- Monero holds firm above $300 as technical indicators confirm sustained momentum.

- Futures data shows resilient trader participation despite declining open interest.

- Exchange inflows and EMAs align to support continued bullish structure into Q4.

Monero (XMR) continues to hold strong momentum as bullish sentiment builds around the privacy-focused cryptocurrency. The token trades near $320, maintaining stability above critical moving averages.

This structure points to renewed investor confidence and healthy participation across both spot and futures markets. Besides, the alignment of technical indicators and on-chain data supports a broader accumulation trend that could extend into the next quarter.

Strong Technical Setup

XMR price action on the 4-hour chart shows sustained support around the $300 zone. The 20-day exponential moving average (EMA) sits at $319, while the 50-day EMA rests near $316, both acting as dynamic supports.

The convergence between these two averages signals growing bullish momentum. Moreover, the 100-day and 200-day EMAs cluster between $308 and $299, creating a powerful demand area near $300.

Fibonacci retracement levels also add strength to the structure. The token is currently testing resistance near the 1.618 Fib level at $322. A successful breakout could open the door to the next resistance at $334 and $343. Conversely, if rejection occurs, buyers are expected to defend the $307–$299 range, where key EMA and Fib supports align.

Market Participation and Open Interest

The futures open interest trend for XMR reflects fluctuating trader activity throughout 2024 and 2025. Open interest peaked near $120 million in early 2025, signaling strong speculative participation.

However, subsequent corrections reduced it to around $53 million by October. This stable rebound shows that long positions remain active despite volatility. Hence, futures markets still indicate consistent engagement from professional traders.

Exchange Flows and Investor Confidence

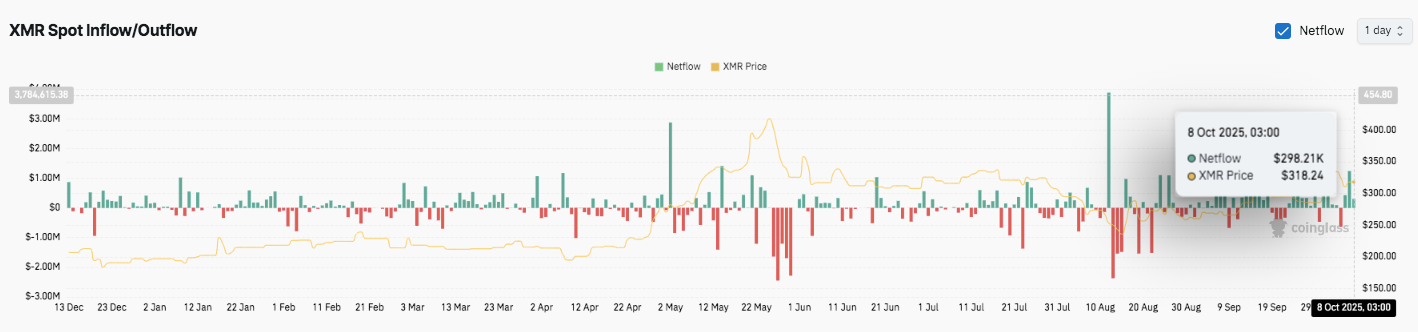

On-chain data reveals that capital movement across exchanges has remained balanced. From late 2024 to mid-2025, alternating inflows and outflows marked investor repositioning.

Significantly, August saw net inflows of nearly $3.8 million, coinciding with renewed buying pressure. As of October 8, Monero recorded a modest $298,000 net inflow, signaling mild accumulation.

Technical Outlook for Monero (XMR)

Key levels remain clearly defined as Monero consolidates above $300 heading into mid-October.

- Upside levels: $322.49 (1.618 Fib), $334.95 (0.786 Fib), and $343.19 (0.236 Fib) stand as immediate hurdles. A breakout above $334 could propel XMR toward $346–$350 in the short term.

- Downside levels: $307.51 (2.618 Fib) and $299.34 (200 EMA) mark strong support zones, with $283.28 as deeper corrective risk if momentum fades below $300.

The technical structure shows XMR compressing within a bullish continuation pattern, supported by converging EMAs near $319–$316. The setup suggests limited downside while buyers remain active near the $300 base.

Will Monero Sustain Its Uptrend?

XMR’s near-term outlook hinges on its ability to hold above $320 and clear $322 resistance. A confirmed breakout could trigger a move toward $343–$350, reinforcing its medium-term bullish trend.

However, failure to defend the $307–$300 zone could expose the price to a broader retracement toward $292. Overall, Monero remains in a pivotal position where volume expansion and renewed inflows could define the next leg higher.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/monero-price-prediction-bulls-eye-343-as-market-interest-rebounds/