- Bullish files with SEC for a $629 million IPO.

- Reflects regulatory shifts and institutional interest.

- Intensifies competition and regulatory scrutiny.

Bullish, the cryptocurrency platform of Vaulta, seeks to raise $629 million via IPO, filing with the SEC amidst a shifting U.S. regulatory landscape.

This move highlights increasing institutional engagement in digital assets, driven by regulatory clarity efforts like SEC’s Project Crypto, impacting BTC, ETH trading volumes.

Bullish’s Landmark $629M SEC Filing Spurs Market Interest

Bullish’s IPO filing with the SEC reflects a significant entry of traditional financial oversight into the cryptocurrency exchange space. The platform is seeking up to $629 million through this public offering, marking a notable stride in integrating digital assets within regulated markets. Bullish, rebranded from Block.one to Vaulta, indicates a strategic shift in focus towards regulation compliance.

The IPO is expected to enhance market confidence as firms turn toward regulated environments. The U.S.’s changing regulatory stance under Project Crypto signifies increased institutional comfort and anticipation of significant capital infusions into the crypto market. This filing could propel similar exchanges to consider public offerings, fostering further crypto market transparency.

Paul Atkins, Chair, SEC, states, “A key objective of Project Crypto is to clarify the classification of crypto assets… At the same time, Atkins emphasizes that most of the current crypto assets are not securities, aiming to reduce legal uncertainty and regulatory ambiguity that have previously driven innovation overseas.”

Historical Parallels with Coinbase and Market Insights

Did you know? In 2021, Coinbase’s IPO brought similar excitement and drew mainstream attention to Bitcoin and Ethereum, parallel to Bullish’s current scenario with its SEC filing.

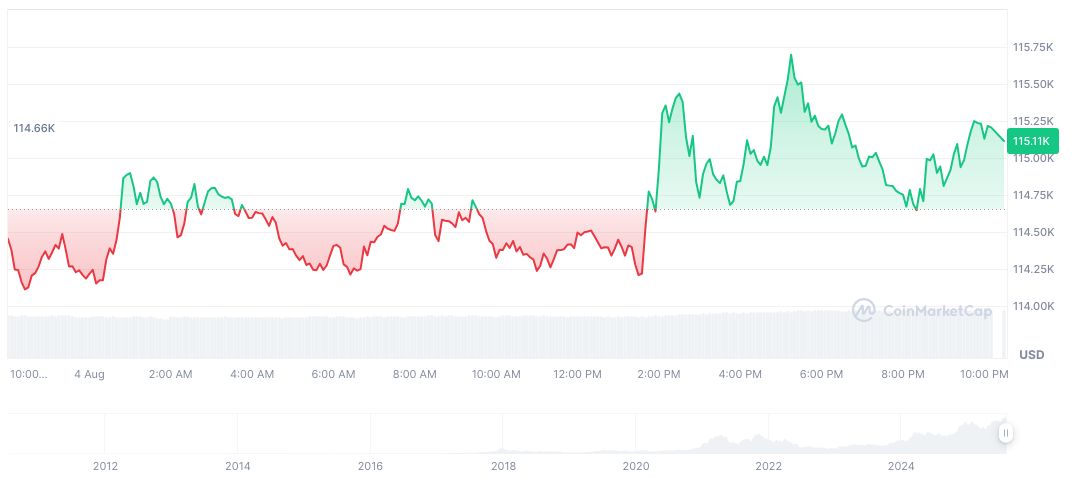

According to CoinMarketCap, Bitcoin (BTC) is priced at $114,341.98 with a market cap of $2.28 trillion and 60.76% dominance. Over the last 90 days, it rose 18.53%, despite recent minor declines. Trading volumes struck $53.56 billion, reflecting dynamic trading activity as of August 5, 2025.

Coincu researchers highlight potential long-term impacts from Bullish’s IPO on crypto asset legitimacy and market dynamics. Historical IPO patterns of digital asset exchanges hint at transient volatility, yet ultimately contribute to sustained market integration under regulatory frameworks. This strategic step could catalyze further technological and financial integrations, bolstering the digital asset landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/bullish-exchange-ipo-sec-filing/