- BlackRock launching a money market fund under the GENIUS Act, simplifying reserve custody.

- Anticipated rise in institutional money market fund investments.

- Stablecoin reserves and regulatory frameworks may stabilize.

BlackRock is poised to launch a compliant money market fund under the “GENIUS Act,” aimed at simplifying stablecoin reserve custody, as reported on October 16, 2025.

This initiative could drive significant institutional capital into stablecoin markets and tokenized financial products, altering the cryptocurrency landscape under new regulatory frameworks.

Historical Insights and Market Implications

BlackRock plans to broaden the scope of stablecoin reserve custody through a new money market fund. The initiative aligns with the GENIUS Act’s regulations, bringing more institutional-grade solutions to crypto assets. BlackRock’s expansion signals increasing interest from major financial institutions in digital assets. The GENIUS Act, effective since July, aims to provide a clear framework for stablecoin. As President Donald J. Trump stated, “The GENIUS Act will make America the undisputed leader in digital assets, bringing massive investment and innovation to our country.“

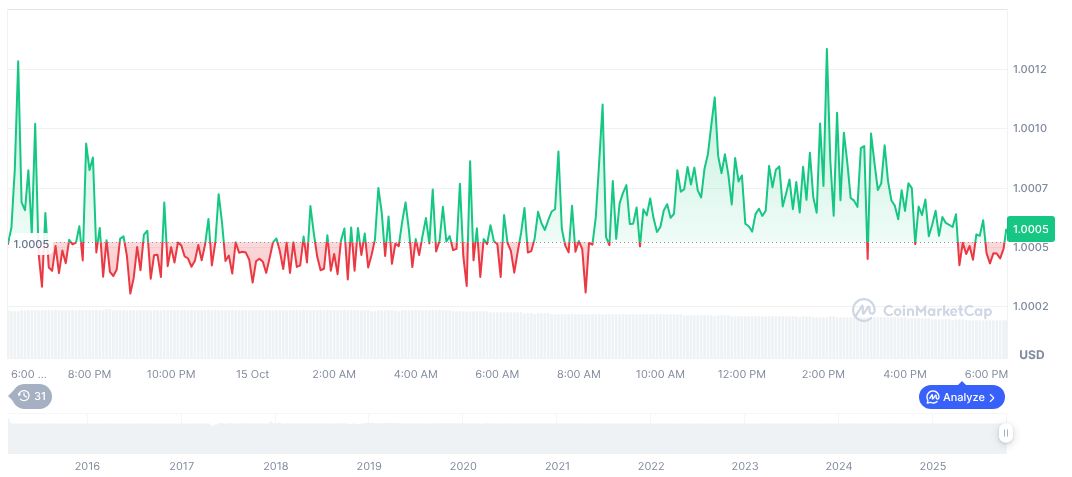

Tether’s USDt holds a price of $1.00 with a market cap of formatNumber(181407265094, 2) and a dominance of 4.79% according to CoinMarketCap. A 24-hour trading volume shows formatNumber(166785499801, 2), revealing a -13.91% change. Price fluctuations have been minimal, with a slight decline of -0.02% in the last day.

Analysis from the Coincu research team suggests that the move by BlackRock could encourage institutions to back digital asset strategies more actively. This aligns with similar trends seen when Bitcoin ETFs debuted, signaling substantial capital reallocation towards secure, regulated financial products.

Market Data and Expert Insights

Did you know? The GENIUS Act, comparable to past significant legislations, positions the U.S. as a regulatory leader in digital assets, marking a pivotal step since the Federal Reserve Act in 1913.

Tether’s USDt holds a price of $1.00 with a market cap of formatNumber(181407265094, 2) and a dominance of 4.79% according to CoinMarketCap. A 24-hour trading volume shows formatNumber(166785499801, 2), revealing a -13.91% change. Price fluctuations have been minimal, with a slight decline of -0.02% in the last day.

Analysis from the Coincu research team suggests that the move by BlackRock could encourage institutions to back digital asset strategies more actively. This aligns with similar trends seen when Bitcoin ETFs debuted, signaling substantial capital reallocation towards secure, regulated financial products.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/blackrock-genius-act-money-market-fund/