- California pension funds invest $276 million in MicroStrategy shares.

- Significant institutional Bitcoin exposure increase.

- Signals growing institutional interest in digital assets.

California pension funds have invested $276 million in MicroStrategy shares, indirectly boosting their Bitcoin exposure.

The investment highlights a major institutional shift towards digital assets and strengthens Bitcoin’s status among traditional finance sectors.

California Pension Funds’ $276M Bet on MicroStrategy for Bitcoin Access

California’s public pension funds, including CalSTRS and CalPERS, have made a substantial investment in MicroStrategy, now referred to as Strategy, aligning with their Bitcoin acquisition strategy. MicroStrategy is renowned for its significant Bitcoin holdings under the leadership of founder Michael Saylor. The investment by California pension funds amounts to $276 million, reflecting a strategic move toward indirect Bitcoin exposure.

This development underscores the increasing institutional interest in digital assets, as California’s decision aligns with a broader trend among US states enhancing their stakes in Bitcoin through proxies. “A collective increase of $302m in one quarter. The average increase in holding size was 44%,” stated Julian Fahrer, Founder of Bitcoin Laws. Julian Fahrer has also commented on recent events regarding institutional affirmation for Bitcoin.

Social media responses have been notably positive, with key figures like Julian Fahrer emphasizing the investment’s significance. This shift is widely seen in the community as a bullish indicator for future crypto market sentiments.

Bitcoin’s Institutional Uptake Anticipates Regulatory Adaptations

Did you know? The California pension funds’ investment in MicroStrategy marks a pioneering effort by public retirement systems to gain indirect Bitcoin exposure, aligning with the growing institutional embrace seen in previous high-profile crypto ventures.

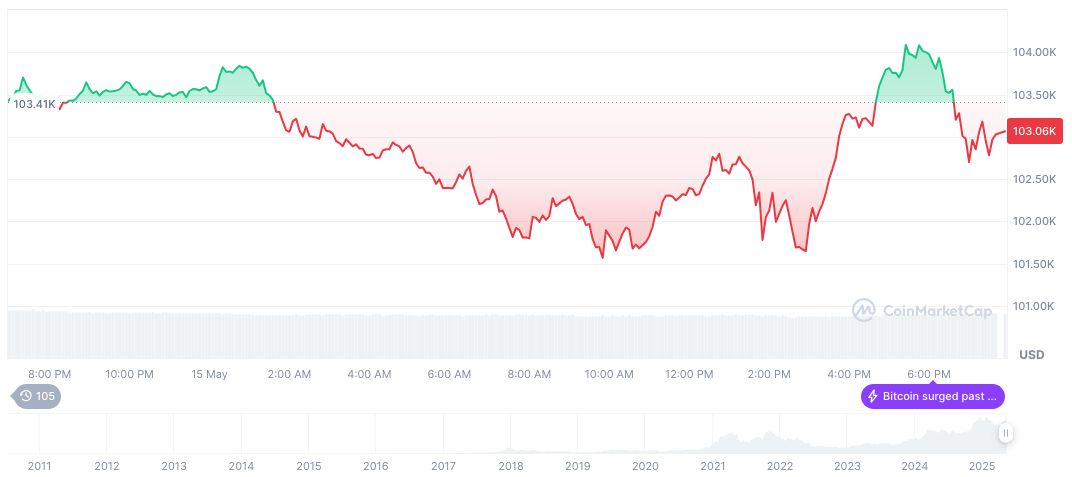

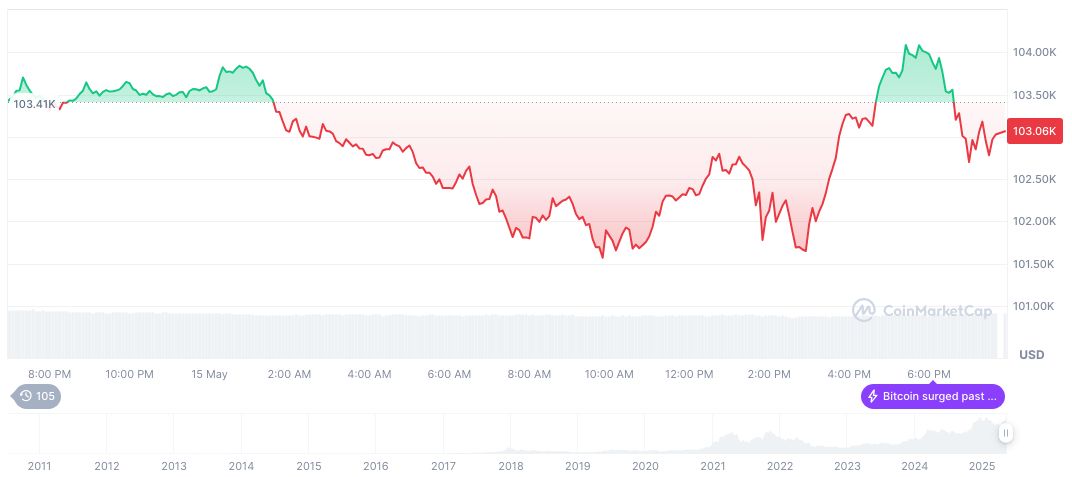

CoinMarketCap reports Bitcoin (BTC) trading at $103,676.85, bolstered by increased institutional interest. The market capitalization now stands at $2.06 trillion, with a circulating supply of about 19.87 million BTC. The asset observed a 23.31% price surge over the last month.

According to Coincu’s research team, this institutional entry could signal forthcoming regulatory frameworks adapting to broader Bitcoin adoption. Historical data suggests such actions often lead to increased market confidence, influencing technological innovations and broader acceptance of Bitcoin-centric financial products.

Source: https://coincu.com/337927-california-pension-microstrategy-bitcoin-investment/