- $4.3 billion settlement, oversight reduction, Changpeng Zhao steps down.

- Significant market implications with BNB price surge.

- Regulatory shift may influence other global cryptocurrency policies.

Binance is negotiating a $4.3 billion settlement with the U.S. Department of Justice to reduce compliance oversight, potentially shifting regulatory approaches in the cryptocurrency industry.

This significant settlement indicates a potential easing in regulatory monitoring, impacting Binance operations and triggering a positive reaction for Binance Coin in the cryptocurrency market.

BNB Price Soars Amid Regulatory Shift

Bloomberg first reported the negotiations involving Binance and the U.S. Department of Justice.

The settlement would involve Binance paying $4.3 billion to resolve allegations of inadequate anti-money laundering measures. The discussion of canceling the external compliance monitor shows a trend toward reduced regulatory oversight, aligning with recent DOJ actions under the Biden administration.

Changpeng Zhao’s anticipated departure as Binance’s CEO forms part of the settlement. His departure aligns with the DOJ’s softened stance, potentially easing regulatory frictions. Changes could bolster Binance’s U.S. footprint by lessening compliance obligations.

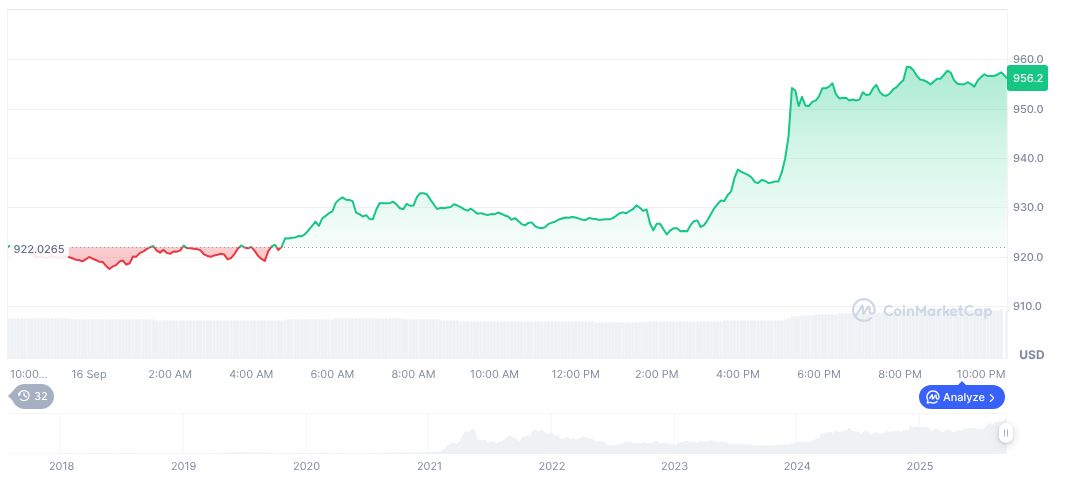

Market reactions have been mixed, yet traders view the reduction in regulatory uncertainty as a positive outcome. Binance Coin (BNB) surged to unprecedented levels above $950, following news of the potential DOJ settlement. While no direct statements have been made by Changpeng Zhao or current Binance leadership across public channels, anticipation of eased regulatory tensions has fueled market optimism.

Historical Context, Price Data, and Expert Analysis

Did you know? In a similar regulatory context, Binance settled with the SEC for $4.3 billion in November 2023, addressing securities registration violations. The impact was notably significant for Binance Coin (BNB), mirroring current uptrends.

As of September 16, 2025, Binance Coin (BNB) stands at $957.47, according to CoinMarketCap. Its market cap is reported at approximately $133.27 billion, while market dominance reaches 3.29%. Over the past 90 days, BNB has climbed by 48.38%, recording an 11.57% increase in the last 30 days. The trading volume at over $3.06 billion reflects an increase of 23.05% within the day.

According to analysts at the Coincu research team, the DOJ’s changing regulatory stance could inspire broader global financial reforms. Binance’s evolution from strict oversight marks a significant regulatory shift, potentially reshaping compliance frameworks across the cryptocurrency landscape. BNB price explodes to $909 and continues to be a central focus for market analysts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/binance-doj-settlement-oversight-reduction/