- BNB’s recent recovery helped the coin close above its EMAs—depicting a strong bullish edge.

- The coin’s derivatives data showed a bullish edge amid the recent BTC recovery.

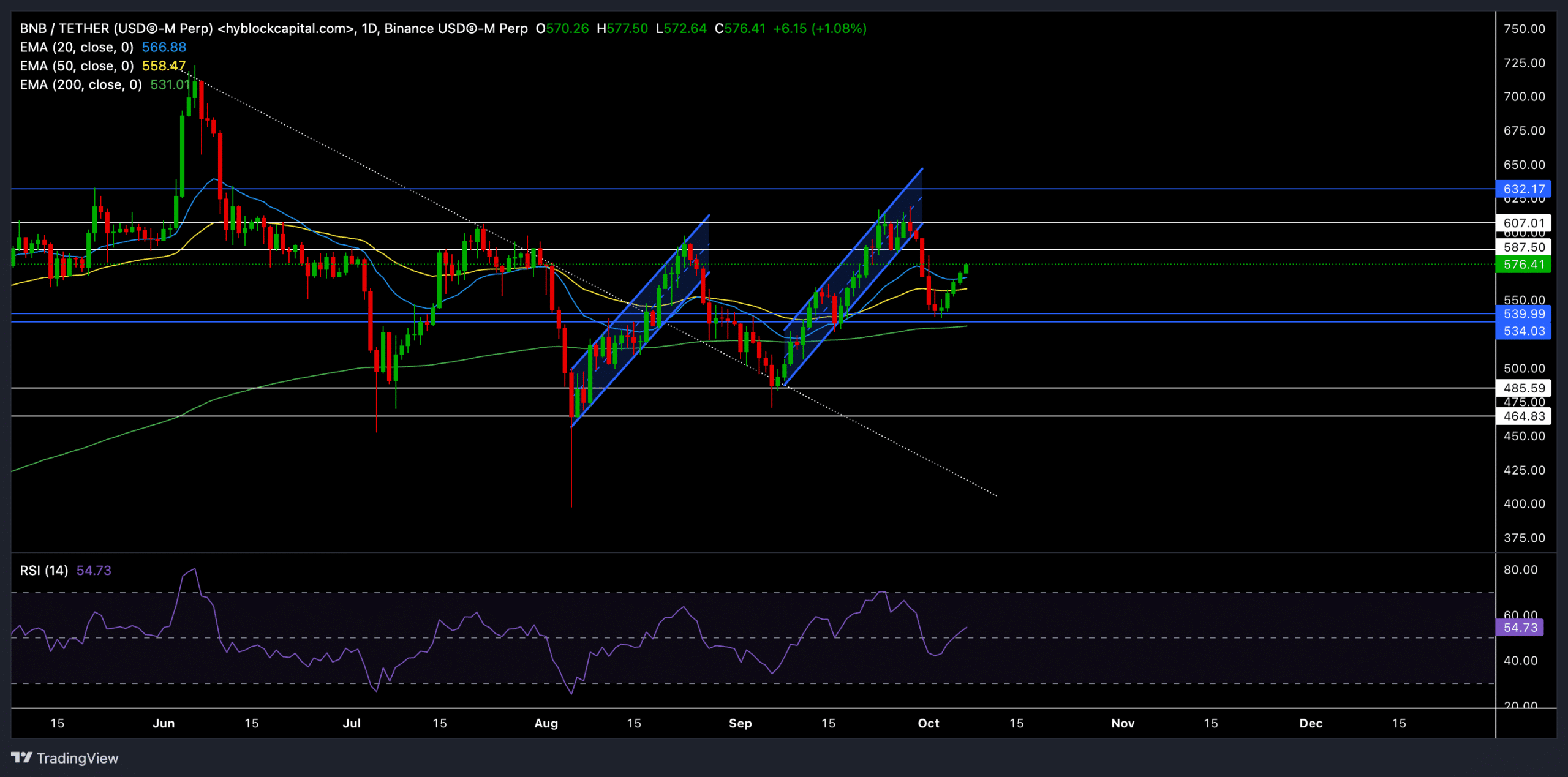

The recent sideways movement of Binance Coin [BNB] has been contained within the $460-$600 range for nearly four months, reflecting its struggle against broader market headwinds. The most recent price action has reversed from the $607 resistance, triggering a near-term dip.

However, the bulls re-emerged at the $539 support level in tandem with a slight recovery in Bitcoin [BTC].

At press time, Binance Coin was trading at approximately $576, up by around 2.5% over the past 24 hours.

BNB primed for another rally?

Source: TradingView, BNB/USDT

BNB’s daily chart highlighted how the altcoin broke above critical EMAs, giving the bulls a short-term edge. After bouncing off the $539 support level, BNB climbed above its 20, 50, and 200-day EMAs to reflect renewed buying pressure.

Should this momentum persist, the Binance Coin will likely retest the $607 resistance and possibly breach it in the coming days. A successful close above $607 could see BNB entering a new price discovery phase, with potential tests at $630 and beyond.

But it’s worth noting that a rejection at the $607 level could stall the current bullish momentum and prompt a consolidation phase between $539 and $607.

The RSI stood at 54.73, indicating a slight bullish bias. If it manages a clean break above the 60 mark, it would reinforce the buying pressure and potentially accelerate the bullish breakout.

Derivatives data suggest…

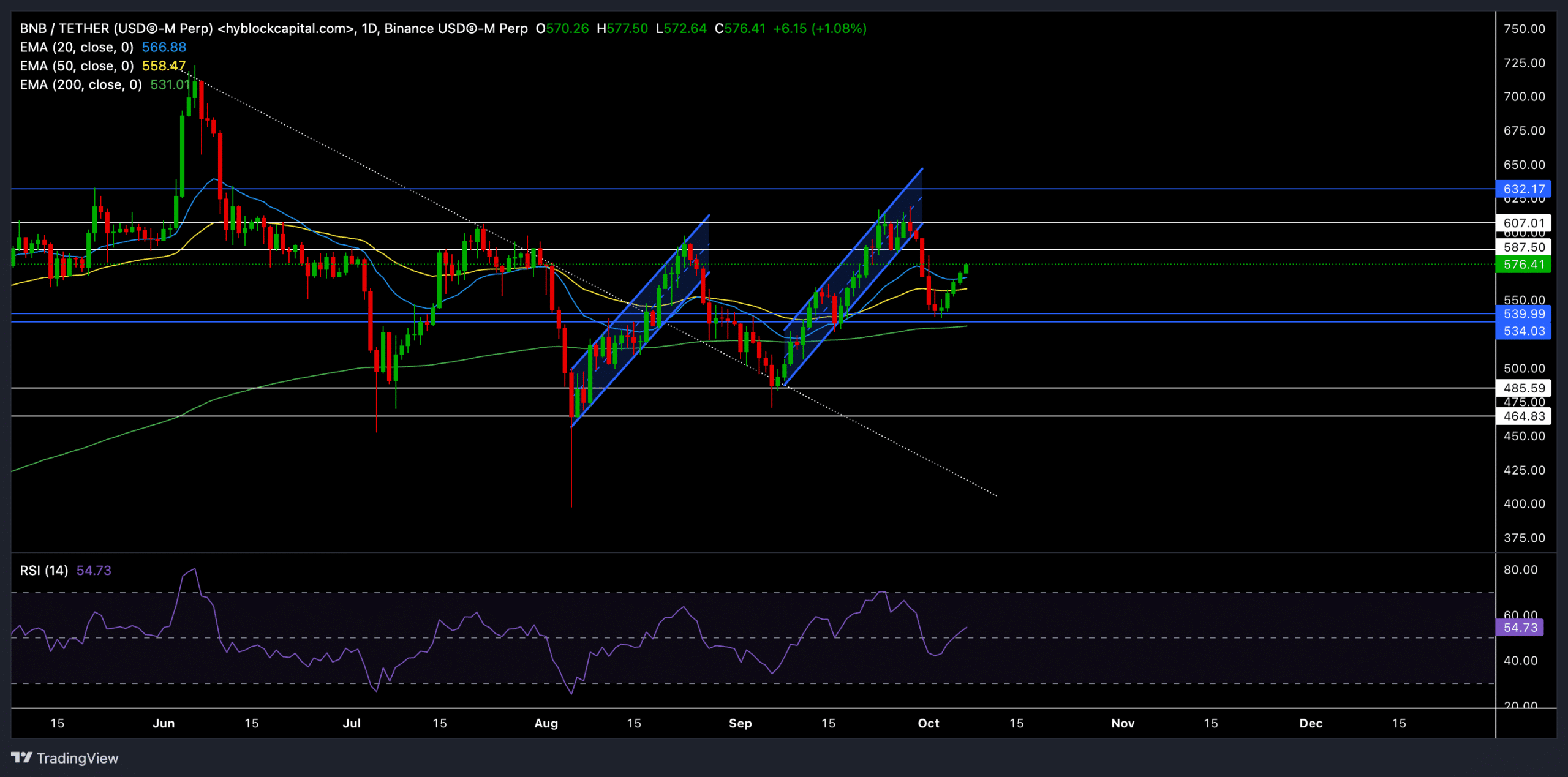

Source: Coinglass

The derivatives market sentiment further corroborated the current bullish scenario. BNB’s 24-hour long/short ratio was at 0.9623, reflecting a balanced sentiment.

However, on Binance and OKX, the long/short ratios were more favorable for the bulls, standing at 1.5907 and 1.73, respectively. This suggested some optimism among traders, especially for short-term gains.

In contrast, the open interest for BNB options witnessed a slight 4.11% decline, indicating some traders are cautious about holding positions amid the ongoing consolidation phase.

Interestingly, the trading volume grew from 111.22% to $546.86 million. This increase in volume alongside the 24-hour gains painted a relatively positive picture for the coin.

The recent rekt data highlighted a mixed sentiment, with most short traders being liquidated over the past 12 hours, indicating the bullish push might still have some steam left.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Given BNB’s high correlation with BTC, traders should keep a close watch on Bitcoin’s movement. A bullish breakout in BTC could also set the tone for BNB’s trajectory.

For now, a decisive move above or below the $607 and $539 levels will clarify BNB’s next trend.

Source: https://ambcrypto.com/bnb-buyers-should-watch-out-for-these-price-levels-before-going-long/