMA at $9.0971 remained a critical resistance that ICP would need to overcome to establish a long-term bullish trend.

The MACD indicator highlighted a lack of strong momentum, with the MACD line and the signal line hovering close in the negative territory. This suggested that any bullish momentum might be fragile, especially if ICP fails to break above immediate resistances.

The immediate support lies at $7.648, which aligns with the lower boundary of the current range. A decline below this level could see ICP finding some buying interest near the trendline support at $7.00.

The upper resistance at $8.3 was crucial. A break above this could potentially lead ICP towards the 200-day EMA at the $9 region.

Derivative data revealed THIS

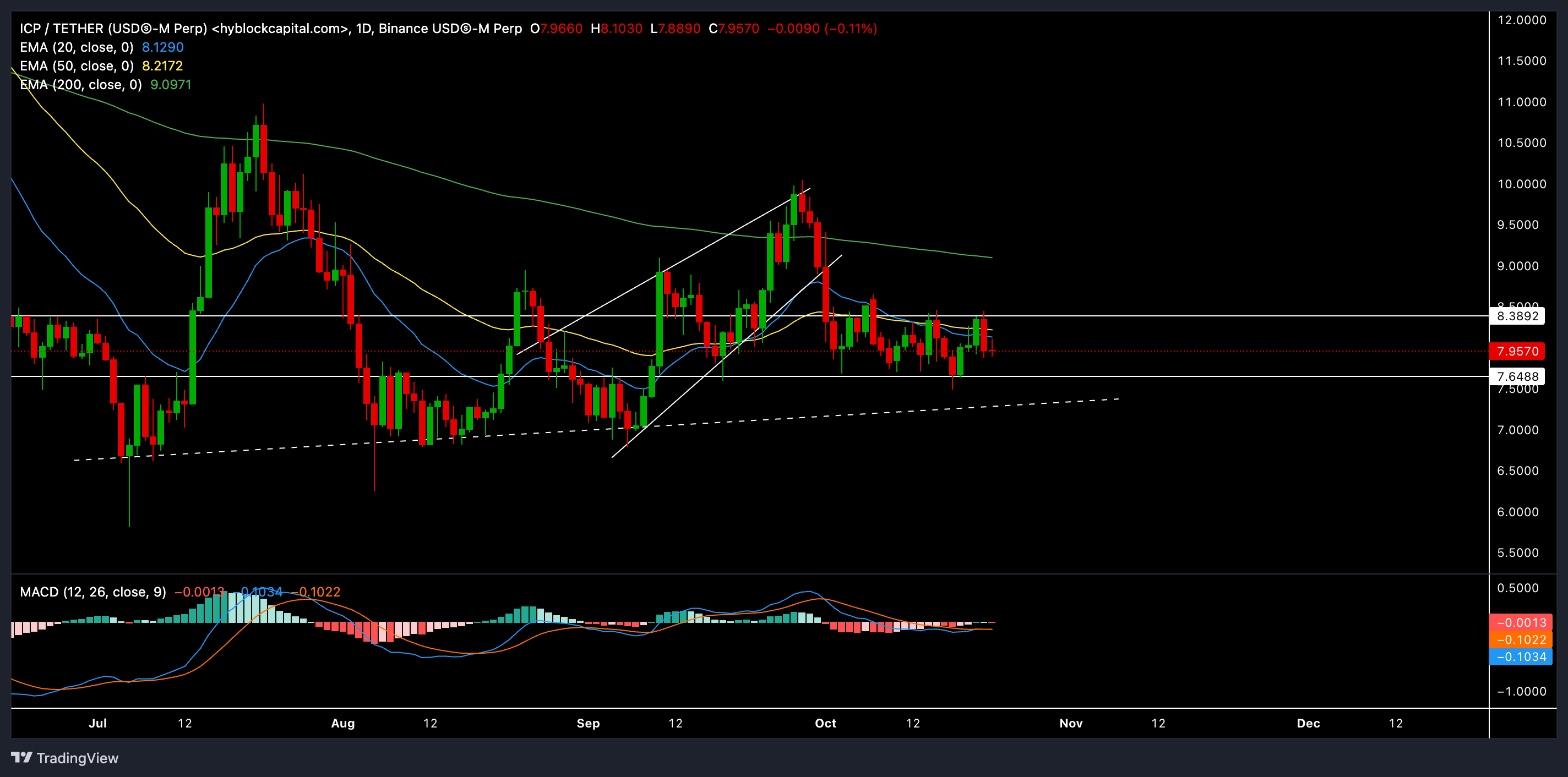

Source: Coinglass

ICP’s trading volume dropped significantly by 24.59% to $53.90 million, indicating less trading activity in the current range-bound market.

The long/short ratio for ICP over the last 24 hours was 0.7724, indicating that short positions slightly outweighed long ones, revealing a bearish bias in the broader market.

However, on Binance, the ICP/USDT long/short ratio is at 2.9, reflecting a more optimistic stance among traders on the platform.

Top traders on Binance have maintained a bullish bias, with a long/short ratio of 3.1 (accounts) and 1.6 (positions), suggesting that leading traders expect a potential near-term rebound.

Read Internet Computer’s [ICP] Price Prediction 2024-25

For ICP to exit its current consolidation phase and establish a clear trend, bulls must secure a decisive close above the $8.3 resistance level. On the flip side, if ICP fails to clear this hurdle, the prolonged consolidation may continue and cause a likely test of the $7.648 support.

Traders should monitor Bitcoin’s broader market trend, which can significantly impact ICP’s near-term trajectory.

Source: https://ambcrypto.com/can-icp-bulls-regain-momentum-amid-prolonged-sideways-action/