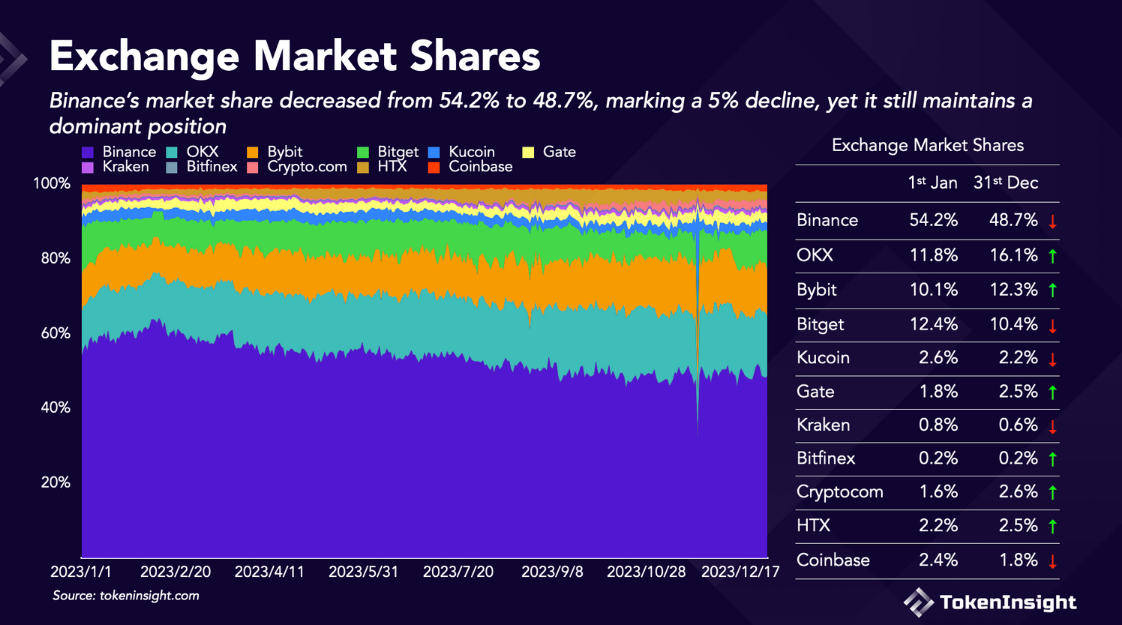

Once an undisputed monarch, Binance relinquished 5% of its cryptocurrency exchange kingdom in 2023, but clung to the throne despite regulatory storms and a CEO’s exodus. While upstart rivals OKX and Bybit chipped away at its dominance, Binance still commanded a 50% share, proving its resilience in a year marked by turbulence, based on the most recent analysis from renowned cryptocurrency research company Token Insight.

Binance Dominance Wavers: Competitors Gain Ground

Analysts attribute the dip to the expiration of Binance’s popular zero-fee Bitcoin promotion. Promotional campaigns can give a temporary boost, but ultimately market fundamentals reign supreme, analysts said.

Legal challenges, though not explicitly mentioned, likely played a role as well. The departure of Changpeng Zhao, Binance’s charismatic leader, sent its share plummeting to 32%, but a swift recovery pushed it back above 45% by year-end, showcasing the exchange’s adaptability.

Source: Token Insight

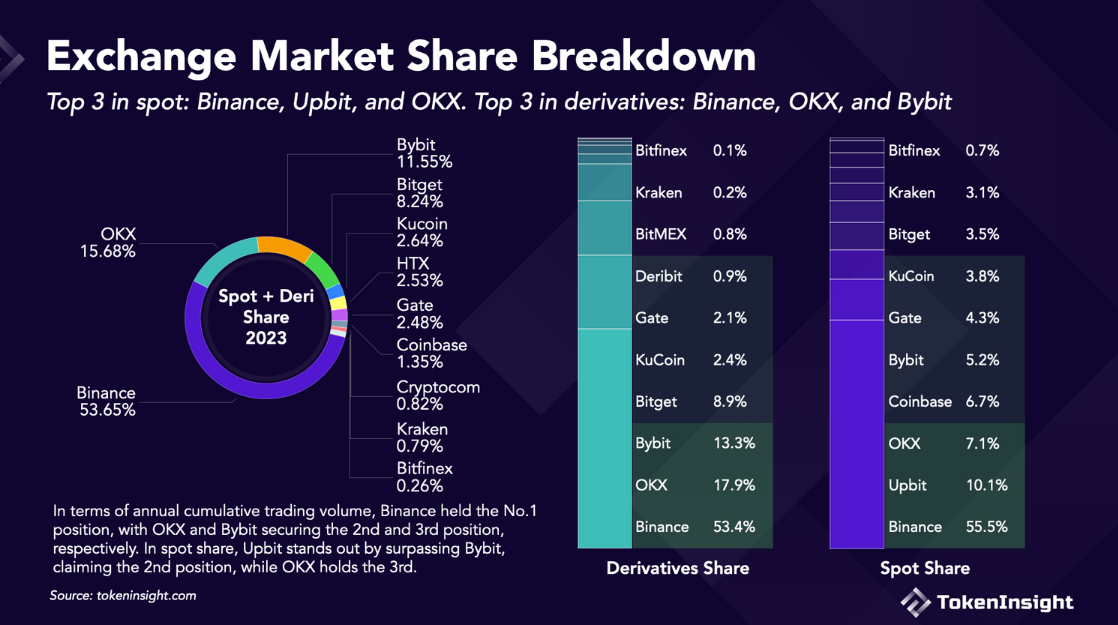

This changing of the guard isn’t a one-horse race. OKX, fueled by strategic partnerships and an innovative platform, claimed the coveted second spot with a 16% share, a 4% gain from the year prior. Bybit followed closely behind at 12%, having captured a 2.2% slice of the pie. Their ascent signals a fiercer battle for crypto exchange supremacy in the years to come.

Meanwhile, Coinbase staged a commendable comeback. Despite a mid-year trading volume slump, the exchange rallied, surpassing its pre-2023 levels. This resilience indicates a renewed focus on customer experience and regulatory compliance, potentially positioning Coinbase for a larger slice of the pie in the future.

Beyond the battle for market share, Gate.io quietly became the king of tokens. By listing a staggering 362 new tokens, a total exceeding 1,871, it attracted enthusiasts seeking less mainstream crypto ventures. This strategic move highlights the growing diversity of the crypto landscape and the potential for niche exchanges to carve out their own kingdoms.

BNB market cap currently at $47.474 billion. Chart: TradingView.com

Derivatives Surge: Exchanges Face Evolutionary Pressures

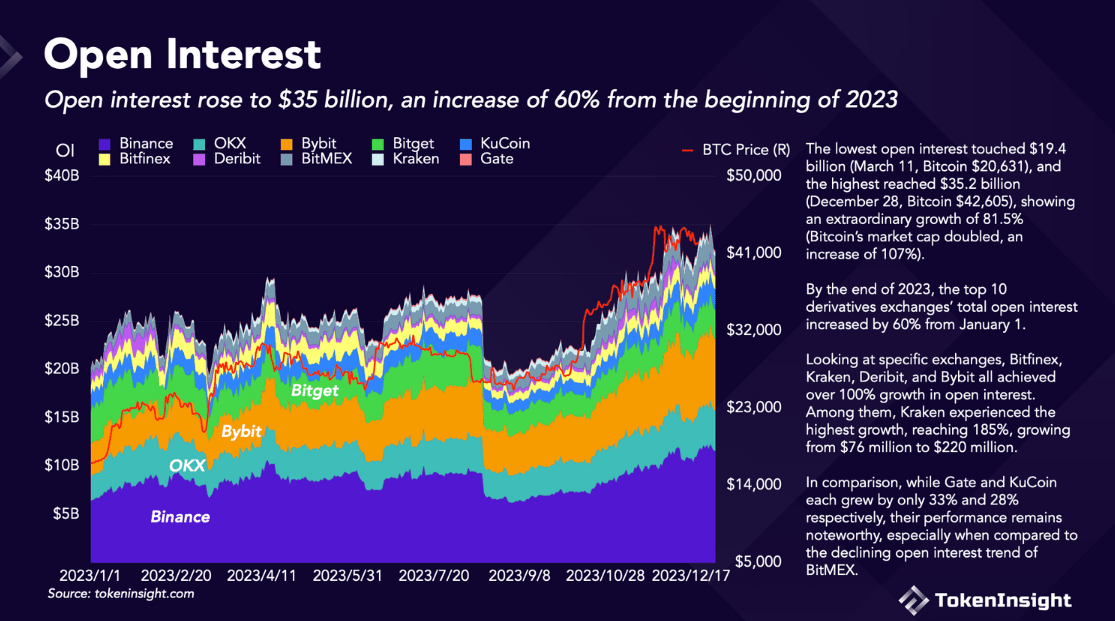

The derivatives market also saw a tectonic shift. Open interest across the top 10 exchanges skyrocketed by 60%, reaching a jaw-dropping $35 billion by year-end. Bitfinex, Kraken, Deribit, and Bybit led the charge, each experiencing over 100% growth. This surge suggests a growing appetite for leveraged crypto trading amongst investors, adding another layer of complexity to the already dynamic exchange landscape.

2023 was a year of dethronements and comebacks for crypto exchanges. While Binance remains the king, its crown sits less tightly than before. The rise of ambitious rivals, the burgeoning derivatives market, and the diversifying token landscape paint a picture of a rapidly evolving landscape. How these power players adapt and maneuver in the years to come will be a riveting chapter in the ever-unfolding story of cryptocurrency.

Featured image from Pixabay

Source: https://bitcoinist.com/binance-faces-5-market-share-loss-as-rivals-surge-ahead-details/