- BlackRock’s Glenn Purves highlights potential inflation rise due to tariffs.

- Tariffs may push inflation above Fed’s target, impacting prices.

- Market awaits clarity on who bears tariff costs: consumers or businesses.

BlackRock’s Global Head of Macro Research, Glenn Purves, noted on July 16 that U.S. core CPI in June rose less than expected, but tariffs are causing price hikes. The report from BlockBeats News highlighted signs of increasing prices in household appliances and entertainment products despite inventory buffers being currently depleted.

Purves explained tariffs might lead to an extended period of inflation, with potential impacts possibly felt the hardest by consumers or businesses through higher prices or reduced margins.

Tariff-Induced Inflation Pressures Seep into Consumer Sectors

Glenn Purves at BlackRock stated that despite the U.S. core CPI being lower, tariffs are leading to price increases. Specifically, sectors like household appliances are experiencing heightened costs. As inventories deplete, the situation might worsen. Insights shared by James Wynn Real further illustrate ongoing market discussions around these pressures.

Purves explained tariffs might lead to an extended period of inflation, with potential impacts possibly felt the hardest by consumers or businesses through higher prices or reduced margins.

Cryptocurrency Market Calm Amid Inflationary Concerns

Did you know? The last U.S.-China tariff escalation in 2018-19 led to cost hikes primarily shouldered by U.S. consumers, mirroring current concerns highlighted by Purves.

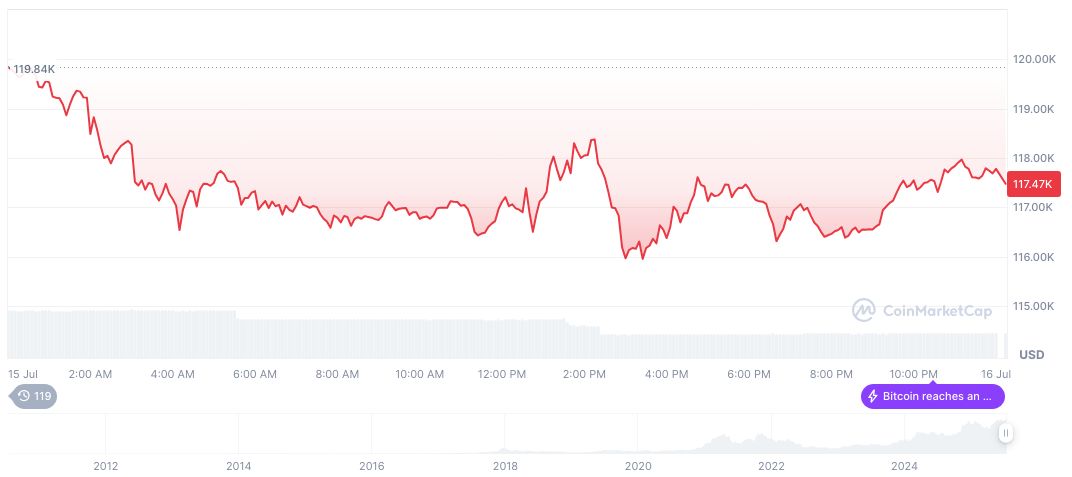

Bitcoin (BTC) currently trades at $117,623.67, with a market cap of $2.34 trillion, retaining a dominance of 62.98%. Its price increased by 0.22% in the last 24 hours, clocking a 7-day rise of 8.35%. Recent trading volumes stand at $85.48 billion.

Experts, such as those at AICoincom, suggest that the issue of inflation with persistent pressures could bring institutional attention to cryptocurrencies such as BTC as a potential hedge. The market’s past responses to inflationary signals have not led to immediate surges, yet the macroeconomic stress could bolster crypto appeal.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348918-blackrock-inflation-tariffs-impact/