- BNB held on to key support around $560, eyeing a breakout above $618 for further gains

- Social volume and sentiment underlined potential for further growth

Binance Coin [BNB] flashed strong bullish sentiment recently, catching the attention of market participants around the world. At press time, BNB was trading at $579.69, following a slight 0.23% decline on the charts.

However, the overall market sentiment remains positive, with both the crowd and smart money leaning towards optimism. Therefore, the question arises – Can BNB maintain its bullish momentum and break through the $618 resistance to initiate a more significant rally?

Can BNB bulls maintain control?

After a significant pullback from its previous highs above $700, Binance Coin, at press time, was testing key support levels around $560. The price bounced after hitting this level, showing that the support zone is holding strong for now.

However, for the bullish momentum to continue, BNB must break through the crucial resistance at $618.6. A successful breakout could spark a rally towards the next resistance at $679.5, bringing further attention to BNB.

Nevertheless, the altcoin must first establish clear momentum before this happens.

Source: TradingView

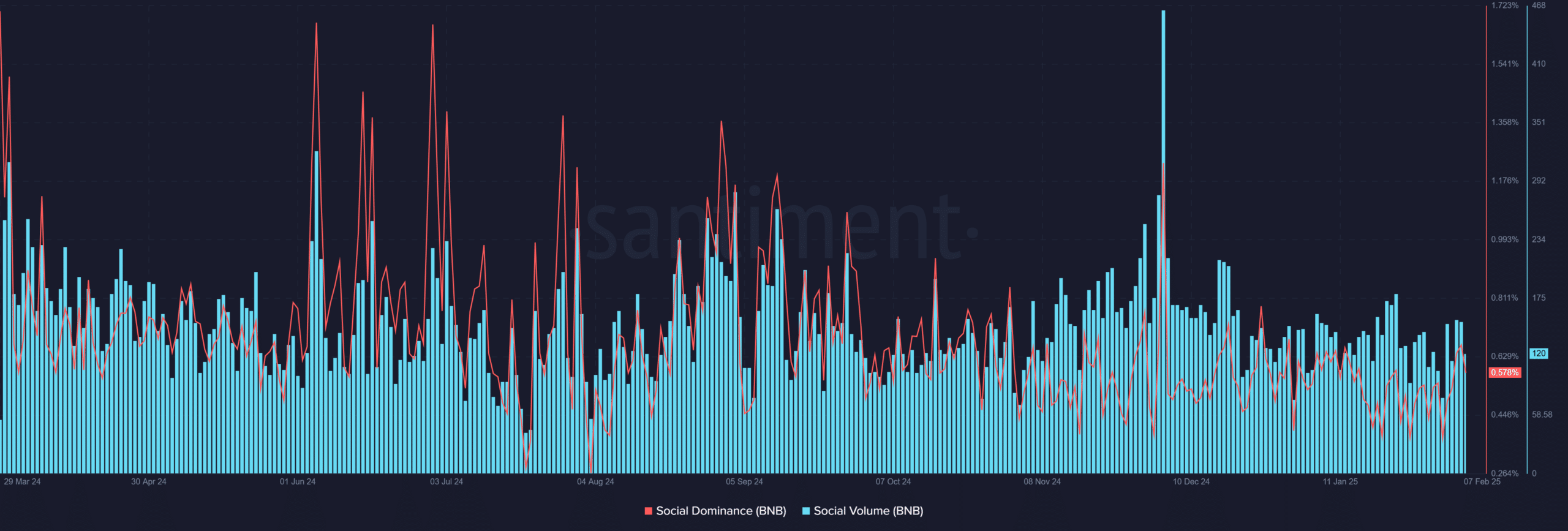

Social volume and dominance

BNB’s social volume and dominance flashed moderate levels – A sign of growing interest. However, they were not yet at the explosive levels that often precede price breakouts. At press time, social volume had a reading of 120, while social dominance stood at 0.578%.

These figures underlined an uptick in discussions surrounding BNB, indicating a hike in market awareness. However, despite this hike, the coin is yet to reach a level where social media buzz could drive a massive rally.

Therefore, while social activity may be on the rise, it has not yet reached the levels required to spark a significant breakout.

Source: Santiment

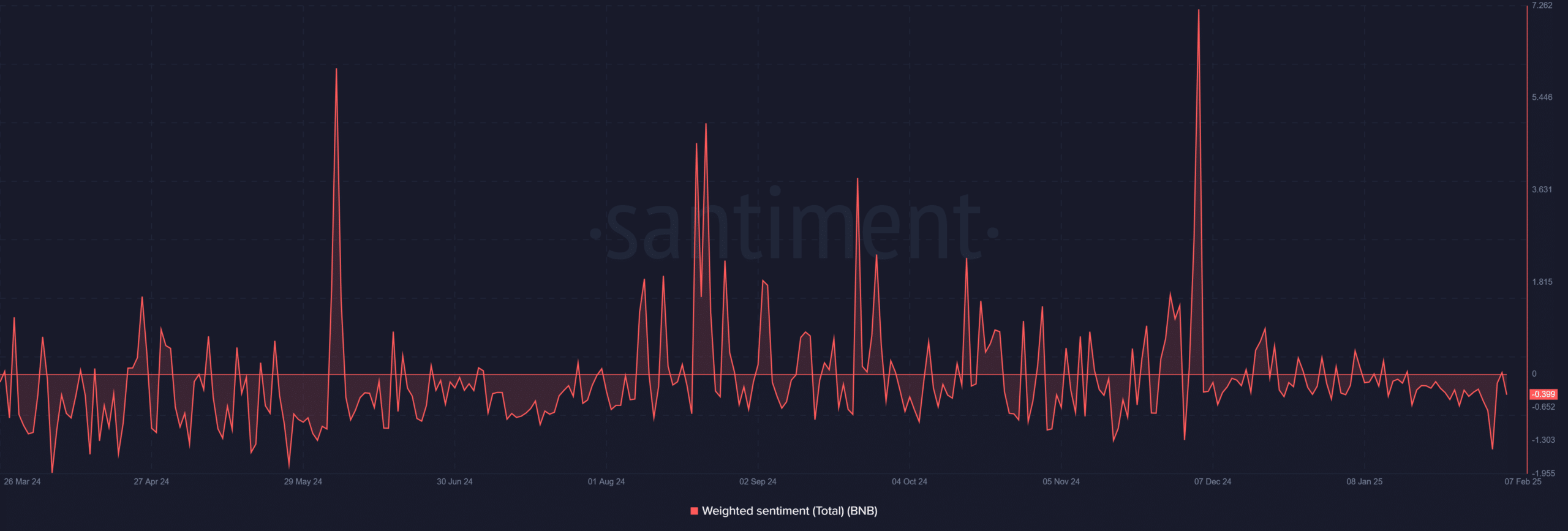

Weighted sentiment – A positive outlook, but with room for growth

BNB’s weighted sentiment was also relatively positive, at press time. The metric’s value was -0.399, indicating a somewhat favorable market view despite minor fluctuations.

This hinted that while investors have continued to have confidence in BNB’s prospects, the sentiment has not reached a euphoric high yet. On the contrary, the sentiment’s uptrend signaled that BNB could still have some room for growth. Especially if it breaks key resistance levels and triggers further buying interest.

Source: Sentiment

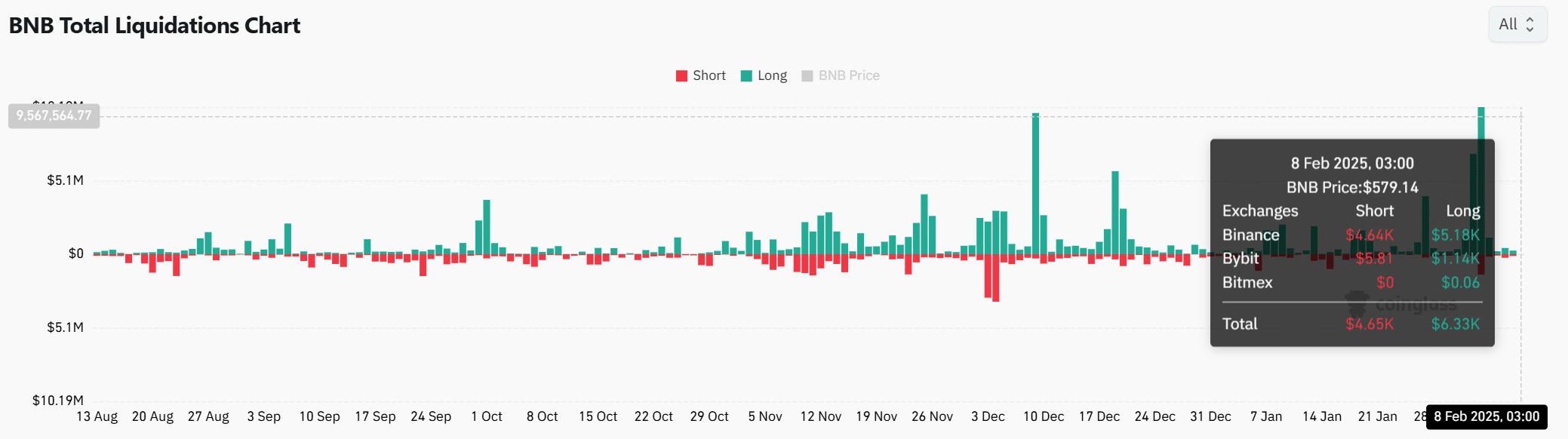

BNB’s liquidation data – A balanced market

When analyzing BNB’s liquidation data, we noticed a relatively balanced market. On 8 February, 2025, BNB saw $6.33 million in long liquidations and $4.65 million in short liquidations. Such a balance means that the market is in a state of flux, with neither bulls nor bears fully in control.

The volatility could lead to sudden price movements, but it also keeps the market uncertain. Therefore, the liquidations may add to the unpredictability.

Source: Coinglass

At the time of writing, Binance Coin was showing some strong potential to break through the $618 resistance level. Its press time price action, moderate social volume and dominance, and positive but subdued sentiment, all suggested that the coin may be gearing up for further growth.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

If BNB manages to overcome this resistance level, it could trigger a broader bullish rally. Therefore, if BNB can maintain its current momentum and break the $618-level, it is likely to initiate a new uptrend.

Source: https://ambcrypto.com/bnbs-price-to-618-next-yes-but-its-hike-will-depend-on/