- Avantis price today consolidates at $2.27 while defending key $2.16 support within a rising wedge structure.

- AVNT saw $10M in spot inflows, marking one of its strongest accumulation signals this year.

- Avantis price prediction points to $2.38–$2.64 resistance and $2.16–$1.87 as critical support zones.

Avantis (AVNT) price today is trading near $2.27, slightly lower after testing the $2.33 resistance zone. Buyers are defending support around $2.16, where the 20-EMA is aligned, while short-term momentum shows consolidation inside a rising wedge. The question now is whether AVNT can extend toward $2.64 or if profit-taking will drag it back to deeper supports.

Avantis Price Holds Rising Wedge Structure

The 1-hour chart highlights AVNT trading inside a steep ascending wedge. Current support sits near $2.16, which lines up with the 20-EMA, while the $1.87 and $1.57 levels mark the 50-EMA and 100-EMA cushions. The broader trend remains intact as long as AVNT stays above these averages.

Momentum is showing signs of cooling. RSI has slipped from overbought levels to 59, reflecting neutral sentiment after the strong rally. A breakdown below $2.16 could trigger a pullback toward $1.87, while a decisive bounce would put $2.33 and $2.64 back in focus.

On-Chain Flows Show $10M In Spot Inflows

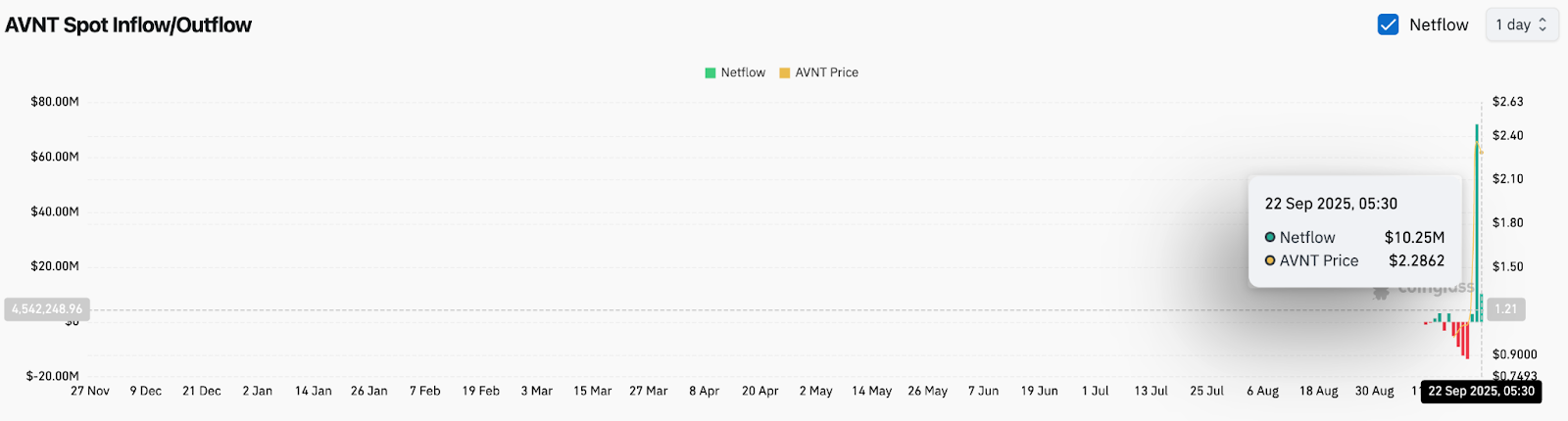

Spot exchange data shows a net inflow of $10.25 million on September 22, one of the largest single-day moves for AVNT this year. This sharp injection of capital coincided with the breakout from $1.20 to $2.30, underlining strong speculative demand.

While inflows suggest accumulation, the sustainability of this trend is unproven. Analysts warn that if inflows reverse, AVNT could see heightened volatility, given its thin liquidity profile. For now, the $10M spike reflects growing interest in AVNT as traders seek exposure to the emerging derivatives platform.

Venture Backing Strengthens Long-Term Narrative

Beyond technicals, Avantis continues to benefit from its venture capital pedigree. Earlier this year, Peter Thiel’s Founders Fund co-led an $8 million Series A round, positioning the project as one of the few Base-native derivatives exchanges with major institutional backing.

This long-term narrative has resurfaced on social platforms, with traders pointing to the fundraising as a reason to avoid underestimating AVNT’s potential. The credibility of backers provides a tailwind, even if near-term volatility remains high.

Technical Indicators Suggest Cooling Momentum

Short-term charts highlight resistance near $2.38, aligned with the Supertrend ceiling. The Parabolic SAR currently points to a potential shift lower, with dots hovering above spot levels. Support remains firm at $2.08, while a break below this level would expose $2.00 and $1.87.

Momentum indicators are no longer overbought, suggesting consolidation is healthy after a parabolic rise. However, the wedge structure warns of a possible breakdown if buyers fail to defend $2.16.

Technical Outlook For Avantis Price

Avantis price prediction for the short term hinges on support at $2.16 and overhead resistance at $2.38.

- Upside levels: $2.38, $2.64, and $2.80 if momentum extends.

- Downside levels: $2.16, $2.08, and $1.87 as key defense points.

- Trend support: $1.57 and $1.23 as deeper liquidity zones.

Outlook: Will Avantis Go Up?

The outlook for AVNT depends on whether inflows sustain and buyers can hold the $2.16–$2.20 zone. On-chain data confirms renewed demand, while venture capital support adds a long-term bullish narrative.

A decisive breakout above $2.38 would open the door toward $2.64, while losing $2.16 could force a retest of $1.87. For now, Avantis remains in a consolidation phase within its broader bullish cycle, with momentum cooling but long-term optimism intact.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/avantis-price-prediction-can-avnt-sustain-momentum-after-10m-spot-inflows/