- BTX Capital accused of manipulating token prices on Hyperliquid.

- Significant losses of $4.9 million reported.

- On-chain evidence links Vanessa Cao to the scheme.

On-chain analysis indicates BTX Capital and founder Vanessa Cao may have manipulated token prices on Hyperliquid, causing significant losses on November 12 through coordinated buy wall strategies.

This suspected manipulation highlights vulnerabilities in decentralized exchanges, affecting trader trust and market stability, while prompting increased scrutiny of aggressive trading practices and potential regulatory responses.

BTX Capital’s Alleged Role in Multi-Million Dollar Losses

Investigations reveal BTX Capital’s involvement in manipulating prices of tokens such as POPCAT and TST on Hyperliquid, with Vanessa Cao actively facilitating these actions. On-chain analysis discovered large capital flows, connecting multiple wallets linked to Cao and BTX Capital to market manipulation schemes.

The focused manipulation on November 12 ensnared POPCAT, leading to forced liquidations and financial losses estimated at $4 million for the attackers and $4.9 million for Hyperliquid. The incident underscores the vulnerabilities within decentralized exchanges and the risks of price manipulation.

“Emerging wallet flows tie 26 coordinated addresses to aggressive buy wall tactics on POPCAT. Funding and multisig movements indicate direct mobilization by BTX Capital-linked entities, with material losses offset by shorting activity on centralized venues. Evidence suggests wider impact across TST and other tokens, with governance patterns and large capital reserves consistent with past dual-market manipulation events.” — Specter, Cryptanalysis Expert, On-chain investigation thread

Intensified Scrutiny as Popcat’s Value Plummets

Did you know? Price manipulation schemes like the one allegedly involving BTX Capital can drive token prices significantly below their baseline, leading to potential capital shortfalls and cascading market effects.

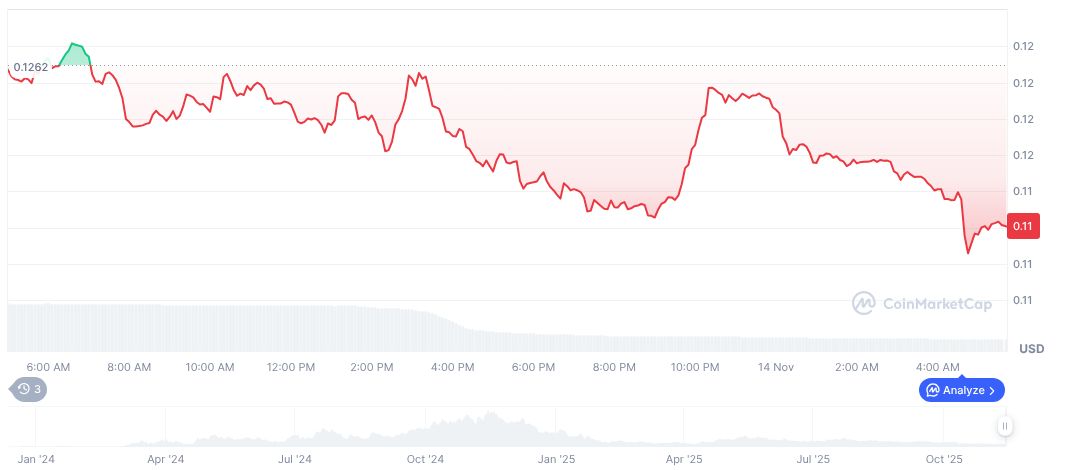

According to CoinMarketCap, Popcat’s price stands at $0.12, reflecting a decline of 7.85% over the past 24 hours as of November 14, 2025. The token has experienced a marked downturn, dropping 31.41% in 30 days and 61.18% over 90 days. During the last 24 hours, its trading volume was approximately $69.12 million, a reduction of 72.33%.

Experts from Coincu suggest the situation could lead to increased scrutiny of exchange mechanisms. Enhanced regulatory frameworks may emerge to better monitor and mitigate manipulation risks, aligning financial oversight with evolving crypto technologies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/btx-capital-cryptocurrency-manipulation/