Key Takeaways

How strong was BSOL’s trading performance?

BSOL saw $56 million in volume on day one and $72.4 million on day two, making it the highest first-day turnover among nearly 850 ETFs launched this year.

Are other crypto ETFs seeing similar activity?

Yes, the Canary Litecoin ETF (LTCC) and Canary HBAR ETF (HBR) are sustaining trading volumes – uncommon after the debut day.

The first U.S. investment product offering full direct exposure to Solana [SOL] is showing no signs of cooling off.

After a record-setting debut, the Bitwise Solana Staking ETF (BSOL) delivered an even stronger performance in its second trading session, posting $72.4 million in volume on the 29th of October.

That builds on its $56 million opening day, the highest first-day turnover among nearly 850 ETF launches so far this year.

Execs weigh in

Bloomberg Senior ETF Analyst Eric Balchunas wrote in a post on X,

“$BSOL did more volume on Day Two.. $72m is a huge number. Good sign.”

Echoing similar sentiments, Kyle Samani, Managing Partner at investment firm Multicoin Capital, added,

“Truly a watershed moment. The amount of available capital that can now buy SOL that could not previously is tremendous.”

That being said, the momentum around Solana-linked exchange-traded products is not limited to Bitwise alone. Data showed that other recently launched crypto ETFs were also seeing steady activity.

Other SOL ETF activity

Balchunas further noted that the Canary Litecoin ETF (LTCC) and Canary HBAR ETF (HBR) held volumes near $8 million and $1 million, respectively. Most ETFs usually see sharp post-launch declines, making these steady figures noteworthy.

Meanwhile, Bitwise’s BSOL ETF continued to lead the pack, recording roughly $69.5 million in first-day inflows and followed by $46.5 million on the 29th of October, according to Farside.

Seeing this, Matt Hougan, CIO of crypto index fund manager Bitwise Invest, also tweeted,

“I have a feeling the Bitwise Solana Staking ETF, BSOL, is gonna be huge. Institutional investors love ETFs, and they love revenue. Solana has the most revenue of any blockchain. Therefore, institutional investors love Solana ETFs.”

Grayscale’s newly converted Solana staking ETF (GSOL) also entered the market with approximately $4 million in volume, while the REX Osprey SOL Staking ETF (SSK) added around $18 million mid-week.

Market sentiments and more

Despite the excitement around the new ETFs, market sentiment isn’t fully aligned with the bullish narrative.

On the predictions platform Myriad, traders were assigning only a 32.7% probability that Solana will set a new all-time high before the year ends.

Meanwhile, SOL saw mild volatility, sliding 3.1% in the last 24 hours to around $194 as Bitcoin [BTC] also cooled from recent highs. However, at press time, Solana recovered slightly to $195.53, up 0.41% according to CoinMarketCap.

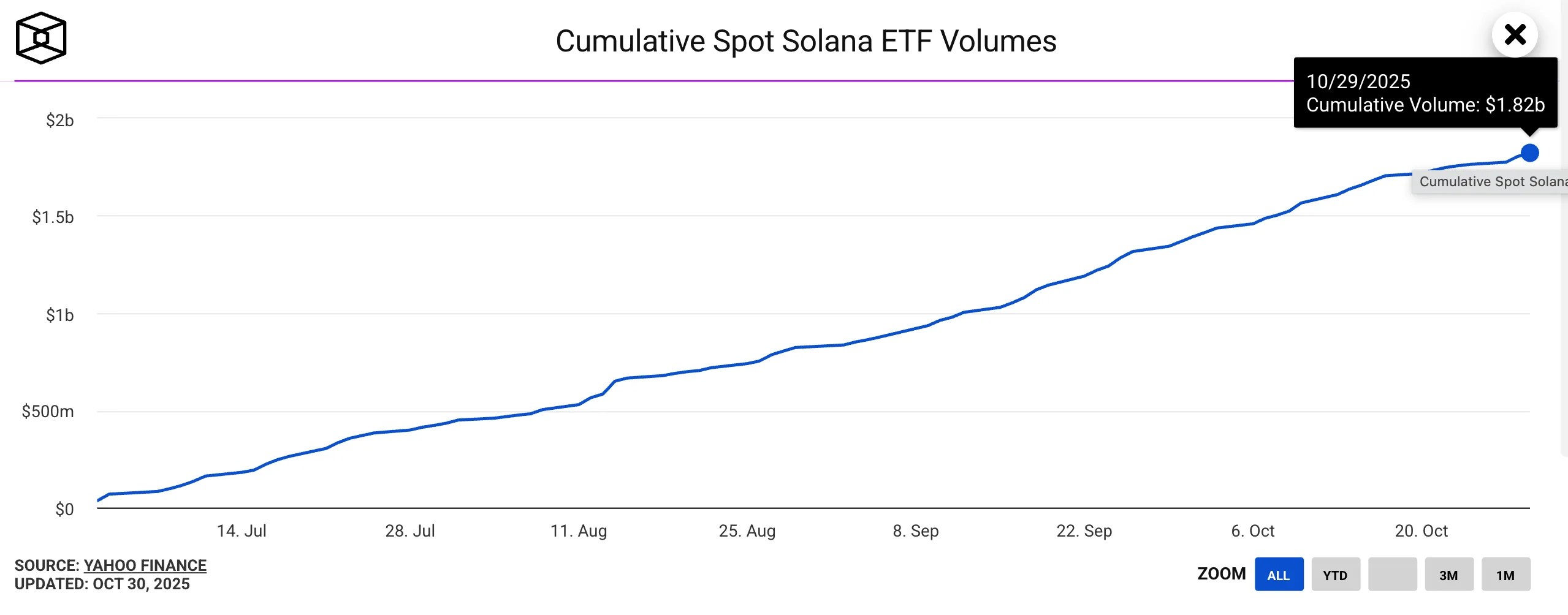

Still, the bigger picture looks far from quiet; the combined daily Spot Solana ETF volume, led by the REX-Osprey SOL ETF, has already reached $1.82 billion as of the 29th of October.

Source: The Block

Source: https://ambcrypto.com/bitwise-solana-etf-breaks-records-will-the-watershed-moment-last/