- Solana consolidates near $228.90 with strong EMA support and bullish setup.

- Futures open interest hits $14.64B, signaling rising speculation and volatility.

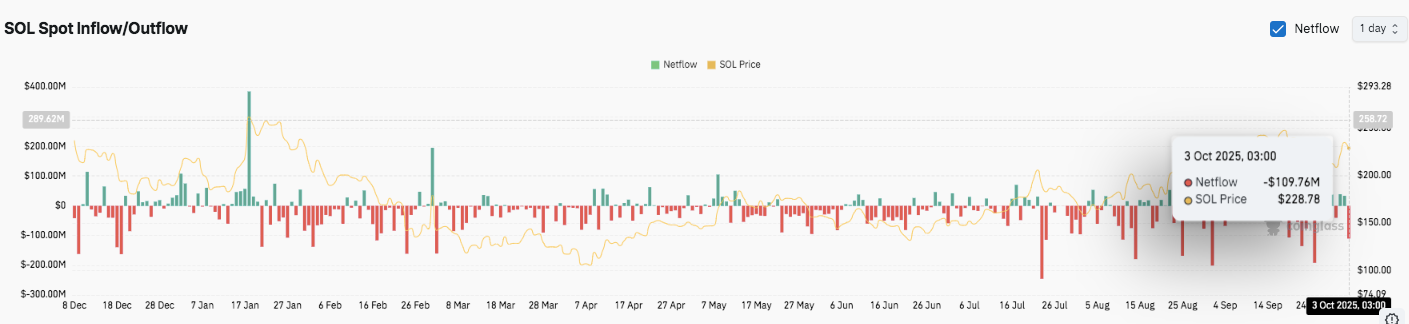

- Spot outflows of $110M indicate profit-taking amid recovery from recent lows.

Solana has staged a strong comeback following its sharp correction, with the price stabilizing near $228.90. Traders are watching closely as the token consolidates after rebounding from a steep drop earlier in the week. With momentum building and futures activity hitting record highs, Solana now sits at a crucial juncture that could shape its short-term trajectory.

Technical Setup Shows Resilience

Solana’s rebound has been supported by a favorable technical setup. The recovery above the $230 zone, aligned with the 0.618 Fibonacci retracement, has provided a key continuation signal. Moreover, exponential moving averages are stacked bullishly, with the 20-EMA at $223 and the 50-EMA at $218 offering immediate support.

This alignment suggests that buyers remain in control as long as the price holds above these thresholds. If strength persists, the next test could be the $241 level, with a possible extension toward $254. Conversely, a breakdown under $222 may invite pullbacks toward $215 or $205.

Related: Solana Price Eyes Breakout as Bitwise CEO Says Faster Unstaking Gives It ETF Edge Over Ethereum

Futures Market Participation Surges

Besides the spot recovery, futures data highlights a sharp rise in market activity. Open interest in Solana contracts climbed to $14.64 billion by October 3, marking one of its highest levels. This increase reflects aggressive speculative positioning and greater liquidity inflows.

Historically, such expansions in open interest have coincided with periods of heightened volatility. Hence, traders should be prepared for sharper swings, particularly if price momentum continues.

Spot Flows Indicate Profit-Taking

While futures markets show rising enthusiasm, spot data paints a more cautious picture. Net outflows reached $110 million on October 3, one of the largest single-day movements in months. These exits suggest profit-taking as prices recovered strongly from recent lows.

Earlier this year, similar spikes in outflows often occurred near local tops. However, inflows during calmer phases revealed steady accumulation, highlighting ongoing interest in Solana among long-term participants.

Technical Outlook For Solana (SOL) Price

Key levels remain well-defined heading into October:

- Upside levels: $230–$231 (0.618 Fib retracement) is the immediate hurdle. A sustained breakout here could extend gains toward $240.69 (0.786 Fib) and ultimately retest the $254 high.

- Downside levels: $222–$223 (20-EMA and 0.5 Fib) remains the first line of defense, followed by $215. A sharper decline could expose $205 (0.236 Fib).

- Resistance ceiling: $230 is the critical zone to flip for near-term bullish continuation. A successful close above it strengthens the case for a move to $240+.

The technical picture suggests SOL is consolidating inside a recovery channel, with the EMAs providing firm support while futures open interest signals rising speculation. This compression phase is likely to trigger heightened volatility in either direction.

Related: Solana Price Prediction: Can SOL Sustain Momentum Above $200?

Outlook: Will Solana Push Higher?

Solana’s price prediction for October depends on whether buyers can defend the $222–$223 support cluster. Holding this zone would encourage bulls to attempt a breakout beyond $230 and target $240–$254.

Moreover, record futures positioning adds fuel to the possibility of amplified moves. However, failure to maintain above $222 risks pulling the market back toward $215 and $205. For now, Solana trades in a pivotal range where both accumulation and profit-taking remain active.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.