- Trump criticizes Fed interest decisions, BIS assures independence.

- No threat to Fed independence, BIS confirms.

- Cryptocurrency markets remain stable post-announcement.

On June 29, 2025, the Bank for International Settlements (BIS) confirmed the U.S. Federal Reserve’s independence amidst criticism from Donald Trump in Washington.

The BIS’s statement reassures the financial community of the Fed’s autonomy, easing concerns over potential political influence on monetary policy decisions.

BIS: Trump’s Criticism Holds No Threat to Fed

Donald Trump, former U.S. President, has recently voiced criticism regarding the Federal Reserve’s interest rate decisions, urging reductions from the current 4.3% to between 1% and 2%. According to Trump, “reductions to between 1% and 2% from the current 4.3%” are necessary. Agustín Carstens, the General Manager of BIS, addressed these criticisms by affirming that political discourse does not threaten the Fed’s independence. Jerome Powell, the Federal Reserve Chair, has maintained his position of non-engagement with political remarks, emphasizing the Fed’s focus on its mandates. He stated, “I’m not going to have any response or comment whatsoever on what the president said. It’s not appropriate for me to do… [W]e will continue to do our work as we always have.”

The BIS report states that no immediate threats arise from Trump’s remarks, implying continued Fed policy independence. With no drastic monetary policy changes in view, financial markets have remained stable, particularly noting no significant shifts in the exchange rate for the U.S. dollar.

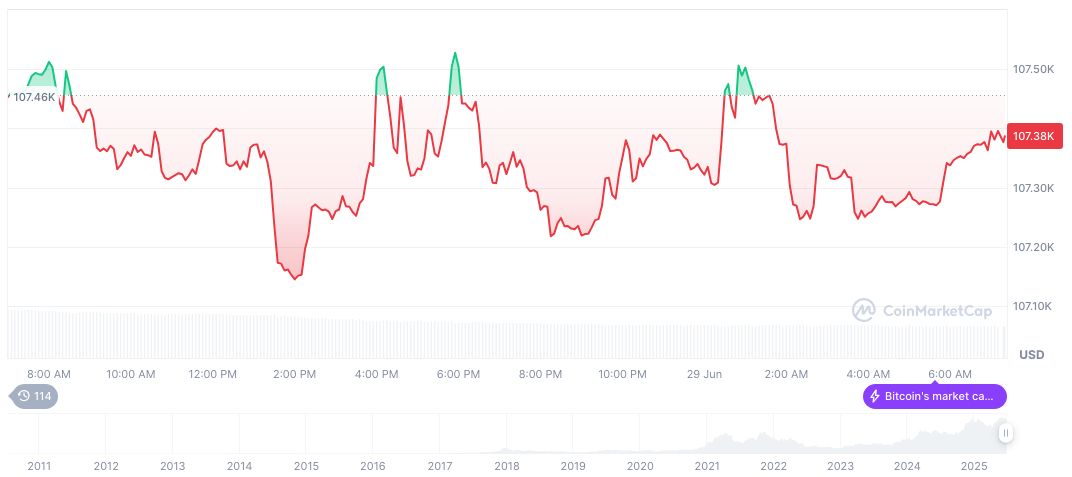

In response to the BIS report, market analysts have largely seen this assurance as a calming influence. The cryptocurrency market, sensitive to changes in USD stability, showed no significant volatility. BTC and ETH prices remained steady, with no notable trading volume increases in major exchanges.

Stability in Crypto Markets Amid Fed Independence Assurance

Did you know? The Federal Reserve’s independence is crucial for maintaining economic stability and preventing political pressures from influencing monetary policy.

Bitcoin (BTC) values at $107,831.88 per CoinMarketCap data, dominate 64.8% of the market and have a market cap of $2.14 trillion. Trading volumes noted a decrease of 29.6% over 24 hours, while its value rose by 5.17% over the past week, highlighting a trend of growth despite broader economic challenges.

Coincu researchers suggest the current stable interest rate environment supports Bitcoin’s positioning as a hedge asset. Addressing the BIS concerns over rising trade fragmentation, experts indicate crypto assets could gain traction as investors seek diversification amidst traditional market uncertainties.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345825-bis-affirms-fed-independence/