Key Takeaways

Why is BNB positioned for a potential rebound?

BNB’s circulating supply dropped to a 20-month low of 139 million, while on-chain activity and spot demand surged, signaling strong organic growth and accumulation.

What factors could slow BNB’s rally?

Bearish momentum signals from the DMI and Stochastic RSI suggest buyer exhaustion, with $883 acting as key support if the retracement deepens.

After hitting a new all-time high of $949 three days ago, Binance Coin [BNB] faced strong rejection and declined to a low of $911.

However, the altcoin recovered slightly to trade at $928 at press time, after moderately declining by 0.27% on daily charts.

Despite the recent retrace, crypto analysts remained optimistic, with CryptoQuant analysts eyeing more gains, citing reduced supply.

BNB circulating supply hits 20-month low

According to CryptoQuant, BNB’s circulating supply has declined to a 20-month low of 139.187 million tokens.

The last time the supply reached such levels was January 2023, when the supply dipped to 134 million. This decline is not an isolated case, but a continuation of a long-term trend that has intensified since mid-2024.

Source: CryptoQuant

Usually, supply declines are driven mainly by token burning mechanisms and supply caps. The Binance team has burned a total of 62.8 million BNB, with an average of 1.5 million every quarter.

Source: BNBburn

Such a sustained token burn leads to deflationary pressure, as fewer tokens over time increase scarcity. This creates a positive price action by reducing potential selling pressure if market demand remains constant or rises.

On-chain activity remains elevated

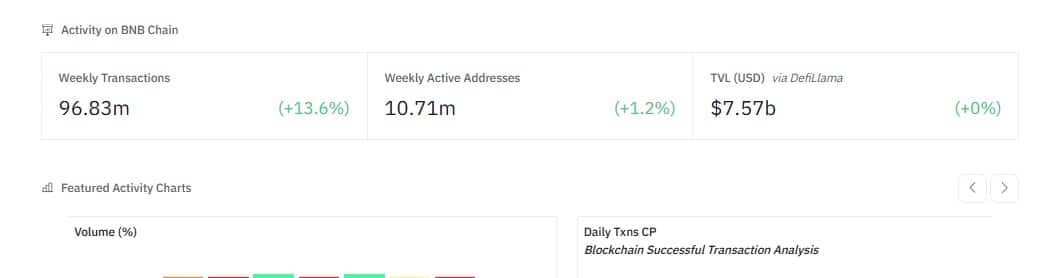

Amid reduced supply, on-chain activities have surged steadily as well. According to data from Dune, the number of active BNB users has surged 1.2%, reaching a weekly average of 10.7 million.

Source: Dune

At the same time, the number of chain transactions surged 13.6% over the past week, reaching 96.83 million with a daily average of 13 million.

Typically, when these two metrics rise in tandem, it signals vigorous on-chain activity and participation. Thus, the current price action is strongly backed by organic demand, a prelude to higher prices.

Demand for BNB remains solid

Notably, as BNB retraced from its ATH, investors rushed into the spot market to buy the dip. According to Coinalyze, at press time, the altcoin saw 21.38k in Buy Volume compared to 18.25k in Sell Volume.

Source: Coinalyze

The market thus recorded a positive Buy Sell delta of 3.13k, a clear sign of aggressive spot accumulation. Exchange activities further echoed the trend.

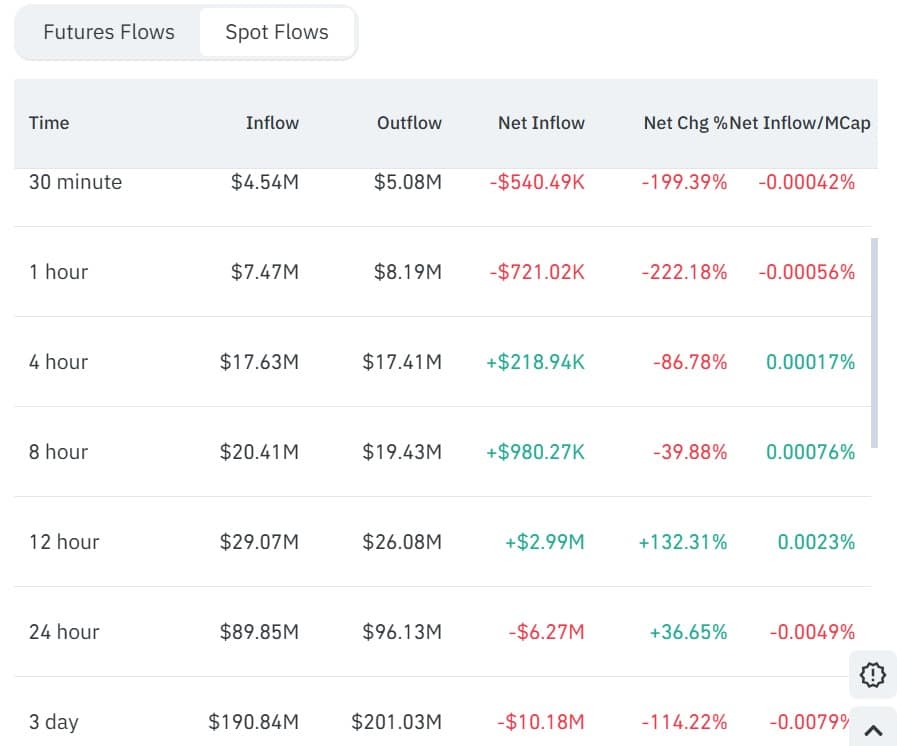

According to CoinGlass, BNB has recorded a negative Spot Netflow of -$10.18 million over the past three days. At press time, netflow was -$6.27 million, indicating higher outflows — a sign of increased spot accumulation.

Source: CoinGlass

Will BNB bounce back to another ATH?

Binance Coin showed resilience on its price charts as supply declined, while on-chain activity and spot demand remained strong.

These market conditions positioned BNB for more gains on its price charts. If they hold, BNB could reclaim $944 and rally to another high.

Source: TradingView

However, AMBCrypto found that BNB’s upward momentum weakened while the downward momentum slowly strengthened. Notably, Directional Movement Index (DMI) has declined to 27 after making a bearish crossover.

At the same time, Stochastic RSI flipped bearish and declined to 79. When these two metrics turn bearish, it suggests potential buyer exhaustion.

So, if buyers remain exhausted, BNB’s retracement could be prolonged, with $883 as the new support.

Source: https://ambcrypto.com/short-term-weakness-coming-for-bnb-2-key-levels-hold-the-answer/