- The Binance exchange has paid $2.25 million in fines over non-compliance with Indian regulatory requirements.

- As a result, the Binance URL is now accessible in India once again.

After a long wait, crypto users in India can now access the Binance [BNB] URL, since it has been completely restored.

In the recent past, the crypto exchange faced many challenges in navigating regulatory needs in the country, resulting in facing strict measures from the government.

Despite the legal handles, the company has managed to settle with the authorities after paying fines. Therefore, with the URL fully accessible, the exchange is set to enjoy a considerable user base.

Binance had to pay the fine over failure to comply with India’s anti-money laundering regulations.

According to India’s FIU, the exchange had operated in the country within the country without fulfilling the required registration and also failed to comply with local AML regulations.

What does the Indian market mean for Binance?

The Indian government has shown serious concerns over foreign crypto companies. The state started restricting offshore companies and thus blocked nine platforms such as OKX, Kucoin, and Binance.

With Binance complying with the local regulations, becomes the major foreign company to restore its services for the Indian market. This move is significant, especially following the recent hacking of WazirX.

The development also opens the doors for other companies to comply with the legal requirements and return to the market.

In the recent past, the significance of regulatory compliance has become popular with Binance and other exchanges to try to avoid legal actions through compliance.

Any impact on BNB?

Source: TradingView

As of this writing, BNB was trading at $527 after a 1.35% increase in the last 24 hours. Equally, the last 24 hours have seen a 1.31% increase in BNB’s market cap.

The gains on daily charts show the developments in India have positively impacted its native token.

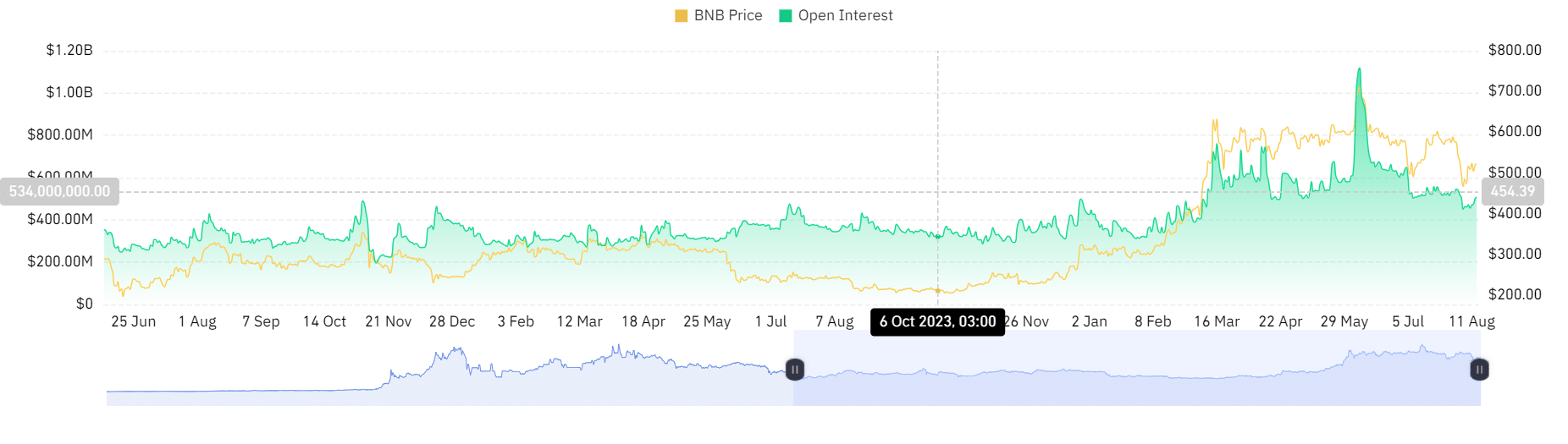

Source: Coinglass

Equally, AMBCrypto’s look at Coinglass showed that Open Interest increased from $500 million to $508 million over the last 24 hours.

Although this was a small rise in Open Interest, its significance cannot be discounted.

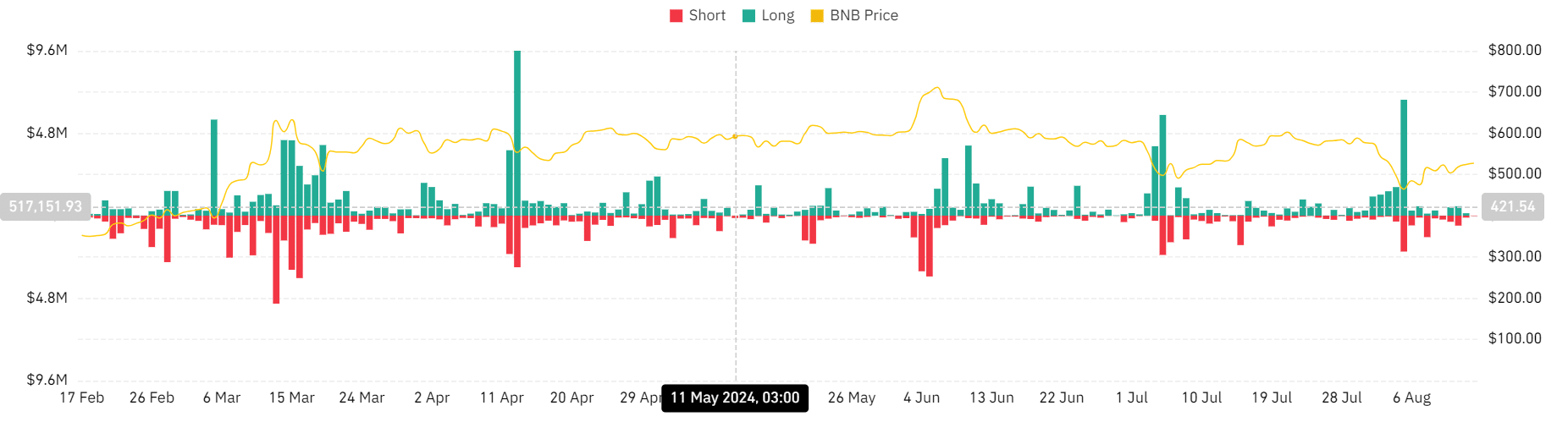

Source: Coinglass

Read Binance Coin’s [BNB] Price Prediction 2024-25

Additionally, BNB’s liquidation has hit a low of $795 over the past 24 hours.

Therefore, with increased users, Binance and its native token are well-positioned for future gains. In the long term, the restoration of the Indian market will have a considerable impact on Binance and BNB.

Source: https://ambcrypto.com/binance-pays-2-25m-fine-returns-to-india-impact-on-bnb/