- BONK spot Buy Volume beat sell pressure by 127 billion tokens.

- BONK must reclaim $0.000015 or risk sliding back toward its recent $0.000013 support.

Bonk [BONK]rebounded from its recent low of $0.000013, tapping $0.00001480 before mildly retracing to $0.00001446 by press time.

Over the same period, the memecoin’s volume surged by 98.33% to $160.5 million, reflecting higher on-chain activity.

But was this just a technical bounce or the start of something bigger?

Bonk buyers make a strong comeback

After taking a step back in the market amidst higher selling pressure, buyers returned to displace sellers.

According to Coinalyze, BONK saw 309 billion in buy volume against 182 billion in selling volume on the 29th of June.

Source: Coinalyze

Of course, this resulted in a +127 billion Buy-Sell Delta—a clear signal of aggressive spot demand.

Such a high buying spree reflects newfound demand as investors returned to buy the dip.

Source: CoinGlass

Amidst increased accumulation, the memecoin’s Netflow turned negative, reaching -765k at press time.

When more tokens leave exchanges than enter, it typically reflects accumulation and declining sell-side risk.

This kind of behavior, historically, has often preceded upward continuation, especially during local trend shifts.

Derivatives follow the action

Interestingly, when we examine derivatives, we find that these buyers entered the market to take strategic positions, particularly long ones.

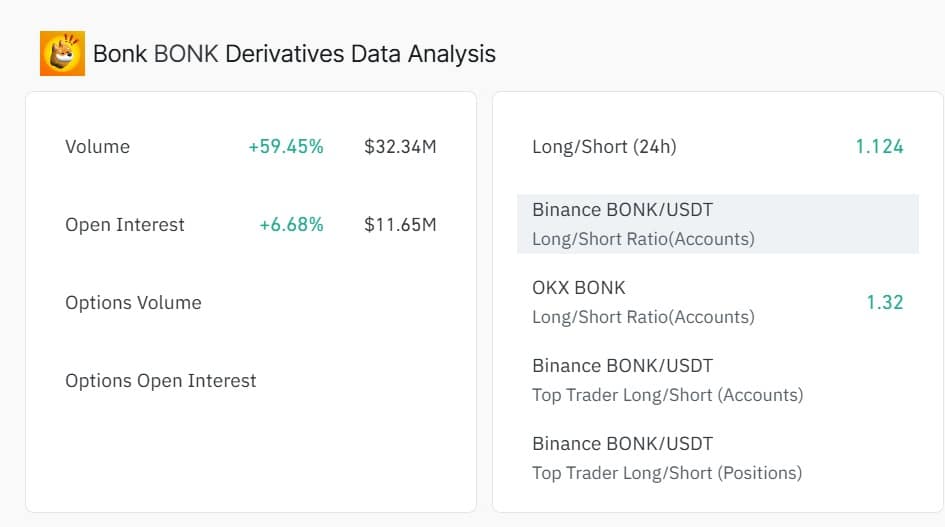

Source: Coinglass

BONK’s Open Interest jumped 6.68% to $11.65 million, while Volume surged 59.45% to $32.34 million, confirming increased participation in futures.

At the same time, the Long/Short Ratio hit 1.124, reflecting a tilt toward long positioning.

Typically, a higher demand for long positions, alongside rising Open Interest, implies that investors are bullish and are betting on prices to rise.

Momentum indicators flash but…

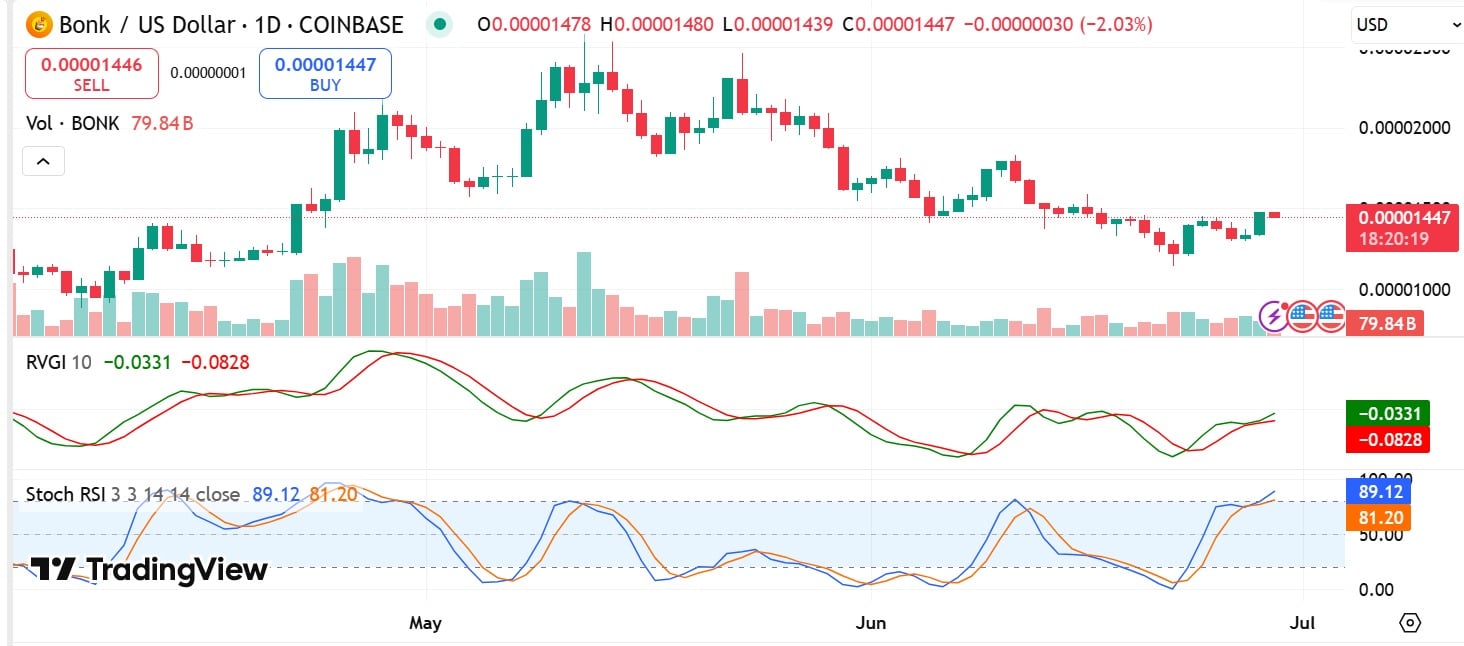

According to AMBCrypto, BONK saw a sharp upswing as buyers re-entered the market with strength.

As a result, the memecoin’s Stochastic RSI surged to 89, signaling overbought conditions.

Likewise, the Relative Vigor Index (RVGI) climbed to -0.0332, reinforcing the presence of strong bullish momentum.

Source: TradingView

That said, when oscillators heat up like this, they often hint at one of two things: sustained breakout or whiplash reversal.

If buying continues, BONK could reclaim $0.000015 with relative ease. But if bulls hesitate or run out of fuel, the coin might retrace toward its recent base at $0.000013.

Source: https://ambcrypto.com/bonk-surges-98-in-volume-but-the-odds-of-reversal-loom-if/