- Brian Quintenz released texts claiming Winklevoss brothers’ pressure.

- Public scrutiny intensifies before Gemini’s IPO.

- Regulatory impacts raise concerns for U.S. exchanges.

Brian Quintenz, nominated for CFTC Chair, publicly released text exchanges with Gemini co-founders, revealing alleged pressure to favor Gemini before their IPO, intensifying scrutiny.

The incident draws attention to regulatory lobbying in crypto, potentially influencing market sentiment and raising concerns over governance in the rapidly evolving U.S. crypto sector.

Quintenz-Winklevoss Texts Stir Nomination Controversy

Brian Quintenz’s public release of text messages with Tyler Winklevoss has sparked significant attention. The messages suggest that the Winklevoss brothers sought Quintenz’s support in Gemini’s ongoing civil case with the CFTC, which he refused. Quintenz shared these texts to prevent President Trump from being misled and to clarify his stance.

In response to the refusal, it is alleged that the brothers contacted the White House, seeking a pause on Quintenz’s confirmation. These events unfolded just before Gemini’s anticipated IPO, adding pressure to the situation.

Responses from key figures include Brian Quintenz stating clearly his refusal to make promises under pressure from the Winklevoss brothers. A White House spokesperson affirmed continued support for Quintenz, emphasizing his role in promoting the U.S. as a leader in cryptocurrency. The Senate Agriculture Committee’s decision to delay the confirmation adds another layer to this complex situation, indicating high-level discussions affecting the crypto space.

Regulatory Scrutiny and Market Impact

Did you know? Such direct communication between crypto founders and regulatory nominees has precedent but rarely leads to public documentation. Gary Gensler’s SEC nomination delay caused similar market unease previously.

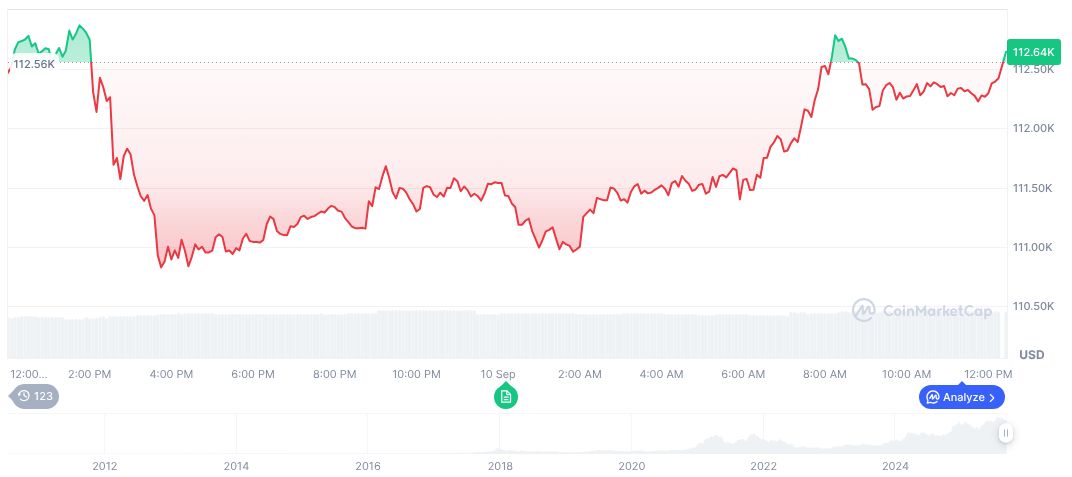

Bitcoin (BTC) currently trades at $113,736.85, with a market dominance of 57.54% and a market cap of $2.27 trillion. Data from CoinMarketCap reveals a 2.25% price gain in the past 24 hours, with a 9.36% rise over 90 days. Trading volume reached $56.17 billion, marking a 19.72% increase. These metrics reflect ongoing market dynamics. The circulating supply is at 19,919,181 BTC out of a maximum of 21,000,000 coins as of September 11, 2025.

Coincu research team highlights that ongoing regulatory scrutiny could impact Gemini and other U.S. exchanges. Given the current market environment, the team’s analysis suggests potential volatility in asset prices related to regulatory developments. This may lead to increased caution among investors as they monitor the evolving situation closely.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/quintenz-texts-winklevoss-cftc-nomination/