- BlackRock’s BUIDL fund sees significant growth in tokenized U.S. Treasury sector.

- BUIDL’s market share now represents 40% of tokenized money funds.

- Growth reflects institutional interest in digitized high-yield instruments.

BlackRock’s BUIDL fund expanded significantly, reaching $2.89 billion in size as of June 2025, positioning it as a leader in the tokenized U.S. Treasury market.

This expansion underscores growing institutional demand for tokenized financial products, highlighting BUIDL’s potential in the digital asset space.

BlackRock BUIDL Fund Hits $2.89 Billion Milestone

The BUIDL fund by BlackRock achieved substantial growth, now valued at approximately $2.89 billion, thus leading the tokenized U.S. Treasury market. This surge is attributed mainly to institutional inflows, with USDtb contributing prominently. The halt by EthenaLabs in stablecoin holdings marked a significant shift, yet BUIDL continued its expansion, signaling robust market engagement beyond single-entity actions. The fund’s growth trajectory is particularly notable, having nearly tripled since reaching a preliminary milestone in March 2025. Moreover, the asset manager’s strategic direction showcases a commitment to RWA tokenization, potentially reshaping how institutions interact with such instruments. Rob Goldstein, COO, emphasized this vision:

Market observers and stakeholders have positively received this, signaling an increased appetite for similarly regulated digital products.

“BUIDL is the largest tokenized fund in the industry at over $3bn… Imagine a world where every financial asset is represented on a blockchain.” – Markets Media

Institutional Interest Drives Tokenization Proliferation

Did you know? BlackRock’s BUIDL fund’s rapid growth eclipses past tokenization attempts, with its market share doubling other efforts.

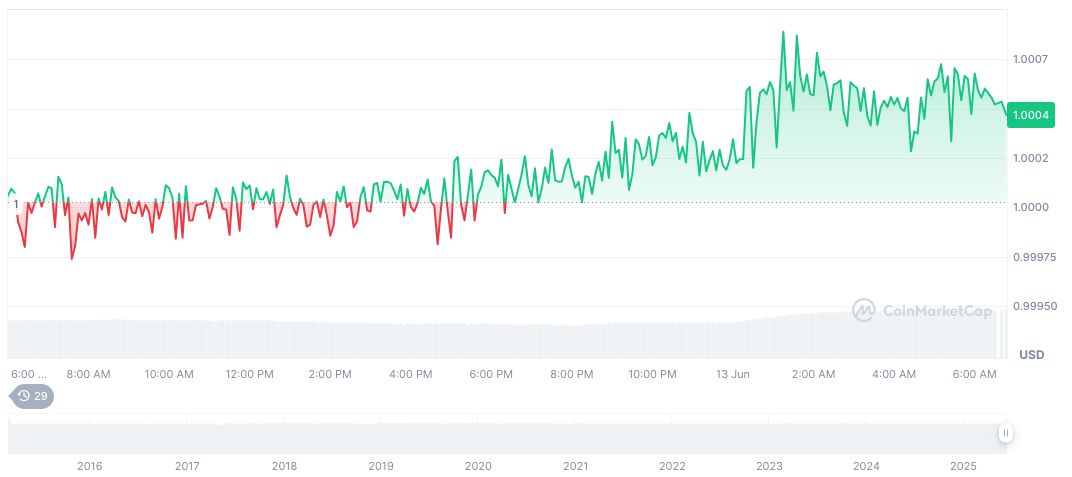

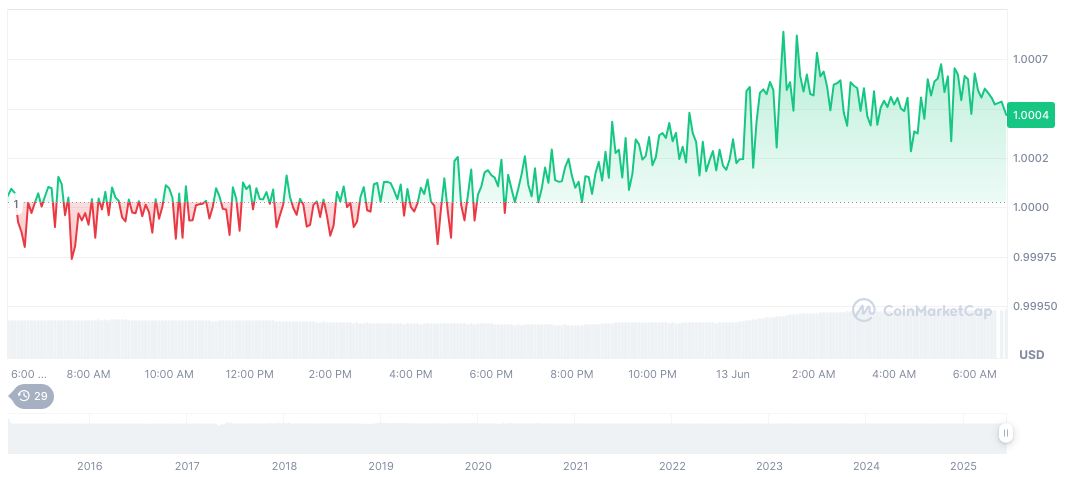

As of June 13, 2025, Tether USDt is priced at $1.00, with a market cap according to CoinMarketCap representing 4.80% market dominance. The fully diluted market cap stands at $formatNumber(157076625348, 2). Despite a marginal 0.04% increase over 24 hours, the cryptocurrency’s trading volume hit $formatNumber(112195427232, 2), changing by 26.00%. Circulating supply is pegged at 155,192,186,081 USDT from CoinMarketCap. The Coincu research team suggests BUIDL’s trajectory could serve as a precedent for future regulatory models in tokenized assets, aligning traditional and digital financial systems. Such integration represents a pivotal shift, as institutions look for compliant, scalable blockchain solutions.

Latest updates on cryptocurrency trends and news.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343023-blackrock-buidl-fund-leads-tokenization/