- Key Point 1

- Key Point 2

- Key Point 3

On November 10, an official from the Central Bank of Brazil, reportedly named Vivan, claimed crypto companies should avoid complex operations, emphasizing a ban on algorithm-based stablecoins.

The announcement signals potential regulatory tightening in Brazil, potentially impacting traders and provoking broader discussions about digital asset regulations globally. Immediate market impacts remain unconfirmed with stability observed.

TerraUSD Collapse to Dai Valuation: A Critical Observation

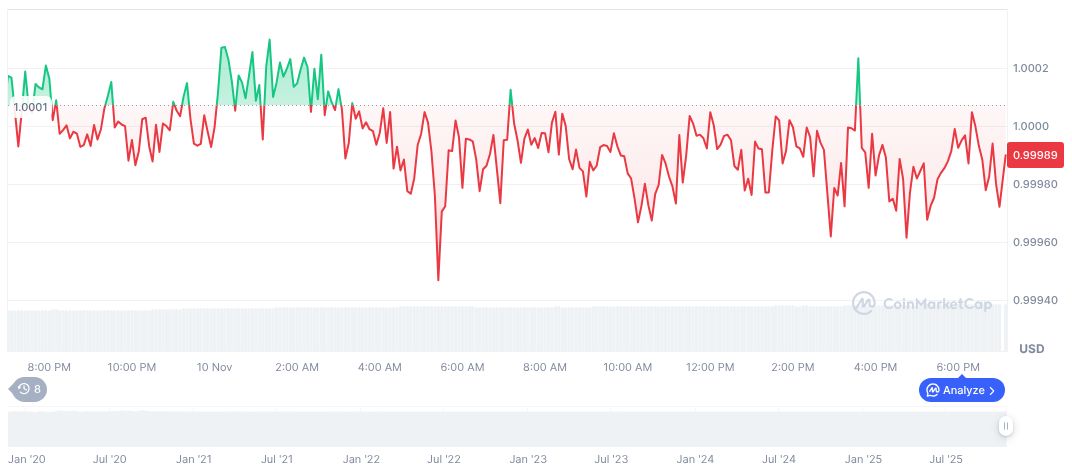

As per CoinMarketCap, Dai (DAI) is trading at $1.00 with a market cap of $5,364,226,258.00. It witnessed a 24-hour trading volume of $110,984,127.00 with price changes over various periods, including a 2.73% increase in the past seven days.

Coincu’s research indicates that this situation may lead to speculative behavior among investors and regulatory adjustments in the short term. Crypto companies might need to realign strategies adapting to potential legal narratives and evolving market dynamics.

Roberto Campos Neto, President, Central Bank of Brazil, stated, “Our regulatory framework continues to prioritize prudential oversight without explicitly banning algorithmic stablecoins.” CBB Official News

Market Insights

Did you know? In 2022, the TerraUSD (UST) collapse prompted global regulatory scrutiny on algorithmic stablecoins, leading some countries to revise their crypto oversight frameworks.

As per CoinMarketCap, Dai (DAI) is trading at $1.00 with a market cap of $5,364,226,258.00.

Coincu’s research indicates that this situation may lead to speculative behavior among investors and regulatory adjustments in the short term.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/brazil-denies-stablecoin-ban-reports/