- Brazil’s Central Bank initiates reform to standardize digital asset accounting.

- Consultation open for feedback until August 24, 2025.

- Focus on Bitcoin, Ethereum, and utility tokens.

The Central Bank of Brazil launched a public consultation on digital asset accounting to improve transparency and comparability.

The Central Bank’s initiative, running until August 24, 2025, seeks inputs to standardize accounting procedures for digital assets like Bitcoin and Ethereum.

Brazil Seeks Feedback on Digital Asset Framework by 2025

The Central Bank of Brazil’s announcement on economic developments initiated a public consultation process to introduce a regulatory framework for digital asset accounting. Involving stakeholders from financial sectors, the move covers the accounting recognition, measurement, cancellation, and disclosure of virtual assets.

Greater transparency and comparability in the accounting of cryptocurrencies, including Bitcoin and utility tokens, are the primary objectives of this initiative. The proposal reflects the growing importance of virtual assets in both domestic and global financial systems and is intended to enhance transparency, comparability, and the quality of financial disclosures related to these instruments.

The Coincu research team notes the proposed regulation continues a trend towards formal recognition and regulation of digital assets worldwide. This regulation may lead to increased digital asset institutional adoption, with potential enhancements in financial transparency.

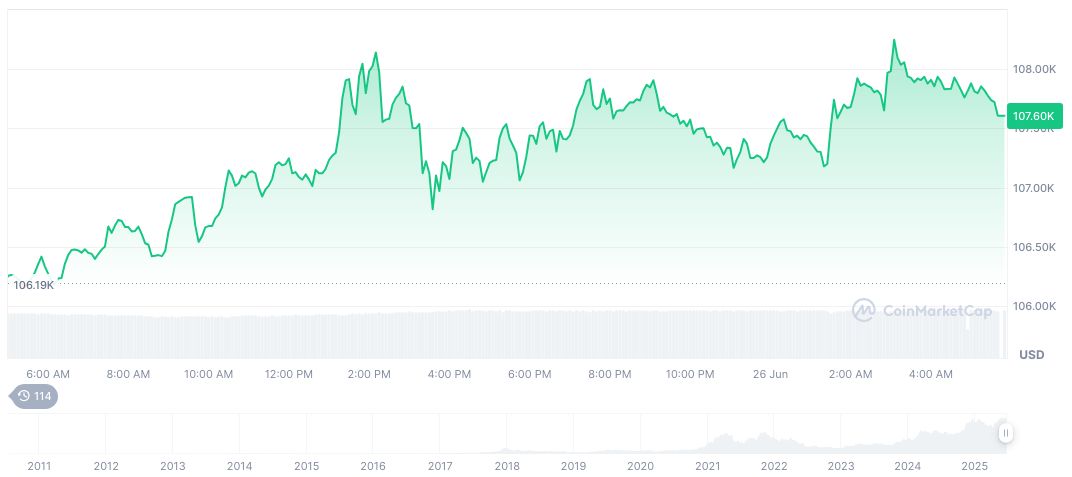

Bitcoin Jumps 26% in 90 Days Amid Regulations

Did you know? The Central Bank’s initiative follows similar regulatory approaches from the EU, aiming to enhance institutional confidence in digital asset markets.

As of June 26, 2025, Bitcoin (BTC) is valued at $107,331.44 with a market cap of Central Bank of Brazil’s press release on financial matters. Over the past 90 days, it observed a 26.35% increase, while its 24-hour trading volume reached $formatNumber(50085359552, 2) as per CoinMarketCap.

The Coincu research team notes the proposed regulation continues a trend towards formal recognition and regulation of digital assets worldwide. This regulation may lead to increased digital asset institutional adoption, with potential enhancements in financial transparency.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345277-brazil-digital-asset-accounting-reform/