- BlackRock’s planned investment in Circle signals major institutional backing.

- BlackRock eyes 10% of Circle’s IPO shares.

- Circle’s USDC may see increased institutional integration.

BlackRock, one of the leading global asset managers, reportedly plans to acquire a 10% stake in Circle Internet Financial’s upcoming IPO, as reported by Bloomberg. This move highlights growing institutional interest in Circle’s stablecoin, USDC.

The reported plan by BlackRock to invest significantly in Circle’s IPO underscores the potential strengthening of USDC’s position within the financial sphere. This could herald a new phase of institutional integration for stablecoins.

BlackRock Seeks 10% of Circle IPO Amid Growing Interest

BlackRock’s anticipated 10% share subscription for Circle’s IPO drew attention globally, hinting at a robust institutional interest in the stablecoin market. Circle, the USDC issuer, stands to gain significant investment backing from BlackRock, reinforcing confidence in stablecoin infrastructure. Without official confirmation from Circle or BlackRock leadership, public statements clarify involvement.

Immediate implications suggest a reinforced perception of Circle’s USDC among potential DeFi integrators. Analysts believe strategic investment moves by major asset managers like BlackRock significantly uphold USDC’s stature in decentralized finance.

The anticipated participation could potentially influence other market players’ decisions, fostering broader acceptance of stablecoin integration.

USDC’s Market Position and Potential Industry Shift

Did you know? Previous major investments by firms like BlackRock in crypto businesses, such as Coinbase’s listing, often sparked widespread increased asset inflows and interest, illustrating a pattern that may repeat with Circle’s IPO.

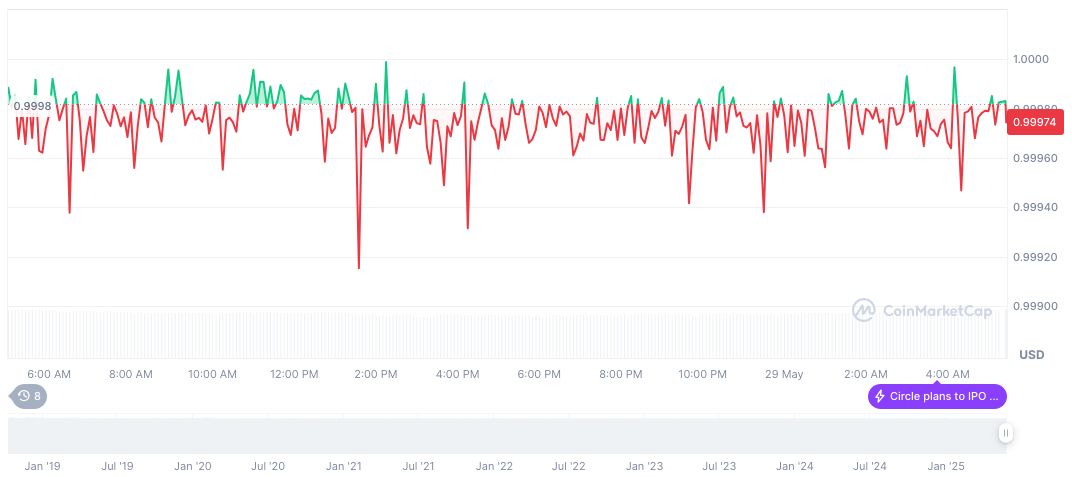

According to CoinMarketCap, USDC is currently valued at $1.00, maintaining a market cap of $61.23 billion and holding a 1.79% market dominance. The stablecoin’s 24-hour trading volume stood at $12.03 billion, noting a -0.01% change. This resilience reflects its position as a leading stablecoin in the crypto space.

Insights from the Coincu research team suggest BlackRock’s commitment could serve as a precedent, encouraging other institutional participants to explore stablecoin investments. This aligns with historical trends observing increased market confidence and adoption following notable investments. Regulatory frameworks might witness evolution to accommodate such expanding institutional interests in stablecoins.

Source: https://coincu.com/340421-blackrock-circle-ipo-usdc-shares/