- Binance’s liquidation of LEVER/USDT futures impacts user trading abilities.

- Delisting scheduled for September 3, 2025.

- Users advised to close positions to avoid liquidation risks.

Binance Futures is set to liquidate and delist the LEVER/USDT perpetual contract on September 3, 2025, ceasing new positions from half an hour before the event.

This delisting highlights Binance’s risk management practices, potentially affecting liquidity and volatility for stakeholders without impacting major cryptocurrencies like BTC and ETH.

Binance Ensures User Preparedness Ahead of LEVER Delisting

Binance Futures will close all positions and conduct an automatic settlement on USDⓈ-M LEVERUSDT perpetual contract at 2025-09-03 09:00 (UTC). The contracts will then be delisted after the settlement is complete.

The announcement reflects a clear directive to avoid forced liquidation risks. Users are encouraged by Binance to proactively manage and close existing positions in advance. Binance’s approach aligns with its typical operational procedures for contracts with diminishing demand or strategic realignment needs. The LEVER token, as the key asset in this contract, experiences direct implications from these changes.

Market reactions have been measured. No comments by Binance’s leadership or notable industry voices have surfaced publicly. Communications from Binance emphasize procedural compliance, but do not cite regulatory or governmental interactions. Increased volatility in the final hour is anticipated, necessitating user vigilance.

Market Volatility Expected as LEVER Faces Delisting

Did you know? Historically, Binance’s decision to delist underperforming contracts like LEVER/USDT aligns with their aim to streamline offerings and manage platform risk profiles effectively.

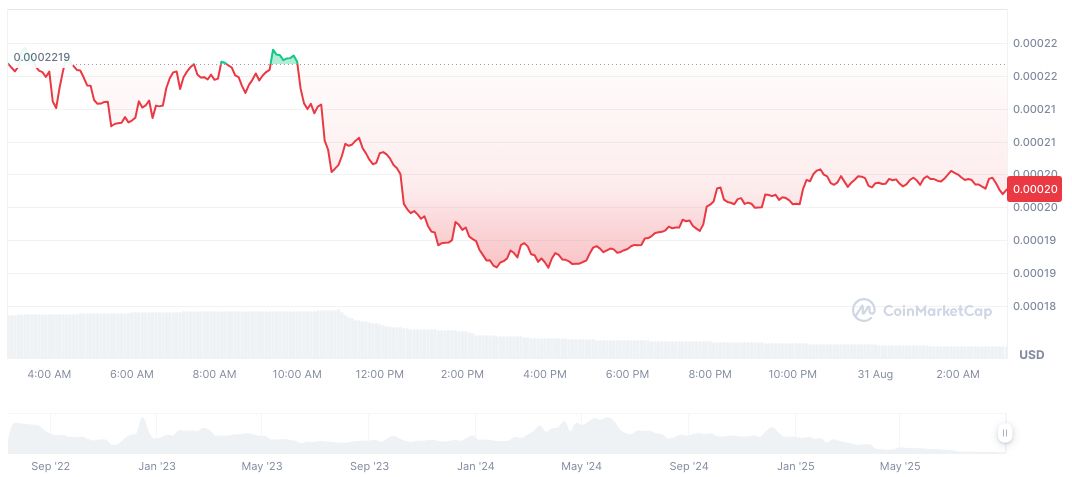

According to data from CoinMarketCap, LeverFi currently holds a market capitalization of $11.31 million, reflecting a minimal market dominance. The token’s recent trading volume dropped by 71.29% over 24 hours, with prices decreased by 7.98% in the same period. The circulating supply stands close to its maximum at 55.79 billion tokens.

Analysis from Coincu’s research team suggests that Binance’s delisting decision could result in increased liquidity challenges for LEVER. Historically, such events tend to heighten short-term volatility, especially if coupled with insufficient market demand elsewhere. Looking forward, broader regulatory scrutiny could emerge, adjusting future operational directions. Pricing data over the past 90 days shows a significant decline, indicating vulnerability amid market changes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/binance-liquidates-delists-lever-usdt/