- Binance to adjust leverage and margin for certain cryptocurrency contracts on June 13, 2025.

- Changes to impact XLM, ETC, ATOM perpetual contracts.

- No immediate funding impacts; market liquidity effects anticipated.

To drive market compliance, Binance plans to alter leverage and margin for various USDT-margined perpetual contracts, including XLM, ETC, and ATOM, on June 13, 2025.

The changes may affect trading in these assets, potentially adjusting position limits and trader strategies across impacted contracts.

Binance to Implement New Trading Limits in Mid-2025

Binance’s planned adjustments, starting June 13, 2025, involve modifying leverage and margin levels on several cryptocurrency contracts like XLM, ETC, and ATOM. These changes include adjustments to both position limits and maintenance margin rates, part of Binance’s broader effort to stabilize trading risks. As stated in an official announcement, these alterations align with regular practices amidst market shifts.

Effectuating these adjustments impacts contract dynamics significantly. Traders must comply with new position limits and altered margin rates. While direct market funding remains stable, the leverage and margin adjustments may influence broader trading behaviors. Potential short-term impacts include increased liquidation events and reduced speculative trading due to decreased leverage capacity. Traders need to recalibrate their positions promptly to mitigate risk exposure.

Market participants, anticipating such changes, prepare to adapt their trading strategies accordingly. Official communications have emerged from Binance’s channels, yet specific market reactions from government or influential figures remain uncited. Historically, similar adjustments were typically characterized by rebalancing acts among traders and immediate impacts leading to decreases in speculative activities on affected contracts.

No statements available regarding the margin adjustment. – Richard Teng, CEO, Binance

Insights on Binance’s Risk Management Strategy

Did you know? Previous margin adjustments by Binance often led to notable shifts in trading volumes and speculative behavior, as traders recalibrated their portfolios to align with new leverage limits.

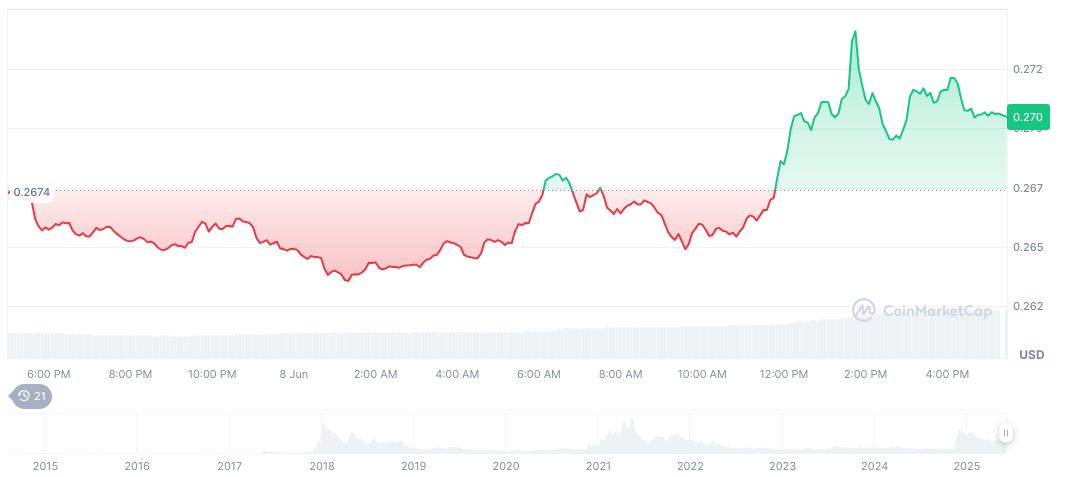

Stellar (XLM) currently trades at $0.27, with a market cap of $8.43 billion and a dominance of 0.25%, according to CoinMarketCap data. The recent trading volume was $161.37 million, witnessing a change of 92.59%. Although the 24-hour price movement showed a rise of 1.28%, a 30-day perspective indicates a decline of 8.62%.

Coincu research suggests that by adjusting leverage and margin tiers, Binance aims to enhance market risk management and stability. Accurate adjustments based on current market data could minimize liquidation risks during volatile trading periods. Historical changes have shown Binance’s proactive approach to managing its trading ecosystem to align with evolving market conditions.

Source: https://coincu.com/342250-binance-alters-leverage-margin-2025/