- Binance expands institutional offerings with CaaS at Token2049.

- Model targets banks, boosts institutional digital asset access.

- Emphasizes Binance’s strategic positioning in the crypto market.

At the Token2049 event in Singapore, Binance CEO Richard Teng announced the launch of a “Crypto as a Service” model and increased institutional collaboration.

This initiative could shape institutional engagement in digital assets, enhancing market dynamics amid broader participation, particularly in sectors like banking and asset security.

Binance’s CaaS Model Aims to Transform Bank Collaborations

At Token2049 in Singapore, Binance CEO Richard Teng announced a new “Crypto as a Service” (CaaS) model. This initiative aligns with Binance’s strategies to enhance institutional collaborations and widen digital asset accessibility for banks and security institutions.

The CaaS model launch is projected to alter existing institutional engagement. Targeting banks and securities institutions, it underscores an increased focus on facilitating crypto integration within traditional finance frameworks.

Industry stakeholders have acknowledged the announcement’s significance. Richard Teng stated at the event,

“Binance is increasing its collaboration with various capital institutions … Binance will also launch the ‘Crypto as a Service’ (CaaS) model to open up to institutional clients in need, such as banks and security institutions.”

This highlights Binance’s concentrated efforts on expanding its institutional reach.

Institutional Adoption Spurs Regulatory and Market Evolutions

Did you know? Institutional interest in crypto has consistently driven significant market trends, notably during prior launches like Coinbase’s custody services in earlier years, impacting established financial protocols.

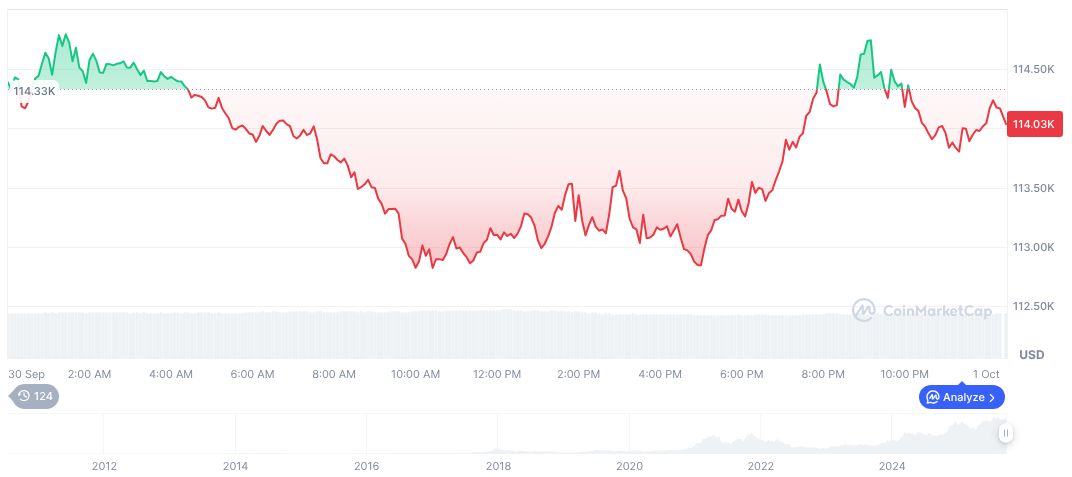

Bitcoin (BTC) trades at $114,474.09, with a market cap of formatNumber(2_281_262_828_087.75, 2). Its price has changed by 6.18% over 30 days. CoinMarketCap reports a 24-hour trading volume of formatNumber(57_497_242_575.36, 2), indicating a drop of 5.57%.

The Coincu research team indicates that Binance’s move reflects an ongoing trend towards institutional adoption. This pattern is anticipated to influence regulatory policies and technical frameworks, integrating digital assets more deeply into mainstream finance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/binance-announces-caas-model-institutional/